April 13, 2005 Department of Revenue

advertisement

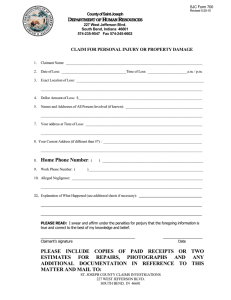

VARIOUS TAXES Definition of Tax Yes April 13, 2005 Separate Official Fiscal Note Requested Fiscal Impact DOR Administrative Costs/Savings No X X Department of Revenue Analysis of H.F. 2178 (Krinkie) / S.F. 2206 (Pogemiller) F.Y. 2006 General Fund $0 Fund Impact F.Y. 2007 F.Y. 2008 (000’s) $0 $0 F.Y. 2009 Effective the day following final enactment. EXPLANATION OF THE BILL The bill creates a definition for the term “tax” in Chapter 645, Interpretation of Statutes and Rules. Tax means any fee, charge, exaction, or assessment imposed by a governmental entity on an individual, person, entity, transaction, good, service, or other thing. It excludes the price an individual or entity chooses to voluntarily pay for receipt of goods or services provided by a governmental entity. A fee or charge that meets the functional requirements of a tax must be treated as a tax for all purposes, regardless of whether the statute or law refers to it as a tax. REVENUE ANALYSIS DETAIL The bill would have no impact on any state funds. Number of Taxpayers: None. Source: Minnesota Department of Revenue Tax Research Division http://www.taxes.state.mn.us/taxes/legal_policy hf2178(sf2206)_1/nrg $0