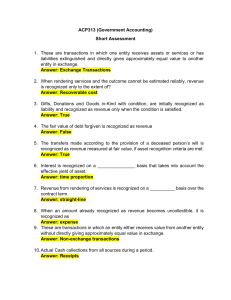

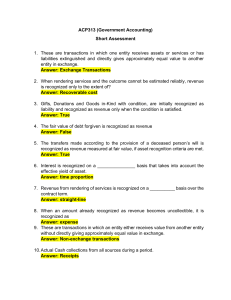

Public Sector Finance [Introduction to GRAP] Prepared by: Prof. Ebrahim Arnold, Rashied Small & Jade Jansen Overview & Objective Legislation [PFMA & MFMA] Financial Statements & Reports Objective: Reliably account for service potential as opposed to future economic bebefits Objective: Service delivery rather than profit motive Accounting Framework [GRAP] Introduction to GRAP 2 Compliance with Accounting Frameworks Type of entities Framework National and provincial departments Accrual basis and/or modified cash basis Parliament and provincial legislature GRAP Constitutional institutions GRAP Schedule 2 public entities IFRS Schedule 3A & 3C public entities GRAP/IFRS High capacity municipalities GRAP Medium capacity municipalities GRAP Low capacity municipalities GRAP Municipal entities GRAP Introduction to GRAP 3 Objectives of Financial Statements • Fulfilling an entity’s duty to be accountable – utilisation of the resources under it control to meet its service delivery goals • Enable users to assess the accountability of the entity – evaluate the performance of the entity in satisfying its service delivery goals • Enable users to evaluate the operating results of the entity for the financial period – evaluate the management of the resources under the control of the entity • Assessing the level of services that can be provided by the entity and its ability to meet its obligations as the become due – evaluate the potential to provide services and its liquidity to meet financial obligations Introduction to GRAP 4 Qualitative Characteristics Introduction to GRAP 5 Measurement Methods Historical cost Current replacement cost Fair value Measurement Realisable / settlement value Market value Present value Introduction to GRAP 6 Additional Reports Details about the entity’s outputs and outcomes Statements of service performance and programme reviews Information about compliance with legislative, regulatory or other external imposed regulations Other reports by management about the entity’s achievements Introduction to GRAP 7 Consideration for Preparation Faithful representation Stringent compliance with the definition & recognition criteria of elements Offsetting Consistency No offsetting is permissible except when it reflects the substance of the transaction Alternative is only permissible if it enhance the reliability & relevance Materiality & aggregation Material items shall be presented separately only immaterial items can be aggregated Introduction to GRAP 8 Basis of Preparation Accrual basis: Cash basis: When the transactions occur When cash inflows / out flows occur Modified cash basis: Hybrid of the cash & accrual basis Basis of measurement Introduction to GRAP 9 Classification Current assets Current Liabilities • It is expected to be realised, or is held for sale or consumption, in the entity’s normal operating cycle • It is expected to be settled in the entity’s normal operating cycle • It is held primarily for the purposes of being traded • It is held primarily for the purpose of being traded • It is expected to be realised within 12 months after the reporting date • It is cash or cash equivalent – unless its use is restricted for a period of 12 months after the reporting date • It is due to be settled within 12 months after the reporting date • The entity does not have an unconditional right to defer settlement of the liability for at least 12 months after the reporting date Introduction to GRAP 10 Revenue Recognition – Principal & Agent Criteria for identification Principal Risk & rewards of ownership Primary responsibility Credit risk Agent Price setting No significant risk Set price Revenue Recognition – Principal & Agent Criteria for identifying the principal in the relationship: • It is exposed to the significant risk and rewards of ownership. • It has the primary responsibility for providing the goods or services • It carries the risk of inventory throughout the transaction • It carries the customer’s credit risk • It has latitude in establishing prices, either directly or indirectly Criteria for identifying the agent in the relationship: • It does not have exposure to significant risk and rewards associated with the transaction • The amount the entity earns is predetermined, fixed fee or percentage of the transaction amount Revenue Recognition – Principal & Agent Example: Legislation mandates Entity A to undertake a specific task and has approved a budget of R 150 million. Entity A can select the following options to execute the mandate: 1. Appoints a contractor and agrees to pay R 120 million. Entity B is appointed as project manager including paying the contractor. Total budget is transferred to Entity B – difference is retained as fee for services rendered. 2. Appoints Entity B to execute the task. Contract provide full details of the task. Agreed cost is the budgeted amount and Entity B carries any additional costs. 3. Assigns the responsibility to Entity B to execute the mandate. Responsibilities include (i) oversight and compliance function, (ii) discretion over how the task is executed, (iii) costs is included in its budget, (iv) cost is limited to budget, and (v) excess costs are borne by Entity B Revenue Recognition – Principal & Agent Example: 1. Entity B acts as the agent – no legislative responsibility in terms of mandate, not responsible to performance of contractor (project manager) and does not bear credit risk. Entity B recognise the R30 million as revenue when the service is performed (stage of completion). 2. Entity B is the principal – limited responsibility i.t.o contract, has performance obligation, carries the financial risk. Entity B recognise the R 150 million as revenue (stage of completion) and the related expenses as incurred. 3. Entity B acts as the principal – responsibility is has been transferred, and carries the financial risk. Entity B recognise R 150 million as revenue - nonexchange transaction(stage of completion) and the related expenses as incurred. Revenue Recognition – Exchange Transactions Revenue – Exchange transactions Sale of goods Rendering of services Interest Royalties Dividends Fair value of consideration on receivable Stage of completion Effective interest method Substance of agreement Right to receive payment Introduction to GRAP 15 General revenue recognition criteria pplicable to all Revenue categories Specific recognition criteria per revenue category Rendering of services It must be probable that economic benefits or service potential associated with the transaction will flow to the entity; and The revenue can be measured reliably Stage of completion of the transaction at the reporting date can be measured reliably; and Cost incurred and the cost to complete the transaction can be measured reliably. Revenue categories Sale of goods It must be probable that economic benefits or service potential associated with the transaction will flow to the entity; and The revenue can be measured reliably Significant risk and rewards of ownership of the goods have been transferred to the purchaser; Cost incurred and the cost to complete the transaction can be measured reliably; and The seller retains neither continuing managerial involvement to the degree usually associated with ownership nor effective control over the goods sold. Introduction to GRAP Interest, royalties and dividends It must be probable that economic benefits or service potential associated with the transaction will flow to the entity; and The revenue can be measured reliably Interest is recognised using the effective interest rate method as set out in GRAP 104 on Financial Instruments. Royalties are recognised as they are earned in accordance with the substance of the relevant agreement. Dividends or similar distributions are recognised when the owner’s or the entity’s right to receive payment is established. 16 Revenue Recognition – Key Issues Recognition Initial recognition Probable recovery & reliably measureable Certainty Uncertainty Recognise gross amount Revenue is not recognised Subsequent recognition Not recoverable Recognised as impairment/expense Revenue Recognition – Key Issues 1. Non-refundable transactions: • Initial recognition – deferred revenue • Subsequent recognition – recognise revenue based on stage of completion • Cancellation – recognise revenue (based on original classification) 2. Multiple revenue transaction: • Separately identifiable components – recognition criteria is applied independently • Recognition of revenue – sale of goods = transfer of risks & rewards - services = stage of completion • Not separately identifiable – inter-dependent transactions • Recognition – based on substance of transaction Revenue Measurement – Key Issues • Gross cash amount = net cash receivable for benefit of the entity (normal terms) • Discounts & rebates: • Trade discounts = deducted from revenue amount (gross cash flow) • Settlement discounts = assessed at transaction date (i) Certainty of occurrence = set off against revenue on initial recognition (ii) Uncertainty of occurrence = recognised as an expense on subsequent measurement • Fair value = present value of future cash flows (deferred settlement terms) • Exchange transactions: • Similar goods/services = non-revenue transaction (no commercial value) • Dissimilar goods/services = revenue transaction (fair value received if reliably measured, if cannot be measured, then fair value of goods/services given) Revenue Measurement – Key Issues • Penalty relating to revenue: • Set off against revenue = legal right to set off and/or management has the intention to settle on a net basis • Recognised as expense = not allowed to set off • Recognition of service revenue = stage of completion • • • • Performance obligation = proportion of obligations completed Straight-line method = performance obligations cannot be determined Alternative method = improved method to stage of completion Limitation (cannot be measured) = limited to costs incurred (if costs are recoverable, if not, then no revenue is recognised) Revenue Measurement – Key Issues • Warranty revenue transactions: • Recognition of revenue = not dependent of warranty • Recognised as warranty = liability as an expense (measured at a reliable estimate) • Right to return: • Revenue recognition = fulfill the performance obligations (transfer of risk & rewards) • Uncertainty about possibility of return = recognised when the time period has elapsed • Contingent revenue: • Recognition of revenue = probable flow of economic benefits (flow of cash or uncertainty is removed) Revenue Recognition – Exchange Transactions • Exchange transaction: • Transactions in which the entity receives an equivalent value in exchange for goods or services • Measurement: • Measured at fair value of the consideration received or receivable, including trade discounts and volume rebates • Recognition – Rendering of services • Recognised by reference to the stage of completion method when the outcome of the transaction can be determined reliably • When the outcome of the transaction cannot be estimated reliably, revenue is recognised only to the extent that expenditure are recoverable Introduction to GRAP 22 Revenue Recognition – Rendering of Services Introduction to GRAP 23 Revenue Recognition – Exchange Transactions • Recognition – Sale of Goods: • Recognised when: (a) Significant risks and rewards have been transferred to the purchaser (b) The entity retains neither continuing managerial involvement with ownership nor effective control over the goods (c) The amount of revenue and costs relating to the transaction can be measured reliably (d) It is probable that future economic benefits / service potential will flow to the entity • Recognition other revenue: • Interest is recognised using the effective interest method • Royalties are recognised on an accrual basis in accordance with the substance of the agreement • Dividends are recognised when the entity’s rights to receive payment is established Introduction to GRAP 24 Revenue Recognition – Sale of Goods Introduction to GRAP 25 Revenue Recognition – Probability Test • Application: • • • • Applicable to initial recognition Recognition of exchange transactions (good or services) Credit revenue transactions Uncertainty that revenue will be eventually be collected • Circumstances: • Provision of goods or services in accordance with their legislative mandate • At date of invoicing there is uncertainty that revenue will be collected • Judgement whether the revenue should be recognised: (a) Probability of collectability should not be the deciding factor – entity has the obligation to collect the revenue (b) Decision not to enforce the right to collect the revenue is a subsequent decision (c) Impairment (non-collectability) should be recognised as an expense Introduction to GRAP 26 Revenue Recognition – Construction Contracts Introduction to GRAP 27 Revenue: Construction Contracts – Key Issues Defining a construction contract Primary features Long-term contract (> 1 reporting period) Recovery of costs through revenue Special inclusions Legal contract & obligations Directly related services (project management) Subsequent events Revenue Recognition – Construction Contracts • Construction contract: • A binding arrangement arrangements for the construction of an asset • Contracts for the rendering of services that are directly related to the asset • Contracts for the destruction or restoration of the asset and/or environment • Application: • • • • Depends on the substance of the binding arrangement Separate construction contract Separately identifiable segments of a single contract Group of contracts as a single unit • Measurement: • Amount agreed in the initial contract • Include variations in the contract work, claims and incentive payments to the extent that it is probable that they will result in revenue • Measured reliably at the fair value of the consideration Introduction to GRAP 29 Revenue Recognition – Construction Contracts • Construction costs: • All costs directly related to the specific contract • Costs that can be attributed to the general contract activities that can be reasonable allocated to the contract • Other costs that are specifically chargeable to the customer under the terms of the contract • Recognition: • Recognised by reference to the stage of completion – outcome of construction contract can be estimated reliably • Estimation of outcomes: (a) Total contract revenue can be measured reliably (b) Probable that the economic benefits / service potential associated with the contract will flow to the entity (c) Contract cost and the stage of completion can be measured reliably (d) Contract costs attributable to the contract can be clearly identified and measured Introduction to GRAP 30 Revenue Recognition – Construction Contracts Fixed price contract Cost plus or cost based contract • Total contract revenue, if any, can be measured reliably; • • It’s probable that economic benefits or service potential associated with the contract will flow to the entity; Contract cost to complete the contract can be measured reliably at reporting date; Stage of completion can be measured reliably at reporting date; and Contract cost attributable to the contract can be clearly identified and measured reliably. • • • • It’s probable that economic benefits or service potential associated with the contract will flow to the entity; and Contract cost attributable to the contract, whether or not specifically reimbursable, can be clearly identified and measured reliably. Introduction to GRAP 31 Revenue: Construction Contracts – Key Issues • Fixed price contract: • Recognition of revenue = stage of completion (cost proportionate basis) • Cost escalation clause = adjustment to cost & price as additional costs are incurred • Contract price of R 90 million with an estimated total cost of R 60 million. Incurred costs of R 25 million of which R 0,3 million related to escalation in costs. Revenue recognised = [(25/(60 + 0,3) x (90 + 0,3)] = R 37,438 million • Indirectly funded contracts = recipient of assets does not pay for the contract • Non-commercial transactions = indication of incurring losses Revenue Recognition – Construction Contracts • Recognition: • Outcome cannot be estimated reliably: (a) No surplus is recognised (b) Revenue is recognised to the extent of the contract costs incurred are expected to be recovered (c) Contract costs are expensed as incurred • Probable that the contract costs will exceed the contract revenue – expected loss is recognised immediately • Stage of completion method is applied on a cumulative basis in each reporting period – represents a change in accounting estimate Introduction to GRAP 33 Revenue Recognition – Construction Contracts • Arrangements: • Arrangement with the buyers before the construction is completed • Funding to support the construction will be provided by an appropriation • Exclude aids or grant funds • Recognition: • Application of GRAP 9 (Revenue from exchange transactions) or 11 (Construction Contracts) is based on the judgement of the facts of the circumstances • When the buyer is able to specify the major structural elements in the design prior to or during the to construction – GRAP 11 (a) If the outcome can be estimated reliably then revenue should be recognised by the stage of completion method • When the buyer has limited influence in the design of the asset – GRAP 9 (a) Determine if the entity provides goods (entity provide the services plus the construction material) or rendering services (entity is not required to supply the material) Introduction to GRAP 34 Revenue Recognition – Barter Transactions • Barter transactions: • Applicable to the provision of advertising services in exchange for receiving other services • Exchange of services must be dissimilar • Measurement: • Fair value of the advertising services must be measured reliably • Fair value of the services provided can be measured reliably: (a) Measurement is based in the fair value in a non-barter transaction (b) Advertising similar to the service provided in the barter transaction (c) These transactions occur frequently (d) Represent a predominant number of transactions (e) Involve cash and/or another form of consideration that has a reliable fair value (f) Do not involve the same counterparty as in the barter transaction • Cannot be measured reliably at the fair value of the services received Introduction to GRAP 35 Revenue Recognition – Non-exchange Transaction Introduction to GRAP 36 Revenue: Non-exchange Transactions – Key Issues • Measurement of revenue = fair value of consideration • Non-exchange transactions = revenue is the “donation value” received Entity A paid R 500,000 for a service with a fair value of R 900,000. R 400,000 benefit gained must be recognised as revenue • Distinction between exchange & non-exchange transactions = assess the substance of the transaction Entity A is granted a bulk discount (price paid is less than the fair value). Substance of the transaction = exchange transactions (price is negotiable) Revenue: Non-exchange Transactions – Key Issues • Conditions on transfer of asset: • Restriction on utilisation of asset = not affect revenue recognition (default is a subsequent measurement concern) • Conditions on transfer of asset = affects recognition of revenue (recognition of the condition as a present obligation or liability) • Recognition of conditional grants Entity A received conditional grant of R 35 million (if not used for the specified purpose the funds must be returned. R 22 million was used during the period. Initial recognition: recognise no revenue but a liability for R 35 million Subsequent measurement: recognise revenue of R 21 million (convert the liability to revenue) Revenue: Non-exchange Transactions – Key Issues • Debt forgiveness = recognised as revenue (benefit received) • Non-exchange transactions = revenue is the “donation value” received Entity A paid R 500,000 for a service with a fair value of R 900,000. R 400,000 benefit gained must be recognised as revenue • Distinction between exchange & non-exchange transactions = assess the substance of the transaction Entity A is granted a bulk discount (price paid is less than the fair value). Substance of the transaction = exchange transactions (price is negotiable) Revenue Recognition – License Fees & Taxes Introduction to GRAP 40 Revenue Recognition – Non-exchange Transaction • Non-exchange transaction: • Revenue in the form of taxes, transfers, grants and fines • Transfer of assets that will be used by the recipient in a particular way: (a) Restrictions on transferred assets (b) Conditions of transferred assets (c) Classification is based on the substance of the transactions • Measurement: • Initially measured at its fair value at the date of acquisition • Subsequent measurement is based on the applicable accounting standard • If the are conditions attached to the asset transferred – a liability measured at the best estimate of the amount to settle the present obligation at the reporting date • Corresponding entry is revenue – revenue must be reduced by the liability recognised Introduction to GRAP 41 Revenue Recognition – Non-exchange Transaction Introduction to GRAP 42 Revenue Recognition – Non-exchange Transaction Introduction to GRAP 43 Revenue Recognition – Non-exchange Transaction Introduction to GRAP 44 Revenue Recognition – Non-exchange Transaction Introduction to GRAP 45 Property, Plant & Equipment Introduction to GRAP 46 Property, Plant & Equipment – Land & Buildings Introduction to GRAP 47 Property, Plant & Equipment • Initial measurement • Measured at aggregate costs on initial recognition • Deferred settlement agreements (beyond normal terms) (a) Separate total value between cost (equivalent cash price = present value at the effective interest rate) and interest element (recognised as an expense over the period) • If asset is acquired at no cost of at a nominal value (a) Cost is equal to the fair value at the date of recognition • Subsequent measurement: • Cost model (a) Carrying amount = cost less accumulated depreciation and accumulated impairment loss • Revaluation model (a) Applicable to all items of the class of asset (b) Revaluation must be performed regularly (significant change in the value of the asset) (c) Cost is represented by the fair value at the date of revaluation (d) Carrying amount = revalued amount less accumulated depreciation and accumulated impairment loss Introduction to GRAP 48 Property, Plant & Equipment – Initial Recognition Introduction to GRAP 49 Property, Plant & Equipment – Fair Value Introduction to GRAP 50 Property, Plant & Equipment • Subsequent measurement: • Revaluation model (e) Revaluation surplus is recognised in the statement of changes in net assets (f) Decrease in the revalued amount: - first written off against the surplus - excess is written off against the surplus / deficit (statement of financial performance) • Impairment: • Compensation received from 3rd parties for impairment is recognised as a gain when it becomes receivable Introduction to GRAP 51 Property, Plant & Equipment – Fully Depreciated Introduction to GRAP 52 Property, Plant & Equipment – Fully Depreciated Introduction to GRAP 53 Property, Plant & Equipment – Sewerage Introduction to GRAP 54 Property, Plant & Equipment – Roads Introduction to GRAP 55 Property, Plant & Equipment – Water Introduction to GRAP 56 Investment Property Investment Property Identification Recognition Measurement Initial Measurement Cost Fair Value Subsequent Measurement Depreciation & impairment t Derecognition Disclosure Cost Model Fair Value Model Introduction to GRAP 57 Heritage Assets Introduction to GRAP 58 Biological Assets Introduction to GRAP 59