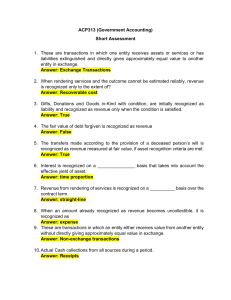

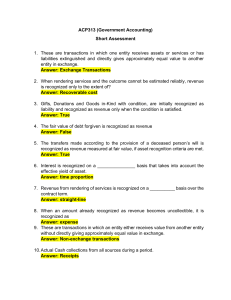

Receivable Financing: Pledging, Assignment, Factoring, Discounting

advertisement

RECEIVABLE FINANCING It is the financial flexibility or capability of an entity to raise money out of its receivable. FORMS OF RECEIVABLE FINANCING ✓ ✓ ✓ ✓ Pledge of accounts receivable Assignment of accounts receivable Factoring of accounts receivable Discounting of accounts receivable PLEDGE OF ACCOUNTS RECEIVABLES ✓ Loan is recorded by debiting cash and discount on NP if loan is discounted and crediting NP ✓ Subsequent payment is recorded by debiting NP and crediting cash ✓ No entry would be necessary for the pledged accounts. Only a disclosure in the notes is made. ASSIGNMENT OF ACCOUNTS RECEIVABLES ✓ A more formal type of pledging AR ✓ Assignment is secured borrowing evidenced by financing agreement and a promissory note both of which the assignor signs. ✓ A borrower called ASSIGNOR transfers rights in some AR to a lender called ASSIGNEE in consideration for a loan ✓ Pledging is general whereas assignment is specific. ✓ Can be done either on a nonnotification or notification basis FACTORING AS A CONTINUING ARRANGEMENT FACTORING OF ACCOUNTS RECEIVABLES ✓ It is a sale of AR usually on a without recourse, notification basis. ✓ In this arrangement, an entity sells AR to a bank or finance entity called a factor. ✓ A gain or loss is recognized for the difference between the proceeds received and the net carrying amount of the receivables factored ✓ In factoring, an entity actually transfers ownership of AR to the factor hence he assumes responsibility for any uncollectible factored accounts. ✓ Whereas in assignment, the assignor retains the ownership of AR. ✓ Factoring could be – casual factoring or factoring as a continuing arrangement ✓ A finance entity purchases all of the AR of a certain entity ✓ The factor assumes the credit function and collection function ✓ To compensate, the factor typically charges a commission or factoring fee. Likewise, the factor may withhold a predetermined amount as a protection against customer returns and allowances and other adjustments. This amount is called “FACTOR’S HOLDBACK”. ✓ Factor’s holdback is a receivable from factor and classified as current asset. ✓ Final settlement of the factor’s holdback is made after the factored receivables have been fully collected. DISCOUNTING OF NOTE RECEIVABLE ✓ Discounting specifically pertains to a note receivable ✓ The original parties here are the maker (one liable) and the payee (the one entitled to payment on the date of maturity) ✓ When a note is negotiable, the payee may obtain the cash before maturity date by discounting the note at a bank or other financing company ✓ To discount, the payee must endorse it. Hence, legally the payee becomes an endorser and the bank becomes an endorsee ENDORSEMENT CREDIT CARD ✓ Transfer of right to a negotiable instrument by simply signing at the back of the instrument ✓ Endorsement with recourse, the endorser shall pay the endorsee if the maker dishonors the note ✓ Endorsement without recourse, the endorser shall avoid future liability even if maker refuses to pay the endorsee on the date of maturity ✓ In the absence of any evidence, endorsement is assumed to be with recourse b. If the entity has retained control over the asset, the financial asset is not derecognized. CONCLUSION CONDITIONAL SALE OR SECURED BORROWING An entity shall derecognize a financial asset when either one of the following criteria is met: a. The contractual rights to the cash flows of the financial asset have expired b. The financial asset has been transferred and the transfer qualifies for derecognition based on the extent of transfer of risks and rewards of ownership CONDITIONAL SALE OR SECURED BORROWING Guidelines for derecognition based on the extent of transfer of risks and rewards: ✓ If the entity has transferred substantially all risks and rewards, the financial asset shall be derecognized. ✓ If the entity has retained substantially all risks and rewards, the financial asset shall not be derecognized. ✓ If the entity has neither transferred nor retained substantially all risks and rewards, derecognition depends on whether the entity has retained control of the asset. a. If the entity has lost control of the asset, the financial asset is derecognized in its entirety. ✓ It is believed that the discounting of note receivable with recourse is to be accounted for as a conditional sale with recognition of a contingent liability. ✓ The main justification is that upon discounting or endorsement of the note receivable, whether with or without recourse, the transferor or endorser has lost control over the note receivable. ✓ Accordingly, the transferee has complete control over the note receivable because the transferee has the practical ability to sell the asset to a third party without attaching any restrictions to the transfer.