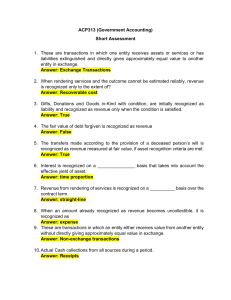

ACCOUNTING FOR TRADE AND OTHER RECEIVABLES OVERVIEW OF IFRS 15 Which statement is incorrect regarding PFRS 15? a. The standard outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers. b. The standard supersedes revenue recognition guidance in PAS 18 Revenue and PAS 11 Construction Contracts and related interpretations. c. The core principle is that an entity recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. d. None, all the statements are correct. LECTURE NOTES: The following standards and related interpretations are superseded by IFRS 15: PAS 18 – Revenue PAS 11 – Construction Contracts IFRIC 13 – Customer Loyalty Programmes IFRIC 15 – Agreements for the Construction of Real Estate IFRIC 13 – Transfers of Assets from Customers SIC 31 – Revenue – Barter Transactions Involving Advertising Services Arrange in proper sequence the five-step approach that entities will follow in recognizing revenue in accordance with PFRS 15: I. Determine the transaction price II. Identify the contract(s) with the customer III. Identify the separate performance obligations in the contract IV. Recognize revenue when (or as) each performance obligation is satisfied V. Allocate the transaction price to separate performance obligations a. I, II, III, IV and V b. II, III, I, V and IV c. III, II, I, V and IV d. II, III, V, I and IV For PFRS 15 to apply, a contract with a customer should meet which of the following conditions? I. The contract has been approved by the parties to the contract. II. Each party’s rights in relation to the goods or services to be transferred can be identified. III. The payment terms for the goods or services to be transferred can be identified. IV. The contract has commercial substance. V. It is probable that the consideration to which the entity is entitled to in exchange for the goods or services will be collected. a. I, II, III, IV and V b. I, III, IV and V c. I, II, III and V d. I, II, III and IV Performance obligation is a promise in a contract with a customer to transfer to the customer a. A good or service (or a bundle of goods or services) that is distinct. b. A series of distinct goods or services that are substantially the same and that have the same pattern of transfer to the customer. c. Either a or b. d. Neither a nor b. Which statement is incorrect regarding transaction price in accordance with PFRS 15? a. Transaction price is the amount of consideration to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer, excluding amounts collected on behalf of third parties. b. An entity shall consider the terms of the contract and its customary business practices to determine the transaction price. c. The nature, timing and amount of consideration promised by a customer affect the estimate of the transaction price. d. The consideration promised in a contract with a customer may include fixed amounts but not variable amounts. When determining the transaction price, an entity shall consider the effects of: I. Variable consideration II. Constraining estimates of variable consideration III. The existence of a significant financing component in the contract IV. Non-cash consideration V. Consideration payable to a customer a. I, II, III, IV and V b. II, III, IV and V only c. III, IV and V only d. III and IV only For the purpose of determining the transaction price, an entity shall assume a. That the goods or services will be transferred to the customer as promised in accordance with the existing contract. b. That the contract may be cancelled. c. That the contract may be renewed d. That the contract may be modified. Statement 1: For the purpose of determining the transaction price, an entity shall assume that the goods or services will be transferred to the customer as promised in accordance with the existing contract, and such contract will not be cancelled, renewed or modified. Statement 2: For the purpose of determining the transaction price, an entity shall assume that the goods or services will be transferred to the customer as promised in accordance with the existing contract, and such contract will be cancelled, renewed or modified. a. Statement 1 is true. b. Statement 2 is true. c. Both statements are true. d. Both statements are false. Where a contract has multiple performance obligations, an entity will allocate the transaction price to the performance obligations in the contract by reference to their relative a. Standalone selling prices. b. Fair values. c. Net realizable values. d. Any of the above. Which statement is incorrect regarding recognition of revenue? a. Revenue is recognized as control is passed, either over time or at a point in time. b. Control of an asset is defined as the ability to direct the use of and obtain substantially all of the remaining benefits from the asset. c. Control includes the ability to prevent others from directing the use of and obtaining the benefits from the asset. d. The benefits related to the asset are the potential cash flows that may be obtained only directly. In accordance with PFRS 15, a contract asset is a. An entity’s right to consideration that is unconditional (only the passage of time is required before payment of that consideration is due). b. An entity’s right to consideration in exchange for goods or services that the entity has transferred to a customer when that right is conditioned on something other than the passage of time (for example, the entity’s future performance). c. An entity’s obligation to transfer goods or services to a customer for which the entity has received consideration (or the amount is due) from the customer. d. A party that has contracted with an entity to obtain goods or services that are an output of the entity’s ordinary activities in exchange for consideration. In accordance with PFRS 15, a contract liability is a. An entity’s right to consideration that is unconditional (only the passage of time is required before payment of that consideration is due). b. An entity’s right to consideration in exchange for goods or services that the entity has transferred to a customer when that right is conditioned on something other than the passage of time (for example, the entity’s future performance). c. An entity’s obligation to transfer goods or services to a customer for which the entity has received consideration (or the amount is due) from the customer. d. A party that has contracted with an entity to obtain goods or services that are an output of the entity’s ordinary activities in exchange for consideration. In accordance with PFRS 15, a customer is a. An entity’s right to consideration that is unconditional (only the passage of time is required before payment of that consideration is due). b. An entity’s right to consideration in exchange for goods or services that the entity has transferred to a customer when that right is conditioned on something other than the passage of time (for example, the entity’s future performance). c. An entity’s obligation to transfer goods or services to a customer for which the entity has received consideration (or the amount is due) from the customer. d. A party that has contracted with an entity to obtain goods or services that are an output of the entity’s ordinary activities in exchange for consideration. DEFINITION OF TRADE AND OTHER RECEIVABLES In accordance with PFRS 15, a receivable is a. An entity’s right to consideration that is unconditional (only the passage of time is required before payment of that consideration is due). b. An entity’s right to consideration in exchange for goods or services that the entity has transferred to a customer when that right is conditioned on something other than the passage of time (for example, the entity’s future performance). c. An entity’s obligation to transfer goods or services to a customer for which the entity has received consideration (or the amount is due) from the customer. d. A party that has contracted with an entity to obtain goods or services that are an output of the entity’s ordinary activities in exchange for consideration. RECOGNITION OF TRADE AND OTHER RECEIVABLES At initial recognition, an entity shall measure trade receivables at their transaction price (as defined in PFRS 15) if the trade receivables a. Do not contain a significant financing component in accordance with PFRS 15. b. When the entity applies the practical expedient in accordance with paragraph 63 of PFRS 15. c. Either a or b. d. Neither a nor b. Statement 1: The practical expedient in accordance with paragraph 63 of PFRS 15 may be applied if the term is not more than one year. Statement 2: The practical expedient in accordance with paragraph 63 of PFRS 15 may be applied if the term is more than one year. a. Statement 1 is true. b. Statement 2 is true. c. Both statements are true. d. Both statements are false. MEASUREMENT OF TRADE AND OTHER RECEIVABLES LECTURE NOTES: Measure of Receivables in Summary Initial Measurement Trade receivables Non-trade receivables Transaction price (PFRS 15) FV plus transaction costs (PFRS 9) Subsequent Measurement Trade receivables Non-trade receivables Amortized cost using the effective interest method Amortized cost using the effective interest method Receivables not measured initially at their transaction price are measured initially at a. Fair value b. Fair value less costs to sell c. Fair value minus transaction costs that are directly attributable to the acquisition of the financial asset. d. Fair value plus transaction costs that are directly attributable to the acquisition of the financial asset. In accordance with PFRS 9, receivables shall be measured at amortized cost if a. The receivables are held within a business model whose objective is to hold assets in order to collect contractual cash flows. b. The contractual terms of the receivables give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding. c. Both a and b. d. Either a or b. The ideal measure of short-term receivables in the statement of financial position is the discounted value of the cash to be received in the future, failure to follow this practice usually does not make the statement of financial position misleading because a. The amount of the discount is not material. b. Most short-term receivables are not interest bearing. c. The allowance for uncollectible accounts includes a discount element. d. Most receivables can be sold to a bank or factor. Accounts receivable are normally reported at the: a. Present value of future cash receipts. b. Current value plus accrued interest. c. Expected amount to be received. d. Current value less expected collection costs. Accounts receivable are normally reported at the: a. Present value of future cash receipts. b. Current value plus accrued interest. c. Net realizable value. d. Current value less expected collection costs. New Corp has the following data relating to accounts receivable at the end of the current year: Accounts receivable Allowance for doubtful accounts Allowance for sales discounts Allowance for sales returns Allowance for freight 1,880,000 94,000 10,000 15,000 3,000 What is the net realizable value of New Corp.’s accounts receivable? a. P2,708,000 b. P1,880,000 c. P1,758,000 d. P1,752,000 The following information pertains to an entity’s accounts receivable: Accounts receivable, beginning Credit sales Sales returns Collections Promissory notes received in payment of accounts receivable Accounts receivable written off as uncollectible Collections on accounts previously written off Accounts receivable used as collateral 3,800,000 18,000,000 280,000 15,300,000 2,000,000 160,000 60,000 1,000,000 The entity’s accounts receivable balance at the end of the period is a. P6,060,000 b. P4,060,000 c. P3,060,000 d. P3,000,000 LECTURE NOTES: Accounting for Freight Buyer Seller Deduct from AR Add to AR Who should pay? FOB shipping point FOB destination FOB destination FOB shipping point Who actually paid? Freight collect Freight prepaid Freight collect Freight prepaid Gross and Net method of recording Sales Cash discounts Cash discounts granted Gross Deducted from sales when granted Deducted from sales (sales discounts) Net Deducted from sales whether granted or not Not accounted for separately since Cash discounts not granted Included in sales already deducted from sales Reported as other income (Forfeited sales discounts) On June 9, Seller Corp. sold merchandise with a list price of P5,000 to Buyer on account. Seller allowed trade discounts of 30% and 20%. Credit terms were 2/15, n/40 and the sale were made FOB shipping point. Seller prepaid P200 of delivery costs for Buyer as an accommodation. On June 25, Seller received from Buyer a remittance in full payment amounting to a. P2,744 b. P2,940 c. P2,944 d. P3,000 The Pacifier Company uses the net price method of accounting for cash discounts. In one of its transactions on December 15, Pacifier sold merchandise with a list price of P500,000 to a client who was given a trade discount of 20% and 15%. Credit terms were 2/10, n/30. The goods were shipped FOB destination, freight collect. On December 20, the client returned damaged goods originally billed at P60,000. Total freight charges paid by the buyer amounted to P7,500. What is the net realizable value of this receivable on December 31? a. P272,500 b. P274,400 c. P280,000 d. P333,200 An advantage of using the net price method of recording cash discounts on credit sales is a. It simplifies recording of sales returns and allowances. b. It eases communication with customers about their balances. c. It requires less record-keeping efforts than the gross method. d. It properly reflects current period sales revenue. The following are advantages of using the gross price method of recording cash discounts on credit sales, except a. It simplifies recording of sales returns and allowances. b. It eases communication with customers about their balances. c. It requires less record-keeping efforts than the gross method. d. It properly reflects current period sales revenue. Statement 1: Theoretically, net price method is preferred over the gross price method. Statement 2: For convenience purposes, traditionally, gross price method is used instead of net price method. a. Statement 1 is true. b. Statement 2 is true. c. Both statements are true. d. Both statements are false. In accordance with PFRS 15, how should volume rebates and/or discounts on goods or services applied retrospectively be accounted for? a. As variable consideration. b. As customer options to acquire additional goods or services at a discount. c. Either a or b. d. Neither a nor b. In accordance with PFRS 15, how should volume rebates and/or discounts on goods or services applied prospectively be accounted for? a. As variable consideration. b. As customer options to acquire additional goods or services at a discount. c. Either a or b. d. Neither a nor b. Statement 1: In accordance with PFRS 15, volume rebates and/or discounts on goods or services applied prospectively shall be accounted for as a separate performance obligation. Statement 2: In accordance with PFRS 15, volume rebates and/or discounts on goods or services applied retrospectively shall be accounted for as a separate performance obligation. a. Statement 1 is true. b. Statement 2 is true. c. Both statements are true. d. Both statements are false. In accordance with PFRS 15, how are variable considerations accounted for? a. Included in transaction price. b. Included in the transaction price only to the extent that it is highly probable that a significant reversal in the amount of cumulative revenue recognized will occur when the uncertainty associated with the variable consideration is subsequently resolved. c. Included in the transaction price only to the extent that it is highly probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved. d. Excluded from transaction price. LECTURE NOTES: Accounting for Cash Discount Traditional Gross method – deducted from sales when granted. Net method – deducted from sales whether granted or not. The forfeited sales discount is treated as other income. PFRS 15 Included in sales if the entity expects to be entitled (that is, the customer will not avail). The forfeited sales discount is treated as adjustment to sales. To account for the transfer of products with a right of return (and for some services that are provided subject to a refund), an entity shall recognize a. Revenue for the transferred products in the amount of consideration to which the entity expects to be entitled (therefore, revenue would not be recognized for the products expected to be returned). b. A refund liability. c. An asset (and corresponding adjustment to cost of sales) for its right to recover products from customers on settling the refund liability. d. All of these. Which statement is incorrect regarding a refund liability? a. An entity shall recognize a refund liability if the entity receives consideration from a customer and expects to refund some or all of that consideration to the customer. b. A refund liability is measured at the amount of consideration received (or receivable) for which the entity does not expect to be entitled. c. The refund liability shall be updated at the end of each reporting period for changes in circumstances. d. Changes in refund liability shall be recognized as other income or expense. Statement 1: Changes in refund liability shall be recognized as other income or expense. Statement 2: Changes in refund liability shall be recognized as an adjustment to revenue. a. Statement 1 is true. b. Statement 2 is true. c. Both statements are true. d. Both statements are false. Which statement is incorrect regarding an asset recognized for an entity’s right to recover products from a customer on settling a refund liability? a. It shall initially be measured by reference to the former carrying amount of the product (for example, inventory) less any expected costs to recover those products (including potential decreases in the value to the entity of returned products). b. At the end of each reporting period, an entity shall update the measurement of the asset arising from changes in expectations about products to be returned. c. An entity shall offset the asset and the refund liability. d. None, all the statements are correct. LECTURE NOTES: Accounting for Sales Return Traditional Deducted from sales as returns occurs. PFRS 15 Recognized as refund liability (if expected to be returned). Changes in refund liability, treated as an adjustment to sales. Changes in right to recover asset from a customer on settling a refund liability, treated as an adjustment to cost of sales. Ely Corp. sold merchandise to various customers with a list price of P1,000,000. The customers were given trade discounts of 20% and 15%. Credit terms were 2/10, n/30. Based on experience, Ely expects that 50% will avail of the cash discounts and 10% will return the products. In accordance with PFRS 15, Ely should recognize revenue of a. P680,000 b. P673,200 c. P605,200 d. P598,400 Seller Corporation sold P21,000 of merchandise during the month of December, which was charged to a national credit card. On December 15, Seller bills the independent national credit card company for these sales and is assessed a 5% service charge. On December 21, a customer returned merchandise originally sold for P2,000 and Seller notifies the credit card company of the return. On December 29, the credit card company remitted amount owed to Seller. Which statement is incorrect? a. In recording this sale, Seller should record an account receivable from the credit card company. b. Seller received P18,050 from the credit card company. c. Seller should recognize P18,050 as net revenue. d. None, all the statements are correct. LECTURE NOTES: Direct write-off vs Allowance method Direct write-off method Doubtful of collection No journal entry Definitely uncollectible Debit: Doubtful Account Expense Credit: Accounts Receivable Recovery Debit: Cash Credit: Bad Debt Recovery Allowance method Debit: Doubtful Account Expense Credit: Allowance for Doubtful Accounts Debit: Allowance for Doubtful Accounts Credit: Accounts Receivable Debit: Accounts Receivable Credit: Allowance for Doubtful Accounts Debit: Cash Credit: Accounts Receivable Accounting for doubtful accounts – Allowance method Profit or loss approach • % of sales FOCUS: Doubtful accounts expense (Matching) SFP approach • % of accounts receivable • Aging FOCUS: Allowance for doubtful accounts (NRV of AR) What is the effect on net income at the time of the collection of an account previously written off under each of the following methods? Direct write-off method No effect Increase Increase No effect a. b. c. d. Allowance method Increase Increase No effect No effect Bangui Company provides for doubtful accounts expense at the rate of 3 percent of credit sales. The following data are available for last year: Allow. for Doubtful Accounts, Jan. 1 Accounts written off as uncollectible Collection of accounts written off Credit sales, year-ended December 31 54,000 60,000 15,000 3,000,000 The allowance for doubtful accounts balance at December 31, after adjusting entries, should be a. P45,000 b. P84,000 c. P90,000 d. P99,000 On January 1, 2020, the balance of accounts receivable of Burgos Company was P5,000,000 and the allowance for doubtful accounts on same date was P800,000. The following data were gathered: 2017 2018 2019 2020 Credit sales 10,000,000 14,000,000 16,000,000 25,000,000 Write-offs 250,000 400,000 650,000 1,100,000 Recoveries 20,000 30,000 50,000 145,000 Doubtful accounts are provided for as percentage of credit sales. The accountant calculates the percentage annually by using the experience of the three years prior to the current year. How much should be reported as 2020 doubtful accounts expense? a. P750,000 b. P812,500 c. P330,000 d. P875,000 John Corp. has the following data relating to accounts receivable for the year ended December 31, 2020: Accounts receivable, January 1, 2020 Allowance for doubtful accounts, January 1, 2020 Sales during the year, all on account, terms 2/10, 1/15, n/60 Cash received from customers during the year Accounts written off during the year 480,000 19,200 2,400,000 2,560,000 17,600 An analysis of cash received from customers during the year revealed that P1,411,200 was received from customers availing the 10-day discount period, P792,000 from customers availing the 15-day discount period, P4,800 represented recovery of accounts written-off, and the balance was received from customers paying beyond the discount period. The allowance for doubtful accounts is adjusted so that it represents certain percentage of the outstanding accounts receivable at year end. The required percentage at December 31, 2020 is 125% of the rate used on December 31, 2019. The doubtful accounts expense for 2020 is a. P6,880 b. P7,120 c. P8,720 d. P8,960 The accounts receivable subsidiary ledger of Besao Corporation shows the following information: Customer Maybe, Inc. 12/31 Account balance 140,720 Perhaps Co. 83,680 Pwede Corp. 122,400 Perchance Co. 180,560 Invoice Date 12/06 11/29 09/02 08/20 12/08 10/25 11/17 Amount 56,000 84,720 48,000 35,680 80,000 42,400 92,560 Possibly Co. 126,400 Luck, Inc. 69,600 723,360 10/09 12/12 12/02 09/12 88,000 76,800 49,600 69,600 723,360 The estimated bad debt rates below are based on the Corporation’s receivable collection experience. Age of accounts 0 – 30 days 31 – 60 days 61 – 90 days 91 – 120 days Over 120 days Rate 1% 1.5% 3% 10% 50% The Allowance for Doubtful Accounts had a credit balance of P14,000 on December 31, 2020, before adjustment. The adjusting journal entry to adjust the allowance for doubtful accounts as of December 31, 2020 will include a debit to doubtful accounts expense of a. P52,795 b. P38,795 c. P24,795 d. P14,000 RECEIVABLE FINANCING Why would a company sell receivables to another company? I. In order to accelerate the receipt of cash from receivables. II. Because money is tight and access to normal credit is unavailable or too expensive. III. To avoid violating existing lending agreements. IV. Because billing and collection of receivables are often time-consuming and costly. a. I, II, III and IV b. I only c. I and II only d. I, II and III only An entity shall derecognize a financial asset when, and only when: a. The contractual rights to the cash flows from the financial asset expire. b. The entity transfers the financial asset and the transfer qualifies for derecognition. c. Either a or b. d. Neither a nor b. An entity transfers a financial asset if, and only if, it a. Transfers the contractual rights to receive the cash flows of the financial asset. b. Retains the contractual rights to receive the cash flows of the financial asset, but assumes a contractual obligation to pay the cash flows to one or more recipients in an arrangement that meets the “pass-through” conditions. c. Either a or b. d. Neither a nor b. When an entity retains the contractual rights to receive the cash flows of a financial asset (the ‘original asset’), but assumes a contractual obligation to pay those cash flows to one or more entities (the ‘eventual recipients’), the entity treats the transaction as a transfer of a financial asset if, and only if, certain conditions are met including a. The entity has no obligation to pay amounts to the eventual recipients unless it collects equivalent amounts from the original asset. b. The entity is prohibited by the terms of the transfer contract from selling or pledging the original asset other than as security to the eventual recipients for the obligation to pay them cash flows. c. The entity has an obligation to remit any cash flows it collects on behalf of the eventual recipients without material delay. d. All of these. How is transfer of risks and rewards evaluated? a. By comparing the entity’s exposure, before and after the transfer, with the variability in the amounts and timing of the net cash flows of the transferred asset. b. By determining the transferee’s ability to sell the asset. c. Either a or b. d. Neither a nor b. Examples of when an entity has retained substantially all the risks and rewards of ownership of transferred financial asset include a. A sale and repurchase transaction where the repurchase price is a fixed price or the sale price plus a lender’s return. b. A sale of a financial asset together with a total return swap that transfers the market risk exposure back to the entity. c. A sale of short-term receivables in which the entity guarantees to compensate the transferee for credit losses that are likely to occur. d. All of these. Which of the following transfers qualify for derecognition? a. An entity sells a financial asset with a carrying amount of P100,000 for P143,000. On the date of sale, the entity enters into an agreement with the buyer to repurchase the asset in three months for P145,000. b. An entity sells a financial asset with a carrying amount of P500,000 for P600,000 and simultaneously enters into a total return swap with the buyer under which the buyer will return any increases in value to the entity and the entity will pay the buyer interest plus compensation for any decreases in the value of the investment. The entity expects the fair value of the financial asset to decrease by P40,000. c. An entity sells a portfolio of short-term accounts receivables carried on its books at P2,100,000 for P2,000,000 and promises to pay up to P60,000 to compensate the buyer if and when any defaults occur. Expected credit losses are significantly less than P60,000, and there are no other significant risks. d. None of the above Which statement is incorrect regarding transfers that do not qualify for derecognition because the entity has retained substantially all the risks and rewards of ownership of the transferred asset? a. The entity shall continue to recognize the transferred asset in its entirety. b. The entity shall recognize a financial liability for the consideration received. c. In subsequent periods, the entity shall recognize any income on the transferred asset and any expense incurred on the financial liability d. The asset and the associated liability shall be offset. LECTURE NOTES: Accounting for transfers of receivables Have substantially all the risks and rewards been transferred? YES – Record as a sale: 1. Derecognize the asset sold. 2. Recognize assets obtained and liabilities incurred. 3. Record gain or loss. NO – Record as a secured borrowing: 1. Do not derecognize the asset. 2.Record liability. 3. Record interest expense. If an entity neither transfers nor retains substantially all the risks and rewards of ownership of a transferred asset, the entity shall a. Derecognize the financial asset and recognize separately as assets or liabilities any rights and obligations created or retained in the transfer. b. Continue to recognize the financial asset. c. Determine whether it has retained control of the financial asset. d. Continue to recognize the transferred asset to the extent of its continuing involvement. How is transfer of control evaluated? a. By comparing the entity’s exposure, before and after the transfer, with the variability in the amounts and timing of the net cash flows of the transferred asset. b. By determining the transferee’s ability to sell the asset. c. Either a or b. d. Neither a nor b. An entity has not retained control of a transferred asset if a. The transferee has the practical ability to sell the transferred asset. b. The transferee does not have the practical ability to sell the transferred asset. c. The entity retains an option to repurchase the transferred asset and the transferee cannot readily obtain the transferred asset in the market if the entity exercises its option. d. A put option or guarantee constrains the transferee from selling the transferred asset. Which statement is incorrect if an entity neither transfers nor retains substantially all the risks and rewards of ownership of a transferred asset, and retains control of the transferred asset? a. The entity continues to recognize the transferred asset to the extent to which it is exposed to changes in the value of the transferred asset. b. When an entity continues to recognize an asset to the extent of its continuing involvement, the entity also recognizes an associated liability. c. The transferred asset and the associated liability are measured on a basis that reflects the rights and obligations that the entity has retained. d. The entity shall offset any income arising from the transferred asset with any expense incurred on the associated liability. Bago Company sells a portfolio of short-term accounts receivable with a carrying amount of P900,000 for P1,000,000 and promises to pay up to P30,000 to compensate the buyer if and when any defaults occur. Bago Company neither transfers nor retains substantially all the risks and rewards of ownership of the transferred asset, and retains control of the transferred asset. How much should be recognized as continuing involvement in the receivables? a. P1,000,000 b. P900,000 c. P30,000 d. P 0 Bago Company sells a portfolio of short-term accounts receivable with a carrying amount of P900,000 for P1,000,000 and promises to pay up to P930,000 to compensate the buyer if and when any defaults occur. Bago Company neither transfers nor retains substantially all the risks and rewards of ownership of the transferred asset, and retains control of the transferred asset. How much should be recognized as continuing involvement in the receivables? a. P1,000,000 b. P900,000 c. P930,000 d. P 0 LECTURE NOTES: The entity continues to recognize the transferred asset to the extent to which it is exposed to changes in the value of the transferred asset. Continuing involvement = CA of asset vs Guarantee made by the entity, whichever is lower. Which statement is incorrect regarding pledge of accounts receivable? a. New receivables can be substituted for the ones collected. b. The accounts pledged are not transferred to a special ledger control account. c. No special accounting for the borrowing is needed. d. Does not require note disclosure relating to details of transaction. LECTURE NOTES: Pledge vs Assignment Specific accounts involved are identified Substitution Special control account Special accounting for borrowing Disclose details of transaction PLEDGE No Yes No No Yes ASSIGNMENT Yes No Yes No Yes Sipalay Co. assigned P500,000 of accounts receivable to Hinigaran Finance Co. as security for a loan of P420,000. Hinigaran charged a 2% commission on the amount of the loan; the interest rate on the note was 10%. During the first month, Sipalay collected P110,000 on assigned accounts after deducting P380 of discounts. Sipalay accepted returns worth P1,350 and wrote off assigned accounts totaling P3,700. Entries to record the foregoing transactions would include a a. debit to Cash of P110,380. b. debit to Bad Debts Expense of P3,700. c. debit to Allowance for Doubtful Accounts of P3,700. d. debit to Accounts Receivable of P115,430. On November 30, accounts receivable in the amount of P900,000 were assigned to Kaban Finance Co. by Kalan as security for a loan of P750,000. Kaban charged a 3% commission on the accounts; the interest rate on the note is 12%. During December, Kalan collected P350,000 on assigned accounts after deducting P560 of discounts. Kalan wrote off a P530 assigned account. On December 31, Kalan remitted to Kaban the amount collected plus one month's interest on the note. How much is Kalan’s equity in the assigned accounts receivable as of December 31? a. P149,470 b. P141,970 c. P141,410 d. P148,910 Use the following information for the next two questions. Entity A factors P500,000 of accounts receivable. Entity A transfers the receivable records to the factor, which will receive the collections. Factor assesses a finance charge of 3 percent of the amount of accounts receivable and retains an amount equal to 5 percent of the accounts receivable (for probable adjustments). If the transfer is on a non-guarantee (or without recourse) basis, which statement is correct? a. Entity A reports both a receivable and a liability of P500,000 in its statement of financial position. b. Entity A records a loss of P40,000. c. The factor’s net income will be the difference between the financing income of P15,000 and the amount of any uncollectible receivables. d. None of the above. If Entity A issues a guarantee to factor to compensate the factor for any credit losses on receivables transferred, which statement is correct? a. Entity A reports both a receivable and a liability of P500,000 in its statement of financial position. b. Entity A records a loss of P15,000. c. The factor’s net income will be the difference between the financing income of P15,000 and the amount of any uncollectible receivables. d. None of the above. Sleeping Corporation factored P600,000 of accounts receivable to Beauty Finance Co. Control was surrendered by Sleeping. Beauty accepted the receivables subject to recourse for nonpayment. Beauty assessed a fee of 3% and retains a holdback equal to 5% of the accounts receivable. In addition, Beauty charged 15% interest computed on a weighted average time to maturity of the receivables of 54 days. The fair value of the recourse obligation is P9,000. The loss on factoring to be recognized by Sleeping Corporation is a. P31,315 b. P40,315 c. P61,315 d. P70,315 Use the following information for the next three questions. The Hinoba-an Department Store wishes to discount a note receivable arising from the sale of merchandise in order to meet some maturing obligations. The note has a face amount of P50,000. The note bears interest of 12% and is due in one year. The bank rate in discounting notes is 12%. Assuming that the note was discounted ten months prior to maturity. The proceeds from this discounted note amounted to a. P56,000 b. P51,000 c. P50,400 d. P50,000 If the note discounting is treated as a sale without recourse, the loss on discounting is a. P1,000 b. P600 c. P400 d. P0 Which statement is incorrect if the note discounting is treated as borrowing? a. The entity shall continue to recognize the note receivable in its entirety. b. The entity shall recognize a financial liability for the consideration received. c. The entity shall report net interest income of P400. d. None of the above. On May 17, Sagay Co. accepted a P6,500, 8%, 90-day note from a customer. On June 11, the note was discounted at 10%. At maturity date, the note was dishonored and the bank charged a P25 protest fee. The amount that Sagay Co. would debit to Notes Receivable Dishonored is: a. P6,655 b. P6,525 c. P6,535 d. P6,130 An entity shall disclose information that enables users of its financial statements a. To understand the relationship between transferred financial assets that are not derecognized in their entirety and the associated liabilities. b. To evaluate the nature of, and risks associated with, the entity’s continuing involvement in derecognized financial assets. c. Both a and b. d. Neither a nor b. PRESENTATION OF TRADE AND OTHER RECEIVABLES Which statement is incorrect regarding presentation of receivables in the statement of financial position? a. Trade receivables are reported under current assets. b. Non-trade receivables are included in the line item ‘trade and other receivables’ if they are expected to be realized within twelve months after the reporting period. c. Non-trade receivables are reported as non-current if they are not expected to be realized within twelve months after the reporting period d. None of these. The following are normally included in the line-item trade and other receivables, except a. Advances to officers and employees b. Advances to subsidiaries and affiliates c. Receivables from sale of securities or property other than inventory. d. Dividends and interest receivable. DISCLOSURE REQUIREMENTS FOR TRADE AND OTHER RECEIVABLES In relation to receivables, an entity is required by PFRSs to a. Classify receivables as current and non-current in the statement of financial position. b. Disclose any receivables pledged as collateral. c. Disclose all significant concentrations of credit risk arising from receivables. d. All of these.