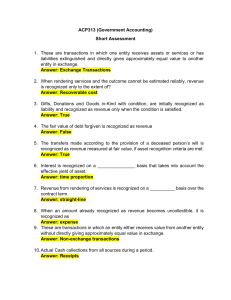

FANNIE GAIL C. PAILAGAO BS ACCOUNTANCY 3 CHAPTER 4 REVENUE AND OTHER RECEIPTS REVENUE Gross inflow of: o Economic benefits o Service potential Inflow increases equity o Not contributions from owners o FUNDAMENTAL PRINCIPLES FOR REVENUE 1. All revenues are remitted to the National Treasury Included in the government fund of NG 2. All moneys and properties received by public officer are government funds and properties 3. Amounts from trust and business-type activities of government separately recorded disbursed according to relevant laws 4. Receipts recorded as revenue of: Special Fund Fiduciary Fund Trust Fund; or Other than General Fund o Only when authorized by law 5. Collecting officer issue OR upon collecting payments 6. Mechanical devices (e-OR) are used to acknowledged cash receipts COA may approve (upon request) exemption from the use of accounting forms 7. Temporary receipts not used to acknowledge receipt of public funds 8. Pre-numbered ORs issued strictly in numerical sequence Duplicate copies = exact copies of original 9. Collecting officers shall accept payments in checks Conditions: o Proper endorsement o Proper identification of payee or endorsee Shall not use government funds to encash private checks. o only in the banks 10. Receipt of government funds acknowledged in accordance by the law, includes: o Date of receipt o From whom o On what account the fund was received purpose XAVIER UNIVERSITY – ATENEO DE CAGAYAN TYPES OF FUNDS 1. General Fund Available for any purpose 2. Special Fund For special purpose Collection/income SAGF 3. Trust Fund (Fiduciary Fund) Held by government agency/officer For the fulfillment of a condition Collection/Income SAGF 4. Revenue Fund All funds from income of government agencies Available for appropriation or expenditure follow Law 5. Depository Fund Held in authorized depository bank Recipient agency o retains control for lawful purposes 6. Special Account in the General Fund (SAGF) Facilitate funding of priority activities Sourced from the ff: o Specific fees o Grants o Donations Relevant legal provisions of SAGF: o All income/collections from Special and Fiduciary Fund remitted to Treasury and Treated as SAGF o SAGF is automatically appropriated and authorized by law Except GAA provides otherwise o SAGF is released to government agencies Subject to President’s approval NOTE!! Money collected for special purpose Special fund Excess of Special fund due to purpose fulfilled/abandoned transferred to General Funds FANNIE GAIL C. PAILAGAO BS ACCOUNTANCY 3 SOURCES OF REVENUE 1. Exchange Transactions 2. Non-exchange Transactions Transferred Consideration not equal to Fair Value entity determines the ff whether: Transactions include a combination of exchange and non-exchange o Recognized separately If not clear if exchange/non-exchange o Examine substance of transaction Sale of Goods = exchange If transaction price is subsidized = non-exchange Does not signify non-exchange: o Receipt of trade discount o Receipt of quantity discounts o Other reduction in price EXCHANGE TRANSACTIONS One entity receives assets/services/liabilities extinguished gives approximately equal value to another o Sale of Goods o Rendering Services Sale of Goods or Provision of Services to third parties a. Service Income Permit fees Registration Fees Franchising Fees Licensing Fees Legal Fees Passport and Visa Fees Processing Fees b. Business Income School Fees Examination Fees Rent/Lease Income Communication Network Fee Income from Hostel/Dorms Sales Revenue Hospital Fees Share in Profit of Joint Venture Use by other entities of assets yielding the ff: a. Interest Income Charges for use of cash or its equivalents Amounts due to entity b. Royalties Fees for the use of entity’s asset XAVIER UNIVERSITY – ATENEO DE CAGAYAN 1. 2. 3. 4. Trademarks Patents Software Copyrights c. Dividends Share of NG from its investment in GOCCs or other entities RECOGNITION OF REVENUE FROM EXCHANGE TRANSACTIONS A. Sale of Goods all conditions are satisfied: Significant risk and rewards are transferred Entity does not retain control Inflow of Economic benefit is probable Revenue and cost can be measured B. Rendering Services Recognized straight line basis Reference Stage of Completion (Percentage of Completion Method) i. Only if outcome can be measured reliably Outcome can be measured reliably under the ff conditions: i. Stage of completion, Revenue and Cost can be measured reliably ii. Probable inflow of economic benefits Services over a period of time revenue is recognized on a straight line basis practical purpose Outcome of Rendering Service cannot be measured reliably revenue is only to extent of recoverable expense C. Interest Recognized on time proportion basis Consider effective yield on the asset D. Royalties Recognized as they are earned Accordance with substance of agreement E. Dividends Right to receive payment is established FANNIE GAIL C. PAILAGAO BS ACCOUNTANCY 3 Government entity recognizes revenue in the ff: Service Income when services are rendered if not practicable when fees are collected Business Income (except sales of goods) when fees are billed in not practicable when fees are collected MEASUREMENT OF REVENUE FROM EXCHANGE TRANSACTION measured at fair value trade discounts and volume rebates shall be taken into account. Fair Value value which an asset can be exchange or value a liability can be settled Deferred Consideration Fair value is LESS than nominal account Fair Value is determined using an imputed rate of interest/ effective interest rate. Interest Revenue FV – Nominal Account Advance Consideration Initial Liability Subsequent Revenue EXCHANGE OF GOODS OR SERVICES Similar Nature and Value no revenue Dissimilar Nature and Value revenue Measuring Revenue following the order of priority FV of goods/services RECEIVED a. Adjusted by amount of cash transferred FV of goods/services GIVEN UP a. Adjusted by amount of cash transferred XAVIER UNIVERSITY – ATENEO DE CAGAYAN Monetary sanctions due to breach of law Gifts, Donations and Goods/Services in-Kind Voluntary transfers of assets and services Free from stipulations RECOGNITION OF REVENUE FROM NON-EXCHANGE TRANSACTIONS Recognized cash basis Recognized when collected OR when measurable and legally collectible TAX REVENUE Recognized gross amount Not reduced for expenses paid through the tax system Shall not be grossed up for the amount of tax expenditures EXPENSES PAID THROUGH THE TAX SYSTEM Expenses which should be paid whether taxpayer pays taxes or uses a particular mechanism to pay taxes TAX EXPENDITURES Preferential provisions of the tax law Provide certain taxpayers grant not available for others Forgone revenue not expense Type of Tax a. Income Tax b. Value Added Tax c. Goods and Services tax d. Customs Duty e. Death duty NON-EXCHANGE TRANSACTIONS Mostly derived from the ff: Taxes Fines and Penalties Gifts Donations Goods in-kind Taxes Compulsory payments Revenue to the government Do not include fines and penalties Fines and Penalties f. Property Tax `Taxable Event Taxable income Payment for taxable activity Purchase or sale of taxable goods or services Movement of dutiable goods/services across the customs boundary Death of the owner of taxable property Passage of the time period for which the tax is levied. TRANSFERS Inflows of future economic benefits or services From non-exchange transactions Includes the following, except taxes: o Fines o Gifts o Donations and Goods o Service in-kind FANNIE GAIL C. PAILAGAO BS ACCOUNTANCY 3 o Debt forgiveness o Bequests o Grants Transfers are transaction where resources are without approximate value FINES AND PENALTIES Income as they are collected Measured at best estimate Revenue only IF meet the criteria for asset Entity Collecting Fines o Not treat fines are revenue GIFTS, DONATIONS AND GOODS IN-KIND Revenue only when probable future economic benefits or service will flow Received w/o conditions o immediate revenue Received w/ conditions o Initial: Liability o Subsequent: Revenue When obligation is satisfied SERVICES IN-KIND Not revenue uncertain control of entity Cannot be measured reliably at Fair value o Technical Assistance from foreign bodies o Community services by convicted person o Volunteer services Disclosed in the notes MEASUREMENTS OF NON-EXCHANGE TRANSACTIONS Asset acquisition date FV Liabilities present value using Effective Interest Rate Revenue amount increase in net asset o Initial: liability o Subsequent reduction = Revenue DEBT FORGIVENESS LENDER Lender cancels debt debtor recognize revenue = CA of Debt forgiven CONTROLLING ENTITY Cancels debt of a whole owned and controlled entity entity recognizes contribution from owners o Not revenue BEQUEST XAVIER UNIVERSITY – ATENEO DE CAGAYAN Transfer made according to a deceased person’s will If satisfy asset recognition revenue measured at FV GRANTS WITH CONDITIONS Initial recognition liability Subsequent revenue PLEDGES Unenforceable undertaking to transfer assets to the recipient entity NOT Revenue If transferred recognized as gift/donation Warrant disclosure as contingent assets CONCESSIONARY LOANS Loans below market terms Entity determines if: Transaction Price (Loan Proceeds) – FV of Loan = Non-Exchange Transaction o If non-exchange REVENUE Except: there is a present obligation Initial: Liability Subsequent: Revenue IMPAIRMENT LOSSES AND ALLOWANCES FOR IMPAIRMENT LOSSES Recognized when revenue becomes uncollectible expense Evaluation of collectability of accounts: o Historical bad debts o Customer/recipient credit worthiness o Current economic trends o Changes in payment activity Allowance provided for Estimated Bad Debts OTHER RECEIPTS A. Receipt of Subsidy from National Government B. Receipt of Subsidy/Assistance from the Government Agencies including LGUs, and GOCCs C. Receipt of Excess Cash Advance granted to officers and employees D. Receipt of refund of overpayment of expenses E. Receipt of performance bond or security deposits F. Collections made on behalf of another entity G. Intra and Inter Agency Fund Transfers