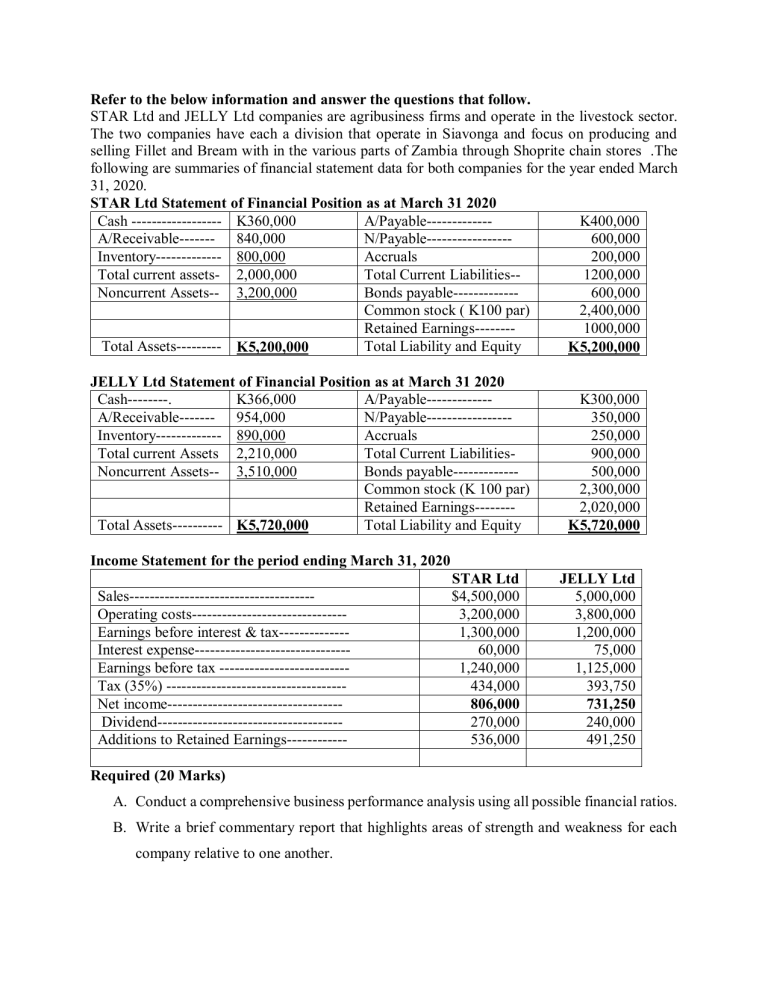

Refer to the below information and answer the questions that follow. STAR Ltd and JELLY Ltd companies are agribusiness firms and operate in the livestock sector. The two companies have each a division that operate in Siavonga and focus on producing and selling Fillet and Bream with in the various parts of Zambia through Shoprite chain stores .The following are summaries of financial statement data for both companies for the year ended March 31, 2020. STAR Ltd Statement of Financial Position as at March 31 2020 Cash ------------------ K360,000 A/Payable------------K400,000 A/Receivable------- 840,000 N/Payable----------------600,000 Inventory------------- 800,000 Accruals 200,000 Total current assets- 2,000,000 Total Current Liabilities-1200,000 Noncurrent Assets-- 3,200,000 Bonds payable------------600,000 Common stock ( K100 par) 2,400,000 Retained Earnings-------1000,000 Total Assets--------- K5,200,000 Total Liability and Equity K5,200,000 JELLY Ltd Statement of Financial Position as at March 31 2020 Cash--------. K366,000 A/Payable------------A/Receivable------- 954,000 N/Payable----------------Inventory------------- 890,000 Accruals Total current Assets 2,210,000 Total Current LiabilitiesNoncurrent Assets-- 3,510,000 Bonds payable------------Common stock (K 100 par) Retained Earnings-------Total Assets---------- K5,720,000 Total Liability and Equity K300,000 350,000 250,000 900,000 500,000 2,300,000 2,020,000 K5,720,000 Income Statement for the period ending March 31, 2020 Sales------------------------------------Operating costs------------------------------Earnings before interest & tax-------------Interest expense------------------------------Earnings before tax -------------------------Tax (35%) -----------------------------------Net income----------------------------------Dividend------------------------------------Additions to Retained Earnings------------ STAR Ltd $4,500,000 3,200,000 1,300,000 60,000 1,240,000 434,000 806,000 270,000 536,000 JELLY Ltd 5,000,000 3,800,000 1,200,000 75,000 1,125,000 393,750 731,250 240,000 491,250 Required (20 Marks) A. Conduct a comprehensive business performance analysis using all possible financial ratios. B. Write a brief commentary report that highlights areas of strength and weakness for each company relative to one another.