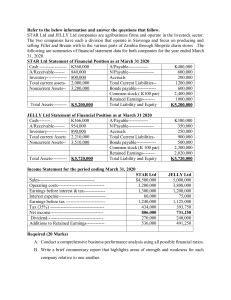

Financial Statements Analysis Assignment One Quick Mart ltd is a firm that specializes in the production, distribution and retail of fresh farm products with food stores in all the modern shopping malls in Kenya. A detailed analysis of the financial statements is summarized as follows; 1 2 3 4 5 6 7 8 9 10 11 Ratio 2018 2019 2020 Gross profit margin Inventory Turnover Depreciation/Total Assets Days’ sales in receivables Debt to Equity Profit Margin Total Asset Turnover Quick Ratio Current Ratio Times Interest Earned Earnings per share 0.45 62.65 0.25 113 0.75 0.082 0.54 1.028 1.33 0.9 1.75 0.40 42.42 0.014 98 0.85 0.07 0.65 1.03 1.21 4.375 1.85 0.35 32.25 0.018 94 0.90 0.06 0.70 1.029 1.15 4.45 1.90 2020Industry Average 0.35 53.25 0.015 130.25 0.88 0.075 0.40 1.031 1.25 4.65 1.88 Additional information In the annual report to the shareholders, the CEO of Quick Mart Ltd note, “2020 was a good year for the firm with respect to our ability to meet our short-term obligations. We had higher liquidity largely due to an increase in highly liquid current assets (cash, account receivables and short-term marketable securities).” Required a) Evaluate the CEO statements using the data provides but also focusing on the efficiency of the company b) You are asked to provide the shareholders with an assessment of the firm's solvency and leverage. Be as complete as possible given the above information, but do not use any irrelevant information. c) Discuss the additional information that you would require to analyze the Diluted Earnings Per Share d) Using a model of your choice explain how you can predict corporate failure (financial distress) of Quick Mart Ltd e) Prepare a report on the general trends from 2018 to 2020 clearly identifying areas that management must focus on