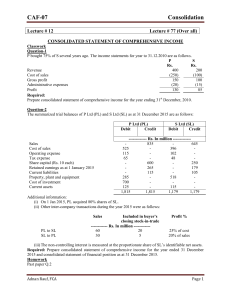

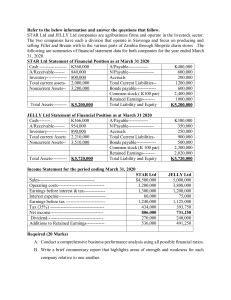

Exercise 2

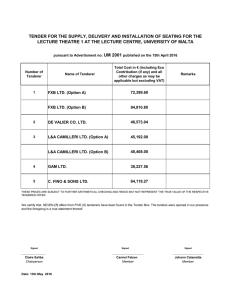

advertisement

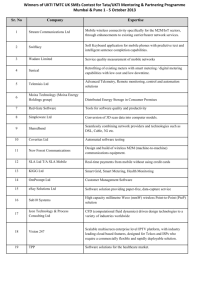

FDM 10 CAPITAL INVESTMENT APPRAISAL 2 Exercise 2 – Whether to continue a project IT Systems Ltd has commenced work on a project. When the company carried out the initial appraisal for the project, the cash flows were forecast to be as follows: Year Cash flow (£000s) 0 (500) 1 (350) 2 (200) 3 450 4 750 5 800 It is now the end of year 0 and the investment is about to be made for year 1. The actual cash outflow in year 0 was £700,000 and it now appears likely that the required investment in year 1 will be £500,000. The estimates of cash flows for subsequent years have not changed. Another company has offered to take over the project from IT Systems Ltd for a consideration paid to IT Systems Ltd of £800,000. If IT Systems Ltd did abandon the project they would have to make redundancy payments of £50,000. IT Systems Ltd’s cost of capital (discount rate) is 12%. Required: Should the project be abandoned on financial terms? What other aspects should IT systems Ltd consider before making this decision?