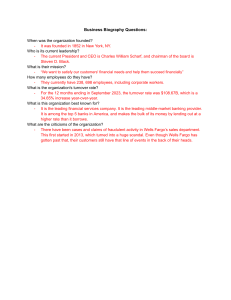

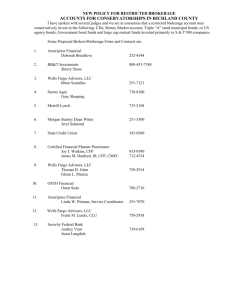

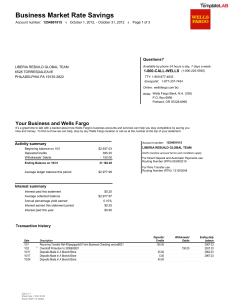

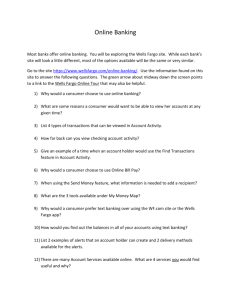

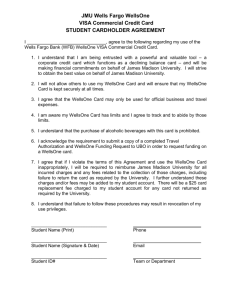

Wells Fargo is part of the big 4 of financial institutions in America having trillions of dollars in assets. Putting emphasis on customer-relationships by dealing with them on a personal level. However, the real motivation was “cross-selling” where in due to positive customer engagement, it would entice them to avail of more products from a trusted brand rather than others, with experience from past transactions. The Company took it a step too far and got obsessed with cross selling where they placed unacceptable pressure on their employees and set out unrealistic sales quotas in worst case scenarios being fired right on the spot. In the span of 14 years ending 2016, employees would use the bank’s database on customers who had pre-approval on their credit card and credit scores and essentially opened credit cards for them, forging their signatures, carefully forging contact information and using fake emails so as to not get caught. In 2017, Wells Fargo admitted to creating an estimate of 3.5M fake accounts. Consequences for the fraud resulted in 5,000 people losing their jobs; the CEO at the time, John Stumpf stepping down and getting banned from the banking industry, and lastly. It resulted in Wells Fargo paying a sum of $4.382B in a span of 4 years starting September 2016. John Stumpf Wells Fargo Logo Cross Selling Putting information Forgery