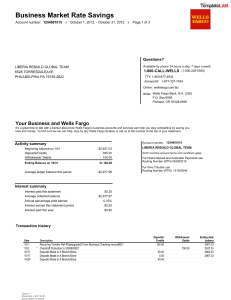

Who is Wells Fargo? • Founded in 1852 by Henry Wells and William Fargo in San Francisco, California • Offered banking where consumers could buy and sell gold and paper bank drafts. • In the 1860’s, they opened offices in other cities of the West and “earned a reputation of trust by dealing rapidly and responsibly with people’s money.” Their Crime • Since 2011, Wells Fargo employees have created fake checking accounts and credit card accounts for existing customers without their consent. • Using forged signatures, phony PIN’s and fake e-mail addresses, the company was able to accomplish this. • The bank also charged customers at least $1.5 million in over-draft and maintenance fees for these fraudulent accounts. How Did They Do It? • This was done due to the unrealistic “cross-selling” expectations led by senior executives of the company. • The average number of bank accounts a person needs is 2-3 accounts, where Wells Fargo was setting that number between 6-8. This put a huge burden on employees to make sure they meet the sales quota. • Executives throwing in incentives such as compensation, this makes for an even more pressured workload. Driven by Greed and Corruption • Corruption within the supervisory and executive level employees and the fine print rules Wells Fargo trapped their customers into. • The executives and supervisors saw this fraud occurring but disregarded it due to million-dollar bonuses and the rise of investment in false-advertised Wells Fargo stock. • In order to make the most capital, they risked their customer’s money and credit scores, as well as the jobs of lower-level employees. • Wells Fargo had written in fine print on every contract that their customers signed that they were forbidden from partnering with others to file a lawsuit against the bank, they were only allowed a private arbitration. It Could Have Been Prevented • The problem started with this absurd proposal from top level executives. • Greedy, manipulative executives need to stop setting the bar so high for their company’s cross-selling numbers when it isn’t going to ever be a reality. • There is no way the average American needs 8 bank accounts and there is no way for lower-level employees to sell that many products to them. Their Victims • Investors/shareholders, the consumers and 5,300 lowlevel employees of Wells Fargo were fired. • Wells Fargo paid $185 million to the Consumer Financial Protection Bureau, its shareholders will ultimately have to swallow the cost of that settlement. New Legislations • Members of Congress are working on laws that will make it harder for Wall Street businesses and banks to commit crimes such as these. • Unfortunately, no one from Wells Fargo executive administration has been incarcerated or fired from their position.