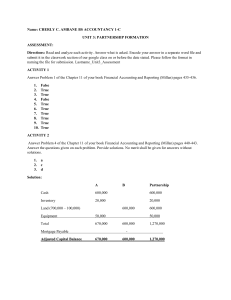

Accounting Problem: Journal Entries, Balance Sheet, Income Statement

advertisement

XYZ has the following balances as of 12/31/02: Cash Accounts receivable, net of $2,500 allowance for doubtful accounts Inventory Marketable securities, at fair value, cost of $11,500 Fixed assets Accumulated depreciation Accounts payable Debt Retained earnings Common stock 10,000 45,000 70,000 11,500 500,000 (200,000) 30,000 200,000 106,500 100,000 The following applies to the month ended January 31, 2003 (XYZ uses perpetual inventory accounting): 1. Combined inventory purchases for the month of $450,000, on credit, terms 2/10 net 30, XYZ uses the gross method 2. Sell goods to customers for $750,000 (no discounts offered). Perpetual inventory system indicates that the cost of the goods sold was $500,000. 3. Combined collections from customers of $560,000 of accounts receivable during January. 4. Management concludes that an adjustment to lower the cost of inventory to market is required; the adjustment required is $20,000. 5. One of the product lines is showing substantial declines in demand from customers. Management performed an undiscounted cash flow analysis and determined that there is an impairment. The cost and accumulated depreciation of the equipment used for this product is $30,000 and $20,000, respectively. The estimated present value of the future cash flows from the equipment is $5,000. 6. Paid $460,000 of invoices; some of the invoices were paid within the discount period, resulting in $5,100 of discounts realized. 7. Compensation to employees who work directly on manufacturing was paid in the amount of 10,000. Management and the administrative staff were paid $25,000. 8. Management uses 1.5% of sales to provide the accounts receivable allowance. 9. Management review of the account receivable aging indicates that $12,500 of balances should be written-off. 10. Management reviews their marketable securities and determines that a $500 unrealized loss occurred during the month. Management has no intentions to sell the securities within the next 12 months. 11. The debt terms are: 10% rate, payments of interest plus $5,000 of principle per month until balance is reduced to zero. The January interest payment and principle payment were made on January 31. 12. The Company spent $100,000 on construction of a fixed asset on January 15. All of the amount spend is deemed “qualifying” for interest capitalization. 13. On January 31, 2003, the company borrowed $100,000 under a line of credit to cover estimated working capital issues. The borrowings must be paid by the end of the year. 14. The depreciation module indicates current month depreciation to be $10,000. 15. The effective tax rate is 35% and no estimated payments have been made. I. List the necessary journal entries based on the above information. It is best to number them as per above. II. PREPARE A CLASSIFIED BALANCE SHEET AND MULTIPLE-STEP INCOME STATEMENT AS OF AND FOR THE MONTH ENDED JANUARY 31, 2003. YOU CAN USE T-ACCOUNTS, A WORKSHEET OR WHATEVER YOU LIKE TO TRACK THE BALANCES AND ACTIVITY.