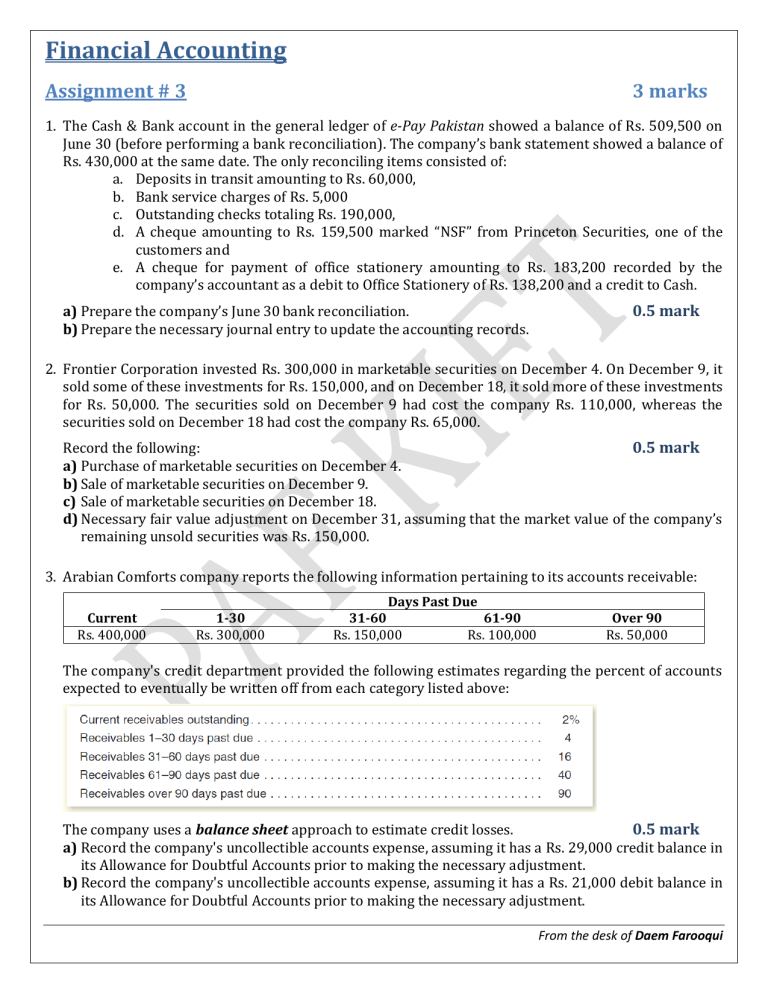

Financial Accounting Assignment # 3 3 marks 1. The Cash & Bank account in the general ledger of e-Pay Pakistan showed a balance of Rs. 509,500 on June 30 (before performing a bank reconciliation). The company’s bank statement showed a balance of Rs. 430,000 at the same date. The only reconciling items consisted of: a. Deposits in transit amounting to Rs. 60,000, b. Bank service charges of Rs. 5,000 c. Outstanding checks totaling Rs. 190,000, d. A cheque amounting to Rs. 159,500 marked “NSF” from Princeton Securities, one of the customers and e. A cheque for payment of office stationery amounting to Rs. 183,200 recorded by the company’s accountant as a debit to Office Stationery of Rs. 138,200 and a credit to Cash. a) Prepare the company’s June 30 bank reconciliation. b) Prepare the necessary journal entry to update the accounting records. 0.5 mark 2. Frontier Corporation invested Rs. 300,000 in marketable securities on December 4. On December 9, it sold some of these investments for Rs. 150,000, and on December 18, it sold more of these investments for Rs. 50,000. The securities sold on December 9 had cost the company Rs. 110,000, whereas the securities sold on December 18 had cost the company Rs. 65,000. Record the following: 0.5 mark a) Purchase of marketable securities on December 4. b) Sale of marketable securities on December 9. c) Sale of marketable securities on December 18. d) Necessary fair value adjustment on December 31, assuming that the market value of the company’s remaining unsold securities was Rs. 150,000. 3. Arabian Comforts company reports the following information pertaining to its accounts receivable: Days Past Due Current Rs. 400,000 1-30 Rs. 300,000 31-60 Rs. 150,000 61-90 Rs. 100,000 Over 90 Rs. 50,000 The company's credit department provided the following estimates regarding the percent of accounts expected to eventually be written off from each category listed above: The company uses a balance sheet approach to estimate credit losses. 0.5 mark a) Record the company's uncollectible accounts expense, assuming it has a Rs. 29,000 credit balance in its Allowance for Doubtful Accounts prior to making the necessary adjustment. b) Record the company's uncollectible accounts expense, assuming it has a Rs. 21,000 debit balance in its Allowance for Doubtful Accounts prior to making the necessary adjustment. From the desk of Daem Farooqui 4. On May 10, Computer Zone sold 80 Satellite Pro laptop computers to Summit Producers. At the date of this sale, Computer Zone’s inventory records included the following cost layers for the laptops: Jan 3: Feb 10: Mar 15: 40 units @ Rs. 100,000 35 units @ Rs. 150,000 25 units @ Rs. 200,000 Determine the cost of goods sold and the ending inventory on the basis of each of the following methods of inventory valuation (under both Perpetual & Periodic inventory systems): 01 mark a) Specific identification method (32 of the units sold were purchased on Jan 3, 28 on Feb 10 and the remaining units were purchased on Mar 15). b) Average-cost method c) FIFO method d) LIFO method 5. A recent annual report of Shah Foods Pvt. Ltd. reveals the following information (amounts are stated in million rupees): Cost of Goods Sold Inventory Balance (Jan. 1) Inventory Balance (Dec. 31) 57,454 8,498 7,796 a) Compute inventory turnover for the year. b) Compute the number of days required by the company to sell its average inventory. 0.5 mark From the desk of Daem Farooqui