Final exam Review

advertisement

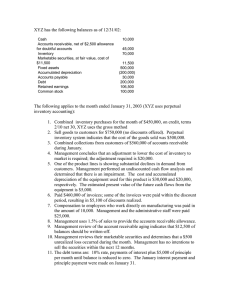

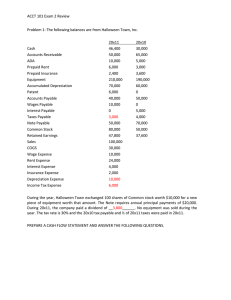

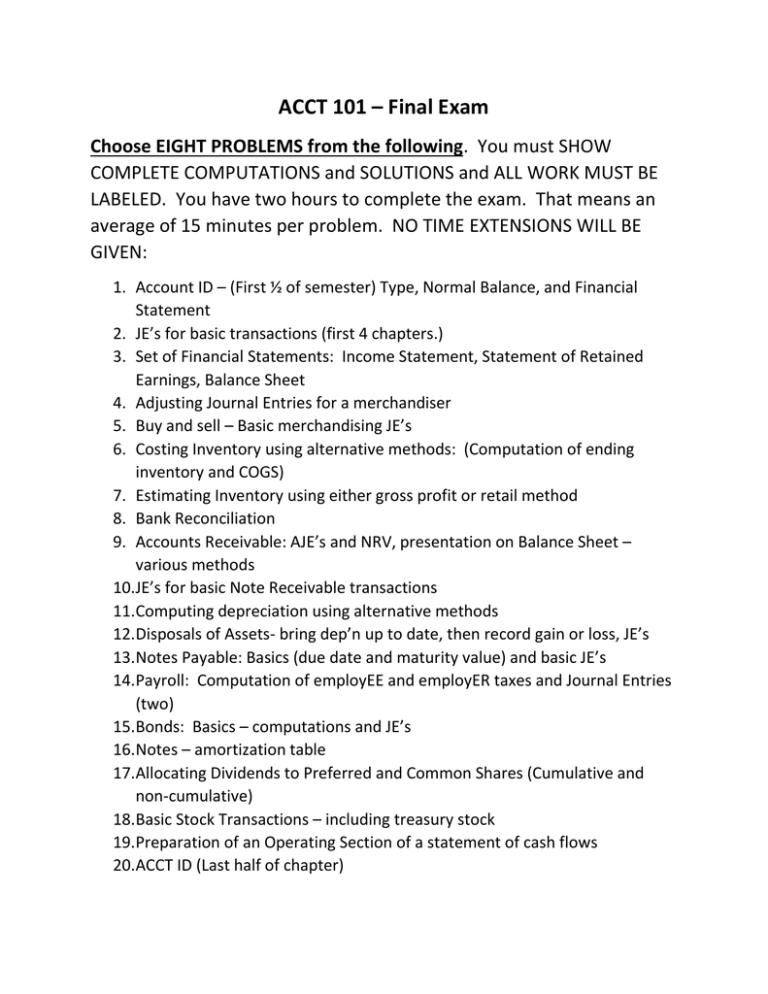

ACCT 101 – Final Exam Choose EIGHT PROBLEMS from the following. You must SHOW COMPLETE COMPUTATIONS and SOLUTIONS and ALL WORK MUST BE LABELED. You have two hours to complete the exam. That means an average of 15 minutes per problem. NO TIME EXTENSIONS WILL BE GIVEN: 1. Account ID – (First ½ of semester) Type, Normal Balance, and Financial Statement 2. JE’s for basic transactions (first 4 chapters.) 3. Set of Financial Statements: Income Statement, Statement of Retained Earnings, Balance Sheet 4. Adjusting Journal Entries for a merchandiser 5. Buy and sell – Basic merchandising JE’s 6. Costing Inventory using alternative methods: (Computation of ending inventory and COGS) 7. Estimating Inventory using either gross profit or retail method 8. Bank Reconciliation 9. Accounts Receivable: AJE’s and NRV, presentation on Balance Sheet – various methods 10.JE’s for basic Note Receivable transactions 11.Computing depreciation using alternative methods 12.Disposals of Assets- bring dep’n up to date, then record gain or loss, JE’s 13.Notes Payable: Basics (due date and maturity value) and basic JE’s 14.Payroll: Computation of employEE and employER taxes and Journal Entries (two) 15.Bonds: Basics – computations and JE’s 16.Notes – amortization table 17.Allocating Dividends to Preferred and Common Shares (Cumulative and non-cumulative) 18.Basic Stock Transactions – including treasury stock 19.Preparation of an Operating Section of a statement of cash flows 20.ACCT ID (Last half of chapter)