Partnership Formation Assessment - Accounting Problems & Solutions

advertisement

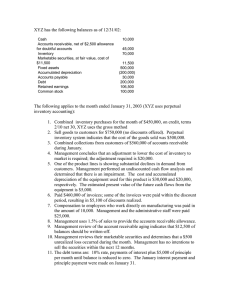

Name: CHERLY C. AMBANE BS ACCOUNTANCY 1-C UNIT 3: PARTNERSHIP FORMATION ASSESSMENT: Directions: Read and analyze each activity. Answer what is asked. Encode your answer in a separate word file and submit it in the classwork section of our google class on or before the date stated. Please follow the format in naming the file for submission. Lastname_Unit3_Assessment ACTIVITY 1 Answer Problem 1 of the Chapter 11 of your book Financial Accounting and Reporting (Millan) pages 435-436. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. False True True False True True True True True True ACTIVITY 2 Answer Problem 4 of the Chapter 11 of your book Financial Accounting and Reporting (Millan) pages 440-443. Answer the questions given on each problem. Provide solutions. No merit shall be given for answers without solutions. 1. 2. 3. a c d Solution: A B Partnership Cash 600,000 600,000 Inventory 20,000 20,000 Land (700,000 – 100,000) 600,000 Equipment 50,000 Total 670,000 Mortgage Payable Adjusted Capital Balance 600,000 50,000 600,000 1,270,000 670,000 600,000 1,270,000 4. b Solution: A Cash 400,000 Account Receivable (100,000-30,000) 70,000 Equipment (700,000-240,000) 450,000 Total 470,000 A’s Capital 470,000 B’s Capital Adjusted Capital Balances B 450,000 450,000 470,000 450,000 Journal Entry Debit 5. 6. Cash 400,000 Accounts Receivable 70,000 Equipment 450,000 Credit A’s Capital 470,000 B’s Capital 430,000 a b Solution: Agreed Initial Capital 2,500,000 A’s Capital (2,500,000×60%) 1,500,000 B’s Capital (2,500,000×40%) 1,000,000 7. a Solution: A B C Partnership Cash 750,000 1,000,000 500,000 2,250,000 Accounts Receivable 875,000 875,000 Inventories (1.125M-375k) 750,000 Building (1.875M-125k) 1,750,000 750,000 1,750,000 Net Contribution 1,625,000 2,750,000 1,250,000 5,625,000 Equal Interest (5.625M÷3) 1,875,000 1,875,000 1,875,000 5,625,000 Cash receipt (payment) (250,000) 875,000 (625,000) - 8. b 9. c 10. b ACTIVITY 3 Read and analyze each problem. Answer and provide solutions. No merit shall be given for answers without solutions Problem 1 Kent Maula, Reynaldo Montecina and Jeremy Maceda have decided to form a partnership business for the first time. Their respective contributions consisted of the following: Maula contributed cash of P150,000 and Furniture and Fixtures worth P100,000 but has a fair market value of P120,000. Montecina contributed a brand new delivery van which he acquired from Kia Motors at P850,000 and a balance of P100,000 from a financing company aside from his P50,000 cash contributions; Maceda’s contribution was his expertise in managing the affair of the business and is given a 15% share in profit. Required: 1. Prepare a compound journal entry to open the partnership book assuming: a. The P100,000 balance from a financing company is assumed by the partnership. b. The P100,000 balance from a financing company is not assumed by the partnership. 2. Prepare a Statement of Financial Position right after the formation in requirement 1-a only 1. Journal Entry Debit Cash 200,000 Furniture and Fixture 120,000 Equipment 850,000 Credit Accounts Payable 100,000 Maula’s, Capital 750,000 Montecina’s, Capital 270,000 To record initial investment of the partnertship Maula, Montecina, and Maceda Statement of Financial Position As of June 30, 2021 ASSETS Cash 200,000 Furniture and Fixture 120,000 Equipment 850,000 Total Assets P 1,170,000 LIABILITIES AND EQUITY Accounts Payable 100,000 Maula’s, Capital 750,000 Montecina’s, Capital 270,000 Total Liabilities and Equity P 1,170,000 Problem 2 Marilou Malquisto, Ma. Fretcyl Beringuel and Mark Anthony Alemanza were all successful entrepreneurs. They believed that once they pulled their resources together and with their combined expertise and managerial skills, they can surely beat the existing competitors in the locality. Their respective post-closing trial balance are presented below: Cash Accounts receivable Malquisto Beringuel Alemanza P 950,000 P 850,000 P 750,000 70,000 90,000 25,000 (5,000) (2,000) Estimated uncollectible accounts (3,000) Merchandise inventory 420,000 600,000 450,000 Equipment 350,000 480,000 250,000 Accumulated Depreciation (180,000) (230,000) (175,000) Capital P1,607,000 P1,785,000 P1,298,000 They agreed to comply with the following adjustments: 1. Accounts receivable should have the following probability of collection: Malquisto, 90%; Beringuel, 95%; and Alemanza, 98% 2. Merchandise should be revalued at 90% of the book value to provide for obsolescence 3. Equipment should have the carrying values as follows: Malquisto, P165,000; Beringuel, P150,000; and Alemanza, P180,000 4. Each of the prospective partner should level off their cash contribution to P1,000,000. Required: 1. Adjusting entries in their respective sole proprietorship book. 2. Closing entries in their respective sole proprietorship book. 3. Compound journal entries to open the books of the partnership. Books of Marilou Malquisito (1) Malquisito’s, Capital 270,000 Interest Receivable 7,000 Cash 50,000 Merchandise Inventory 42,000 Accumulated Depreciation 185,000 To record adjustment to restate Malquisito’s capital. (2) Estimated Uncollectable Accounts 3,000 Accumulated Depreciation 365,000 Malquisito’s, Capital 1,337,000 Cash 900,000 Accounts Receivable 70,000 Interest Receivable 7,000 Merchandise Inventory 378,000 Equipment 350,000 To close the books of Malquisito Books of Fretcyl Beringuel (1) Beringuel’s, Capital 535,500 Interest Receivable 4,500 Cash 150,000 Merchandise Inventory 60,000 Accumulated Depreciation 330,000 To record adjustment to restate Beringuel’s capital. (2) Estimated Uncollectable Accounts 5,000 Accumulated Depreciation 560,000 Malquisito’s, Capital 1,249,500 Cash 700,000 Accounts Receivable 90,000 Interest Receivable 4,500 Merchandise Inventory 540,000 Equipment 480,000 To close the books of Beringuel Books of Mark Anthony Alemanza (1) Alemanza’s, Capital 364,500 Interest Receivable 500 Cash 250,000 Merchandise Inventory 45,000 Accumulated Depreciation 70,000 To record adjustment to restate Alemanza’s capital. (2) Estimated Uncollectable Accounts 2,000 Accumulated Depreciation 245,000 Malquisito’s, Capital 933,500 Cash 500,000 Accounts Receivable 25,000 Interest Receivable 500 Merchandise Inventory 405,000 Equipment 250,000 To close the books of Alemanza Compound Journal Entry Cash 2,550,000 Accounts Receivable 185,000 Merchandise Inventory 1,470,000 Equipment 1,080,000 Estimated Uncollectable Accounts 10,000 Accumulated Depreciation 585,000 Malquisito’s, Capital 1,607,000 Beringuel’s, Capital 1,785,000 Alemanza’s, Capital 1,298,000 To record the investment of Malquisito, Beringuel and Alemanza