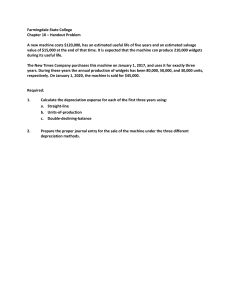

1 UNIVERSITY OF MICHIGAN ROSS SCHOOL OF BUSINESS ACCOUNTING 471 PRINCIPLES OF ACCOUNTING WINTER 2020 Name: Practice Major Quiz #2 (Print) This quiz consists of 20 multiple choice questions worth 4 points each. Read each question carefully. Answer all questions on the scantron answer sheet, using only a No. 2 pencil to record your answers. Mark your answer on the scantron sheet by blackening the appropriate space. Make no extraneous marks on the answer sheet, and if you must change an answer, be sure that your erasure is complete. You have seventy-five minutes to complete this quiz. At the conclusion of the seventyfive minutes, you will be instructed to read the Business School Honor Policy and sign below to indicate your compliance with the policy. Your quiz will not be graded if the statement is not signed. Business School Honor Policy: We, the members of the Business School community – students, faculty, and staff – commit ourselves to do our work and perform our duties honestly. We understand that in striving for excellence in performance, our personal and institutional integrity is our most precious asset; and accordingly, we will not knowingly act in ways that erode our integrity. Because we are an academic community, honesty in our academic work is vital. Therefore, we pledge neither to cheat nor to tolerate cheating. I acknowledge that I have been directed to work individually on this quiz. I certify that I have neither given nor received prohibited aid on this quiz. Signed: 2 Multiple Choice. For each question, circle the most correct answer. (4 points each) 1. Winston Engineering Services had a balance of $8,600 in the Allowance for Uncollectible Accounts at the beginning of its 2017 fiscal year. The firm did not make any adjusting entries to record uncollectible accounts expense during the year. At the end of the year, the firm recorded $3,680 of Uncollectible Accounts Expense based upon the following aging analysis: Age 0-30 days 31-60 days Over 60 days Amount $80,000 $12,000 $ 400 % Uncollectible 3% 20% 75% What were total write-offs for the year? a. b. c. d. e. $7,180 $6,180 $5,120 $5,100 None of the above. 2. The beginning balances in Accounts Receivable and the Allowance for Uncollectible Accounts were $250,000 and $15,000, respectively. The ending balance in Accounts Receivable is $270,000, and an aging analysis estimates that $16,000 of that amount will not be collected. For the year, credit sales were $1,000,000, and bad debt expense was $40,000. What were the amount of accounts receivable written off and the amount of cash collected from customers, respectively, during the year? a. b. c. d. e. $ 0 and $980,000 $39,000 and $980,000 $39,000 and $941,000 $ 0 and $941,000 None of the above. 3 3. A firm uses 5% of credit sales to estimate its uncollectible accounts expense. Under this method, the total uncollectible accounts expense for current year was $ 20,000. Credit sales for the first three quarters of current year were $100,000, $110,000, and $120,000. What were total credit sales for the fourth quarter of the year? a. b. c. d. e. $ 110,000 $ 100,000 $ 70,000 $ 3,500 None of the above. 4. Smithson Co. calculated that its Average Collection Period for Accounts Receivable is 60 days. Which of the situations shown below would cause concern for managers and creditors of the firm? a. b. c. d. e. The average collection period for similar-sized firms is 65 days. Last year’s average collection period was 70 days. The accounts receivable turnover of similar-sized firms was 8 times. The firm’s accounts receivable turnover last year was 5 times. None of the above situations should cause concern. 5. A $100,000 write-off of bad debts under the allowance method will: a. decrease both the Allowance for Uncollectible Accounts and Net Income by $100,000. b. decrease both the Allowance for Uncollectible Accounts and Accounts Receivable by $100,000. c. decrease both the Allowance for Uncollectible Accounts and Net Assets by $100,000. d. increase both the Allowance for Uncollectible Accounts and Net Income by $100,000. e. increase the Allowance for Uncollectible Accounts and decrease Net Assets by $100,000. 4 6. Richmond Corporation reported the following information for its years ended 12/31/13 and 12/31/14: 2013 2014 Sales $428,700 $ ? Beginning inventory ? ? Net Cost of Purchases 323,000 320,300 Ending inventory ? 21,500 Cost of goods sold 321,500 316,100 Gross margin 107,200 135,400 What was Richmond’s beginning inventory at 1/1/13? a. $17,300 b. $15,800 c. $10,900 d. $10,600 e. None of the above. 7. All inventory is purchased on account, and all accounts payable relate to inventory. The beginning balance in Accounts Payable was $352,000, and the ending balances in Inventory and Accounts Payable were $360,000 and $472,000, respectively. A total of $272,000 was paid to suppliers during the year, and cost of goods sold for the year was $544,000. What was the beginning balance in Inventory? a. b. c. d. e. $752,000 $512,000 $352,000 $208,000 None of the above. 8. In January 2018, two inventory errors from the prior years were discovered: Ending inventory at December 31, 2016, was overstated by $19,500, and ending inventory at December 31, 2017, was overstated by $12,000. What effect did these errors have on the 2017 financial statements? (Ignore income taxes.) a. b. c. d. e. Cost of goods sold understated by $31,500; stockholders’ equity understated by $12,000. Costs of goods sold understated by $7,500; stockholders’ equity overstated by $12,000. Cost of goods sold overstated by $31,500; stockholders’ equity overstated by $31,500. Cost of goods sold overstated by $7,500; stockholders’ equity overstated by $12,000. None of the above. 5 9. Superior Sales Co. reported sales of $1,720,000, net purchases of $1,102,000, and a gross margin percentage of 40% in 2016. For 2017, the company reported sales of $2,540,000, net purchases of $1,350,000, ending inventory of $158,000, and a gross margin percentage of 45%. What was the inventory at the beginning of 2016? a. b. c. d. e. $135 000 $185,000 $205,000 $512,000 None of the above. 10. The Marlin Company is contemplating switching from a FIFO to a LIFO inventory cost flow system because it anticipates a prolonged period of increasing quantities and costs in the future. The firm wishes to know which of the following statements about the effect of the switch to LIFO is correct, relative to remaining on FIFO (ignoring income tax effects): a. b. c. d. e. The current ratio will be higher. The inventory turnover will be higher. The gross margin percentage will be higher. The receivables turnover ratio will be higher. None of the above. 11. Kiner Co. paid $102,000 to suppliers of merchandise inventory during the year. All inventory is purchased on account. The company also reported the following: Beginning balance Ending balance Inventory (all bought on account) Accounts Payable (all for Inventory) $192,000 $135,000 $132,000 $177,000 What was Kiner’s Cost of Goods Sold for the year? a. $ 57,000 b. $147,000 c. $159,000 d. $204,000 e. None of the above. 6 12. D&M Corporation had a very good year. To determine bonuses to its employees, two performance measures are used: 1) gross margin percentage (which was 25% for the year) and 2) inventory turnover (which had increased to 6 times for the year). The company began the year with inventory of $100,000 and ended the year with inventory of $80,000. What were the sales for the year? a. b. c. d. e. $540,000 $600,000 $675,000 $720,000 None of the above. 13. The book value of a building reported on the balance sheet can be interpreted as: a. b. c. d. e. The estimated market value. The estimated replacement value. The estimated after-tax amount that would be received upon the sale of the building. The historical cost minus depreciation taken to date. Two of the above statements are correct. 14. At the beginning of the year, Pearl Corporation acquired a new machine at a cost of $152,000, with an expected salvage value of $8,000. Its useful life is estimated to be eight years. What would be the depreciation expense for the second year, using the double-declining-balance method? (Round your answer to the nearest whole dollar.) a. b. c. d. e. $29,576 $28,500 $ 8,000 $ 8,444 None of the above. 7 15. Winston Company has sold a machine that had an historical cost of $75,000. Winston bought the machine on January 1, 2013. At that time, it was estimated that the machine would have a useful life of ten years with a salvage value of $15,000. The machine was sold on January 1, 2015, for $54,000. If the straight-line depreciation method was used on the machine, what is the amount of gain or loss on the sale? a. b. c. d. e. $12,000 gain $ 6,000 gain $ 9,000 loss $18,000 loss None of the above. 16. On June 30, 2016, Smith Company acquired a machine with a cost of $1,350,000, a $120,000 salvage value, and a 5-year useful life. The machine is being depreciated using the straight-line method. The firm is interested in the effect that double-declining balance depreciation would have had. How much lower would the total amount of accumulated depreciation under the straight-line method be than the total amount of accumulated deprecation under the doubledeclining balance method at December 31, 2017? a. $ 441,500 b $ 348,750 c $ 333,000 d. $ 225,250 e. None of the above. 8 17. On January 1, 2015, Battle Company purchased a delivery truck for $252,000 with an estimated useful life of 140,000 miles and zero salvage value. The truck is being depreciated using the units-of-production method. The truck was driven 16,000 miles in 2015 and 20,000 miles in 2016. On January 1, 2017, an improvement was made to the truck that increased its total useful life to 160,000 miles and increased its salvage value to $1,400. The improvement cost $56,000. The firm reported $111,600 of accumulated depreciation on this truck at December 31, 2017. How many miles were driven in 2017? a. 48,000 b. 32,000 c. 30,000 d. 24,000 e. None of the above. 18. On January 1, 2011, a copyright was purchased for $119,000. The copyright will expire on December 31, 2030, and was being amortized over its legal life of 20 years. On January 1, 2015, it was determined that the economic life of the copyright is shorter than its legal life. The company now estimates that the copyright will not have any value past December 31, 2024. What amount should be reported for copyright, net of total amortization, at December 31, 2015? a. $74,970 b. $85,680 c. $88,200 d. $91,600 e. None of the above. 9 19. At January 1, 2012, Diamond Corp. purchased and placed in service a machine costing $264,600. Depreciation is recognized using the straight-line method. The machine was expected to have a useful life of 8 years and an estimated salvage value of $9,000. On January 1, 2015, Diamond determined that the machine would last an additional 9 years from that date, with the salvage value remaining unchanged. What is the depreciation expense to be recognized for 2015? a. $17,750 b. $18,125 c. $18,375 d. $18,750 e. None of the above. 20. On January 1, 2015, a corporation acquired an asset for $120,000 that had a salvage value of $15,000 and a 5-year life. The asset is being depreciated using the double-declining-balance method. Company management wonders what effect this depreciation method had on net income for 2017 compared to the straight-line method. By how much would net income before taxes in 2017 be different if the straight-line method had been used for the entire time? a. b. c. d. e. Net income before taxes would be $1,680 lower using straight-line depreciation. Net income before taxes would be $1,680 higher using straight-line depreciation. Net income before taxes would be $6,720 lower using straight-line depreciation. Net income before taxes would be $3,720 higher using straight-line depreciation. None of the above.