6 Taxable Income from Business Operations Chapter

advertisement

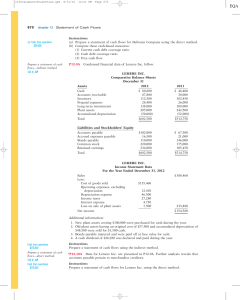

Chapter 6 Taxable Income from Business Operations Interpreting the Tax Provision in Financial Statements Accrual accounting required for financial reporting purposes Publicly traded corporations also generally use accrual accounting for tax reporting purposes However, there remain significant differences in methods of accounting for book and tax even though both use accrual accounting: Bad debts, warranty expense, etc. Depreciation methods are generally accelerated for tax e.g., “bonus” depreciation, Sec. 179 deduction, MACRS Some expenses (fines, “excess” executive compensation, etc.) must be accrued on financial statements, but aren’t deductible Foreign income not subject to U.S. tax until “repatriated” Accounting for Income Taxes (on Financial Statements) Financial statements must report the taxes that will be payable, either currently or in a future year, as a result of current year operations Information must be reported allowing users to interpret income tax expense reported on financial statements: Current tax expense—paid or payable in current year Deferred tax expense—attributable to income earned in current year, but payable in future year Accounting for Income Taxes—Example Depreciable equipment purchased for $40,000,000. Depreciated using SL method for book over 8 years 50% Bonus depreciation + 5-yr MACRS for tax Net income before taxes for book = $75,000,000, of which $25,000,000 is attributable to its foreign subsidiary, taxed in the foreign country at 20% What is taxable income? What is tax payable—foreign? U.S.? What is tax expense for financial reporting purposes?