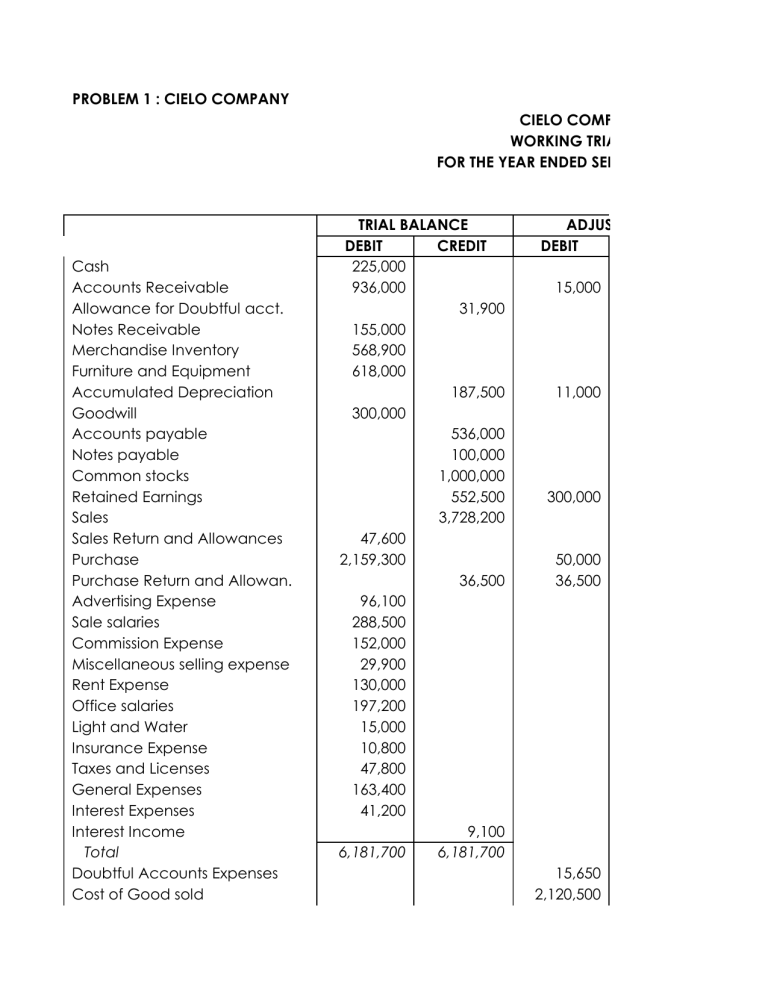

PROBLEM 1 : CIELO COMPANY CIELO COMPANY WORKING TRIAL BALANCE FOR THE YEAR ENDED SEPTEMBER 30, 2018 Cash Accounts Receivable Allowance for Doubtful acct. Notes Receivable Merchandise Inventory Furniture and Equipment Accumulated Depreciation Goodwill Accounts payable Notes payable Common stocks Retained Earnings Sales Sales Return and Allowances Purchase Purchase Return and Allowan. Advertising Expense Sale salaries Commission Expense Miscellaneous selling expense Rent Expense Office salaries Light and Water Insurance Expense Taxes and Licenses General Expenses Interest Expenses Interest Income Total Doubtful Accounts Expenses Cost of Good sold TRIAL BALANCE DEBIT CREDIT 225,000 936,000 31,900 155,000 568,900 618,000 187,500 300,000 536,000 100,000 1,000,000 552,500 3,728,200 47,600 2,159,300 36,500 96,100 288,500 152,000 29,900 130,000 197,200 15,000 10,800 47,800 163,400 41,200 9,100 6,181,700 6,181,700 ADJUSTMENT DEBIT 15,000 11,000 300,000 50,000 36,500 15,650 2,120,500 Merchandise Inventory Gain on sale of Equipment Depreciation Expense Prepaid Insurance Prepaid Rent Discount on notes payable Total Income before income tax Income before income tax Income tax Expense Income tax payable Profit 621,200 64,300 4,200 10,000 11,000 3,259,350 LO COMPANY RKING TRIAL BALANCE ENDED SEPTEMBER 30, 2018 ADJUSTMENT CREDIT 15,000 PROFIT AND LOSS DEBIT CREDIT 15,650 568,900 5,000 64,300 300,000 50,000 613,000 240,800 586,000 100,000 1,000,000 252,500 3,728,200 47,600 2,209,300 10,000 4,200 11,000 FINANCIAL POSITION DEBIT CREDIT 210,000 951,000 47,550 155,000 96,100 288,500 152,000 29,900 120,000 197,200 15,000 6,600 47,800 163,400 30,200 9,100 15,650 2,120,500 621,200 6,000 6,000 64,300 4,200 10,000 11,000 3,259,350 3,394,750 348,550 3,743,300 3,743,300 3,743,300 348,550 104,565 243,985 348,550 348,550 2,575,400 104,565 243,985 2,575,400 Audit Adjusting Entries: Accounts receivable Cash in Bank 15,000 15,000 Doubtful Accounts Expenses Allowance for Doubtful Accounts 15,650 Purchases Accounts payable 50,000 15,650 50,000 Cost of Goods Sold Inventory, end ( 601,200 + 50,000 - 30,000 ) Purchase Returns and Allowances Purchase ( 2,159,300 + 50,000 ) Inventory, Beginning Accumulated Depreciation Equipment Gain on sale of Equipment Furniture and Equipment ( 40,000 - 35,000 ). 2,120,500 621,200 36,500 2,209,300 568,900 *11,000 6,000 11,000 * 40,000 × 10 % × 2.75 Years ) = 11,000 32,000 / 80 % Remaining Life at 10/1/13 = 40,000 Depreciation Expense - Furniture and Equipment Accumulated Depreciation - Furniture and Equipment Furniture and Equipment ,per client Adjustment above Furniture and Equipment ,per audit Depreciation Expense : on Remaining Equipment 613,000 × 10 %. on Remaining Equipment sold 40,000 × 10 % × 9 /12 Depreciation for the year 64,300 64,300 618,000 (5,000) 613,000 61,300 3,000 64,300 Prepaid insurance (8,400 x 6/12) Insurance expense 4,200 4,200 Prepaid Rent 130,000 × 1/13 Rent Expense 10,000 Discount on notes payable Internet Expense 10,000 × 12% × 11/12 11,000 Retained Earnings Goodwill 10,000 11,000 300,000 300,000