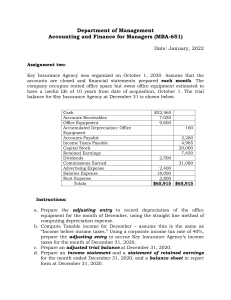

lOMoARcPSD|16594061 Class 4 - Trial Balance Financial Accounting (Trường Đại học Ngoại thương) Studocu is not sponsored or endorsed by any college or university Downloaded by Fazle Rabbi (fazlerabbinouman@gmail.com) lOMoARcPSD|16594061 P4.1 (LO 1, 2, 4) The trial balance columns of the worksheet for Wang Roofing at March 31, 2020, are as follows (amounts in thousands). Solution: Trial Balance Before Adjustments Adjustments Cash Accounts receivable Supplies Equipment Acc. Dep Equipment Accounts Payable Unearned Service Revenue Share Capital Ordinary Dr. 4,500 3,200 2,000 11,000 Cr. Dr. Cr. (1) 1,520 1,250 2,500 550 (2) 250 (3) 290 12,900 Downloaded by Fazle Rabbi (fazlerabbinouman@gmail.com) Balance after adjust. Dr. Cr. 4,500 3,200 480 11,000 1,500 2,500 260 12,900 lOMoARcPSD|16594061 Dividends Service Revenue Salaries and wages expenses Miscellaneous Expense Totals Supplies Expense 1,100 1,100 6,300 1,300 (3) 290 (4) 700 400 400 23,500 23,500 (1) 1,520 (2) 250 Depreciation Expense Salaries and Wages Payable Totals Net Income Totals 1,520 250 (4) 700 $2,760 $2,760 b. Revenues Service Revenue Total Revenue Less: Expenses Supplies Expenses Depreciation Expenses Salaries and Wages Expenses Miscellaneous Expense Total Expense Net Income 6,590 2,000 Warren Roofing Income Statement For the Month ended March 31,2019 Amount Amount 6,590 6,590 1,520 250 2,000 400 (4,170) 2,420 Warren Roofing Owner’s Equity Statement For the month Ended March 31,2019 Amount Amount Returned Earnings. March 01 0 Net Income 2,420 Less: Dividends (1,100) Downloaded by Fazle Rabbi (fazlerabbinouman@gmail.com) 700 24,450 24,450 lOMoARcPSD|16594061 RE, March 31 1,320 Warren Roofing Balance Sheet March 31, 2019 Amount Assets Cash Accounts Receivable Supplies Equipment Less: Accumulated Depreciation Equipment Amount 4,500 3,200 480 11,000 (1,500) Total Assets 17,680 Liabilities and Equity Liabilities Accounts Payable Unearned Service Revenue Salaries and Wages Payable 2,500 260 700 Total Liabilities 3,460 Equity Share Capital RE, March 31 12,900 1,320 Total Equity Total Liabilities and Equity 14,220 17,680 d. Closing entry Day Closing Entry Mar 31 Service Revenue Income Summary 31 Income Summary Salaries and wages expenses Miscellaneous Expense Supplies Expense Depreciation Expense 31 Retained Earnings Income Summary Debit 6,590 Credit 6,590 4,170 2,000 400 1,520 250 2420 Downloaded by Fazle Rabbi (fazlerabbinouman@gmail.com) 2420 lOMoARcPSD|16594061 31 (to close net loss to retained earnings) Retained earnings 1,100 Dividends (to close dividends to retained earnings) 1,100 P4.4 (LO 1, 2, 4) Rusthe Management Services began business on January 1, 2020, with a capital investment of $120,000. The company manages condominiums for owners (Service Revenue) and rents space in its own office building (Rent Revenue). The trial balance and adjusted trial balance columns of the worksheet at the end of the first year are as follows (amounts in $) Downloaded by Fazle Rabbi (fazlerabbinouman@gmail.com) lOMoARcPSD|16594061 Solution: a. Cash Accounts receivable Prepaid Insurance Lands Buildings Trial Balance Before Adjusting Adjustments Dr. Cr. 13,800 28,300 3,600 1,500 67,000 127,000 Downloaded by Fazle Rabbi (fazlerabbinouman@gmail.com) Adjusted trial Balance Dr. 13,800 28,300 2,100 67,000 127,000 Cr. lOMoARcPSD|16594061 Equipment Accounts Payable Unearned Rent Revenue Mortgage Payable Share Capital- Ordinary Retained Earnings Dividends Service Revenue Rent Revenue Salaries and Wages Expenses Advertising Expenses Utilities Expenses Totals 59,000 59,000 12,500 6,000 120,000 130,000 14,000 12,500 1,000 120,000 130,000 14,000 5,000 22,000 22,000 90,700 29,000 5,000 42,000 20,500 19,000 402,200 90,700 34,000 42,000 20,500 19,000 402,200 Insurance Expense Depreciation Expense Accumulated Depreciation – Buildings Accumulated Depreciation – Equipment Interest Expense Interest Payable 1,500 6,600 1,500 6,600 3,000 3,000 3,600 3,600 10,000 10,000 10,000 Totals 23,100 23,100 10,000 418,800 b. Rusthe Management Services Statement of Financial Postion For the year ended December 31, 2020 Monetary units: Assets Property, Land and Equipment Land Buildings Less: Accumulated Depreciation – Buildings Equipment Less: Accumulated Depreciation – Equipment Current Assets Prepaid Insurance Accounts Receivable 67,000 127,000 (3,000) 59,000 (3,600) 2,100 28,300 Downloaded by Fazle Rabbi (fazlerabbinouman@gmail.com) 418,800 lOMoARcPSD|16594061 Cash 13,800 Total Assets Equity and Liabilities Equity Share Capital – Ordinary Retained Earnings (14,000+ 25,100 – 22,000) Non- current liabilities Mortgage payable Current Liabilities Accounts Payable Unearned Rent Revenue Mortgage Payable (due in 2021) Interest Payable Total Equity and Liabilities 130,000 17,100 75,000 12,500 1,000 45,000 10,000 290,600 c. Adjusting Entries 1. Dr Insurance expense 1,500 Cr Prepaid Insurance 2. Dr Unearned Rent revenue 1,500 5,000 Cr Rent Revenue 5,000 3. Dr Depreciation Expense 6,600 Cr Accumulated Depreciation – Buildings 3,000 Cr Accumulated Depreciation – Equipment 3,600 4. Dr Interest Expense 10,000 Cr Interest Payable 10,000 d. Closing Entries Dr Service Revenue 90,700 Dr Rent Revenue 34,000 Cr Income Summary Debit Income Summary 290,600 124,7 99,600 Cr Salaries and Wages Expenses 42,000 Downloaded by Fazle Rabbi (fazlerabbinouman@gmail.com) lOMoARcPSD|16594061 Cr Advertising Expenses 20,500 Cr Utilities Expenses 19,000 Cr Insurance Expense 1,500 Cr Depreciation Expense 6,600 Cr Interest Expense 10,000 Debit Income Summary 25,100 Credit Retained Earnings Debit Retained Earnings Credit Dividends 25,100 22,000 22,000 e. Post- closing entries Rusthe Management Services Post-closing trial balance For the year ended December 31, 2020 Monetary units: Debit Credit Cash 13,800 Accounts receivable 28,300 Prepaid Insurance 2,100 Land 67,000 Buildings 127,000 Accumulated Depreciation 3,000 – Buildings Equipment 59,000 Accumulated Depreciation 3,600 – Equipment Share Capital – Ordinary 130,000 Retained Earnings 17,100 (14,000+ 25,100 – 22,000) Accounts Payable 12,500 Unearned Rent Revenue 1,000 Mortgage Payable 120,000 Interest Payable 10,000 297,200 297,200 Downloaded by Fazle Rabbi (fazlerabbinouman@gmail.com) lOMoARcPSD|16594061 Solution: a. July 1, shareholders invested €20,000 cash in the business in exchange for ordinary shares. Dr Share capital – ordinary 20,000 Cr Cash 20,000 July 1, Purchased used truck for €12,000, paying €4,000 cash and the balance on account. Dr Equipment 12,000 Cr Cash 4,000 Downloaded by Fazle Rabbi (fazlerabbinouman@gmail.com) lOMoARcPSD|16594061 Cr Accounts Payable 8,000 July 3, Purchased cleaning supplies for €2,100 on account. Dr Supplies 2,100 Cr Accounts Payable 2,100 July 5, Paid €1,800 cash on a 1-year insurance policy effective July 1. Dr Prepaid Insurance 1,800 Cr Cash 1,800 July 12, Billed customers €4,500 for cleaning services. Dr Accounts Receivable 4,500 Cr Service Revenue 4,500 July 18, Paid €1,500 cash on amount owed on truck and €1,400 on amount owed on cleaning supplies. Dr Accounts Payable 2,900 Cr Cash 2,900 July 20 Paid €2,800 cash for employee salaries. Dr Salary and Wages Expense 2,800 Cr Cash 2,800 July 21 Collected €3,400 cash from customers billed on July 12. Dr Cash 3,400 Cr Accounts Receivable 3,400 July 25 Billed customers €6,000 for cleaning services. Dr Accounts Receivable 6,000 Cr Service Revenue 6,000 July 31 Paid €350 for the monthly gasoline bill for the truck. Dr Gasoline Expense Cr Cash 350 350 Downloaded by Fazle Rabbi (fazlerabbinouman@gmail.com) lOMoARcPSD|16594061 July 31 Declared and paid a €5,600 cash dividend. Dr Dividend 5,600 Cr Cash 5,600 b. Anya Cleaning Service Trial Balance For the month ended July 31, 2020 Monetary unit: Accounts Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Share Capital – Ordinary Service Revenue Gasoline Expense Salaries and Wages Expense Dividend Dr 5,950 7,100 2,100 1,800 12,000 Cr 7,200 20,000 10,500 350 2,800 5,600 37,700 37,700 c. Adjusting entries 1. Unbilled and uncollected revenue for services performed at July 31 were €2,700. Dr Accounts Receivable 2,700 Cr Service Revenue 2,700 2. Depreciation on equipment for the month was €500. Dr Depreciation Expense 500 Cr Accumulated Depreciation – Equipment 500 3. One-twelfth of the insurance expired. Dr Insurance Expense 1,800/12= 150 Cr Prepaid Insurance 150 Downloaded by Fazle Rabbi (fazlerabbinouman@gmail.com) lOMoARcPSD|16594061 4. An inventory count shows €600 of cleaning supplies on hand at July 31. Dr Supplies Expense 1,500 Cr Supplies 1,500 5. Accrued but unpaid employee salaries were €1,000. Dr Salaries and Wages Expense 1,000 Cr Salaries and Wages Payable 1,000 d. ANYA’S CLEANING SERVICE Income Statement For the month ended July 31, 2020 Monetary unit Revenue Service Revenue Less: Expenses Salaries and Wages Expense Supplies Expense Gasoline Expense Depreciation Expense Insurance Expense Net Income 13,200 3,800 1,500 350 500 150 6,900 ANYA’S CLEANING SERVICE Retained Earnings Statement For the month ended July 31, 2020 Retained Earnings, July 1 Net Income Less: Dividends Retained Earnings, July 31 Monetary unit: 0 6,900 5,600 1,300 ANYA’S CLEANING SERVICE Retained Earnings Statement For the month ended July 31, 2020 Monetary unit: Downloaded by Fazle Rabbi (fazlerabbinouman@gmail.com) Monetary unit lOMoARcPSD|16594061 Assets Property, Land and Equipment Equipment Less: Accumulated Depreciation - Equipment Current Assets Prepaid Insurance Supplies Accounts Receivable Cash Total Assets Equity and Liabilities Equity Share Capital – ordinary Retained Earnings Current Liabilities Accounts Payable Salaries and Wages Payable Total Equity and Liabilities 12,000 (500) 1,650 600 9,800 5,950 29,500 20,000 1,300 7,200 1,000 e. Closing Entries Dr Service Revenue 13,200 Cr Income Summary Dr Income Summary 13,200 6,300 Cr Salaries and Wages Expense 3,800 Cr Supplies Expense 1,500 Cr Gasoline Expense 350 Cr Depreciation Expense 500 Cr Insurance Expense 150 Dr Income Summary 6,900 Cr Retained Earnings Dr Retained Earnings Cr Dividends 6,900 5,600 5,600 f. Downloaded by Fazle Rabbi (fazlerabbinouman@gmail.com) 21,300 8,200 29,500 lOMoARcPSD|16594061 ANYA’S CLEANING SERVICE Post-Closing Trial Balance For the month ended July 31, 2020 Equipment Accumulated Depreciation - Equipment Prepaid Insurance Supplies Accounts Receivable Cash Share Capital – ordinary Retained Earnings Accounts Payable Salaries and Wages Payable Monetary unit: 12,000 500 1,650 600 9,800 5,950 30,000 Downloaded by Fazle Rabbi (fazlerabbinouman@gmail.com) 20,000 1,300 7,200 1,000 30,000