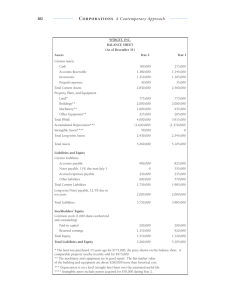

2004 Spring Accounting 011 final exam Spring 2004 answers

advertisement

Temple University Fox School of Business and Management Dr. Steven Balsam Accounting 011 Final Exam-Answer Key May 6, 2004 Instructions: You have 150 minutes. Answer the questions on the pages provided and please remember to show all work so that you may receive partial credit. Also please put your name on each page in case the pages get separated. Good luck! Name _____________________________ 1. When a plant asset is acquired by issuance of common stock, the cost of the plant asset is properly measured by the a. par value of the stock. b. stated value of the stock. c. book value of the stock. d. market value of the stock 2. A plant site donated by a township to a manufacturer that plans to open a new factory should be recorded on the manufacturer's books at a. the nominal cost of taking title to it. b. its market value. c. one dollar (since the site cost nothing but should be included in the balance sheet). d. the value assigned to it by the company's directors. 3. The sale of a depreciable asset resulting in a loss indicates that the proceeds from the sale were a. less than current market value. b. greater than cost. c. greater than book value. d. less than book value. Use the following information for questions 4 through 6. On March 1, 2004, Fairly Company purchased land for an office site by paying $360,000 cash. Fairly began construction on the office building on March 1. The following expenditures were incurred for construction: Date Expenditures March 1, 2004 $240,000 April 1, 2004 336,000 May 1, 2004 600,000 June 1, 2004 960,000 The office was completed and ready for occupancy on July 1. To help pay for construction, $480,000 was borrowed on March 1, 2004 on a 9%, 3-year note payable. Other than the construction note, the only debt outstanding during 2004 was a $200,000, 12%, 6-year note payable dated January 1, 2004. 4. The weighted-average accumulated expenditures on the construction project during 2004 were a. $256,000. b. $1,956,000. c. $208,000. d. $464,000. ($600,000 × 4/12) + ($336,000 × 3/12) + ($600,000 × 2/12) + ($960,000 × 1/12) = $464,000. 2 Name _____________________________ 5. The actual interest cost incurred during 2004 was a. $60,000. b. $67,200. c. $33,600. d. $56,000. ($480,000 × 9% × 10/12) + ($200,000 × 12%) = $60,000 6. Assume the weighted-average accumulated expenditures for the construction project are $580,000. The amount of interest cost to be capitalized during 2004 is a. $52,200. b. $55,200. c. $60,000. d. $67,200. 7. Wriglee, Inc. went to court this year and successfully defended its patent from infringe-ment by a competitor. The cost of this defense should be charged to a. patents and amortized over the legal life of the patent. b. legal fees and amortized over 5 years or less. c. expenses of the period. d. patents and amortized over the remaining useful life of the patent. 8. Purchased goodwill should a. be written off as soon as possible against retained earnings. b. be written off as soon as possible as an extraordinary item. c. be written off by systematic charges as a regular operating expense over the period benefited. d. not be amortized. 9. How should research and development costs be accounted for, according to a Financial Accounting Standards Board Statement? a. Must be capitalized when incurred and then amortized over their estimated useful lives. b. Must be expensed in the period incurred. c. May be either capitalized or expensed when incurred, depending upon the materiality of the amounts involved. d. Must be expensed in the period incurred unless it can be clearly demonstrated that the expenditure will have alternative future uses or unless contractually reimbursable. 3 Name _____________________________ 10. Dade Company purchased a patent on January 1, 2003 for $120,000. The patent had a remaining useful life of 10 years at that date. In January of 2004, Dade successfully defends the patent at a cost of $54,000, extending the patent’s life to 12/31/15. What amount of amortization expense would Dade record in 2004? a. $12,000 b. $13,500 c. $14,500 d. $18,000 2003 amortization is 12,000 (120,000/10). At the beginning of 2004 you capitalize the 54,000 giving you a balance of 162,000 in the account. You amortize the 162,000 over the new useful life which is 12 years (beginning of 04 to end of 15). 11. Hall Co. incurred research and development costs in 2004 as follows: Materials used in research and development projects $ 540,000 Equipment acquired that will have alternate future uses in future research and development projects 3,600,000 Depreciation for 2004 on above equipment 360,000 Personnel costs of persons involved in research and development projects 660,000 Consulting fees paid to outsiders for research and development projects 180,000 Indirect costs reasonably allocable to research and development projects 270,000 $5,610,000 The amount of research and development costs charged to Hall's 2004 income statement should be a. $1,560,000. b. $1,740,000. c. $2,010,000. d. $4,620,000. 540,000 + 360,000 + 660,000 + 180,000 + 270,000 12. Gomez Corp. incurred $350,000 of research and development costs to develop a product for which a patent was granted on January 2, 1999. Legal fees and other costs associated with registration of the patent totaled $100,000. On March 31, 2004, Gomez paid $150,000 for legal fees in a successful defense of the patent. The total amount capitalized for the patent through March 31, 2004 should be a. $250,000. b. $450,000. c. $500,000. d. $600,000. 13. Among the short-term obligations of Lance Company as of December 31, the balance sheet date, are notes payable totaling $250,000 with the Madison National Bank. These are 90-day notes, renewable for another 90-day period. These notes should be classified on the balance sheet of Lance Company as a. current liabilities. b. deferred charges. 4 Name _____________________________ c. long-term liabilities. d. intermediate debt. 5 Name _____________________________ 14. Which of the following is a condition for accruing a liability for the cost of compensation for future absences? a. The obligation relates to the rights that vest or accumulate. b. Payment of the compensation is probable. c. The obligation is attributable to employee services already performed. d. All of these are conditions for the accrual. Use the following information for questions 15 and 16. Ritter Company has 35 employees who work 8-hour days and are paid hourly. On January 1, 2003, the company began a program of granting its employees 10 days' paid vacation each year. Vacation days earned in 2003 may first be taken on January 1, 2004. Information relative to these employees is as follows: Year 2003 2004 2005 Hourly Wages $17.20 18.00 19.00 Vacation Days Earned by Each Employee 10 10 10 Vacation Days Used by Each Employee 0 8 10 Ritter has chosen to accrue the liability for compensated absences at the current rates of pay in effect when the compensated time is earned. 15. What is the amount of expense relative to compensated absences that should be reported on Ritter’s income statement for 2003? a. $0. b. $45,920. c. $50,400. d. $48,160. 35 employees * 8 hour days * 17.20 per hour * 10 days earned = 48,160 16. What is the amount of the accrued liability for compensated absences that should be reported at December 31, 2005? a. $63,280. b. $60,480. c. $53,200. d. $63,840. 12 days remain, 2 of which were earned in 2004 & 10 in 2005 (assumption is that first earned days are used first, i.e., FIFO). From 2004 – 35 employees * 8 hour days * $18 per hour * 2 days remaining = 10,080 From 2005 – 35 employees * 8 hour days * $19 per hour * 10 days remaining= 53,200 10,080 + 53,200 = 63,280 6 Name _____________________________ 17. Included in Turner Corp.'s liability account balances at December 31, 2004, were the following: 14% note payable issued October 1, 2004, maturing September 30, 2005 $375,000 16% note payable issued April 1, 2004, payable in six equal annual installments of $150,000 beginning April 1, 2005 900,000 Turner 's December 31, 2004 financial statements were issued on March 31, 2005. On January 15, 2005, the entire $900,000 balance of the 16% note was refinanced by issuance of a long-term obligation payable in a lump sum. In addition, on March 10, 2005, Turner consummated a noncancelable agreement with the lender to refinance the 14%, $375,000 note on a long-term basis, on readily determinable terms that have not yet been implemented. On the December 31, 2004 balance sheet, the amount of the notes payable that Turner should classify as short-term obligations is a. $525,000. b. $375,000. c. $150,000. d. $0. Turner has refinanced the 900,000 obligation and contracted to refinance the 375,000 note, both prior to the issuance of the financial statements. Since these liabilities can be extinguished without the use of short-term assets they should not be classified as shortterm obligations. 7 Name _____________________________ Use the following information for questions 18 through 20: On December 31, 2003, Queen Co. is in financial difficulty and cannot pay a note due that day. It is a $1,200,000 note with $120,000 accrued interest payable to Trear, Inc. Trear agrees to accept from Queen equipment that has a fair value of $580,000, an original cost of $960,000, and accumulated depreciation of $460,000. Trear also forgives the accrued interest, extends the maturity date to December 31, 2006, reduces the face amount of the note to $500,000, and reduces the interest rate to 6%, with interest payable at the end of each year. 18. Queen should recognize a gain or loss on the transfer of the equipment of a. $0. b. $80,000 gain. c. $120,000 gain. d. $380,000 loss. $580,000 – ($960,000 – $460,000) = $80,000. 19. Queen should recognize a gain on the partial settlement and restructure of the debt of a. $0. b. $30,000. c. $110,000. d. $150,000. ($1,200,000 + $120,000) – [$580,000 + $500,000 + ($500,000 × .06 × 3)] = $150,000. 20. Queen should record interest expense for 2006 of a. $0. b. $30,000. c. $60,000. d. $90,000. 8 Name _____________________________ Problem 1 (10 points) Kiner Equipment Company sells computers for $2,000 each and also gives each customer a 2-year warranty that requires the company to perform periodic services and to replace defective parts. During 2004, the company sold 700 computers. Based on past experience, the company has estimated the total 2-year warranty costs as $40 for parts and $80 for labor. (Assume sales all occur at December 31, 2004.) In 2005, Kiner incurred actual warranty costs relative to 2004 computer sales of $10,000 for parts and $24,000 for labor. Instructions (a) Under the expense warranty treatment, give the entries to reflect the above transactions (accrual method) for 2004 and 2005. 2004 Accounts Receivable ...................................................................... 1,400,000 Sales ................................................................................... 1,400,000 Warranty Expense .......................................................................... 84,000 Estimated Liability Under Warranties .................................. 84,000 Total warranty expense per computer is 120 (40+ 80). 700 * 120 = 84,000 2005 Estimated Liability Under Warranties .............................................. Inventory ............................................................................. Accrued Payroll ................................................................... 9 34,000 10,000 24,000 Name _____________________________ Problem 2 (10 points) On January 1, 2003 Beta Alpha Psi sells bonds with a face value of $10,000, and a stated interest rate of 10%. The bonds pay interest annually on December 31st and mature in 20 years. The applicable interest rate for bonds of this length and risk, is 12%. A. How much do the bonds sell for? _________8,506_____________ Present value of the bond is equal to present value of $10,000 at the end of 20 years plus present value of a 20 year annuity of $1,000 (10% of $10,000). 10,000 * .10367 (from table 6-2, n=20, i=.12)= 1,036.70 1,000 * 7.46944 (from table 6-4, n=20, i=.12)=7,469.44 1,036.70+7,469.44=8,506.14 B Calculate amortization for both 2003 and 2004 under both the Effective and Straightline methods. Effective Interest Straight-Line 2003 (8,506*.12)-1,000=21 1,494/20=75 2004 (8,527*.12)-1,000=23 1,494/20=75 C. Record the sale and the first (annual) interest payment (recognize amortization using the straight-line method). Sale Cash Discount on Bonds Payable Bonds Payable Interest Interest Expense Cash Interest Expense Discount on Bonds Payable 8,506 1,494 10,000 1,000 1,000 75 75 10 Name _____________________________ Problem 3 (10 points) Finney Company exchanged machinery with an appraised value of $585,000, a recorded cost of $900,000 and Accumulated Depreciation of $450,000 with Penny Corporation for machinery Penny owns. The machinery has an appraised value of $565,000, a recorded cost of $1,080,000, and Accumulated Depreciation of $594,000. Penny also gave Finney $20,000 in the exchange. Assume depreciation has already been updated. Instructions (a) Prepare the entries on both companies' books assuming that it is considered an exchange of dissimilar assets. (Round all computations to the nearest dollar.) Finney Machinery ..................................... Cash .............................................. Accum. Depreciation— Machinery.................................. Gain on Exchange of Plant Assets.................. Machinery........................ Penny Machinery ..................................... Accum. Depreciation— Machinery.................................. Gain on Exchange of Plant Assets.................. Machinery........................ Cash................................ 565,000 20,000 Cost A/D BV FV Gain 450,000 $900,000 450,000 450,000 585,000 $135,000 135,000 900,000 585,000 594,000 79,000 1,080,000 20,000 Cost $1,080,000 A/D 594,000 BV 486,000 FV 565,000 Gain $ 79,000 (b) Prepare the entries on both companies' books assuming that it is considered an exchange of similar assets. (Round all computations to the nearest dollar.) Finney Machinery ................................................................................. Cash ........................................................................................... Accumulated Deprecation—Machinery....................................... Gain on Exchange........................................................ Machinery..................................................................... 900,000 434,615 20,000 450,000 4,615 $20,000 ÷ ($20,000 + $565,000) × $135,000 = $4,615 Penny Machinery ................................................................................. Accumulated Depreciation—Machinery...................................... Machinery..................................................................... 1,080,000 Cash............................................................................. 11 506,000 594,000 20,000 Name _____________________________ 12 Name _____________________________ Problem 4 (10 points) Sleepless Nights Inc just purchased some new manufacturing equipment for $1,500,000. The expected life of the equipment is 10 years and the expected residual value is $1,000,000. Calculate depreciation expense for 2004 and 2005 (the equipment was purchased on January 1, 2004) using the straight-line, sum-of-years digits, and doubledeclining balance methods. 2004 2005 Straight-Line ___50,000___ ______50,000___ Sum-of-Years Digits ___90,909___ ______81,818___ Double-Declining Balance __300,000___ _____200,000*___ * The answer is 200,000 rather than 240,000 because we are not allowed to depreciate below the residual value of 1,000,000. 13 Name _____________________________ Problem 5 – 10 points Measure or Ratio Working capital Current ratio Ratio Computation Current assets – Current liabilities Current assets ÷ Current liabilities Net income ÷ (Average shareholders’ equity – Preferred stock) Net income ÷ Average total assets 2003 32,107,000-11,537,000 20,570,000 32,107,000/11,537,000 2.78 3,593,000/(.5*(71,051,000+66,616,000)) 0.052 or 5.2% 3,593,000/(.5*(83,705,000+77,849,000)) 0.044 or 4.4% 27,281,000/(.5*(959,000+780,000)) Cost of sales ÷ Average inventory Accounts 102,959,000/(.5*(1,869,000+1,304,000)) Revenues ÷ receivable Average accounts turnover receivable Debt to total Total liabilities ÷ 12,654,000/83,705,000 assets Total assets Debt to 12,654,000/71,051,000 Total liabilities ÷ equity Shareholders’ equity Interest (Profit before (5,437,000+21,000)/21,000 coverage taxes + Interest (Income expense) ÷ statement) Interest expense Dividend Annual dividends They don’t pay payout dividends per share ÷ EPS 31.4 Return on equity (ROE) Return on assets (ROA) Inventory turnover 14 64.9 0.151 or 15.1% 0.178 or 17.8% 259.9 0 CHICAGO PIZZA & BREWERY INC 10-K 2003-12-28: Balance Sheet 2003/12/28 ASSETS Current assets: Cash and cash equivalents $4,899,000 Investments $22,041,000 Accounts and other receivables $1,869,000 Inventories $959,000 Prepaids and other current assets $1,164,000 Deferred taxes $1,175,000 Total current assets $32,107,000 Property and equipment, net $46,306,000 Deferred income taxes $0 Goodwill $4,762,000 Other assets, net $530,000 Total assets $83,705,000 LIABILITIES AND SHAREHOLDERS EQUITY Current liabilities: Accounts payable $2,796,000 Accrued expenses $8,533,000 Current portion of reserve for st $55,000 Current portion of notes payable $151,000 Current portion of long-term debt $2,000 Total current liabilities $11,537,000 Notes payable to related parties $0 Long-term debt $0 Deferred income taxes $143,000 Reserve for store closures $74,000 Other liabilities $900,000 Total liabilities $12,654,000 Commitments and contingencies (Note 5) Shareholders equity: Preferred stock, 5,000 shares aut $0 issued or outstanding Common stock, no par value, 60,00 $62,513,000 authorized and 19,649 and 19,305 shares issued and outstanding as of December 28, 2003 and December 2002/12/28 $28,440,000 $3,681,000 $1,304,000 $780,000 $1,322,000 $384,000 $35,911,000 $36,177,000 $170,000 $4,762,000 $829,000 $77,849,000 $4,868,000 $4,709,000 $0 $399,000 $9,000 $9,985,000 $151,000 $2,000 $0 $185,000 $910,000 $11,233,000 $0 $62,085,000 Name _____________________________ 29, 2002, respectively Capital surplus Retained earnings Total shareholders equity Total liabilities and shareholder $2,109,000 $6,429,000 $71,051,000 $83,705,000 $1,695,000 $2,836,000 $66,616,000 $77,849,000 16 Name _____________________________ CHICAGO PIZZA & BREWERY INC 10-K 2003-12-28: Income Statement 2003/12/28 Revenues $102,959,000 Costs and expenses: Cost of sales (Note 12) $27,281,000 Labor and benefits $36,828,000 Occupancy $7,889,000 Operating expenses $11,780,000 General and administrative $8,522,000 Depreciation and amortization $3,928,000 Restaurant opening expense $1,467,000 Restaurant closing recovery ($25,000) Total costs and expenses $97,670,000 Income from operations $5,289,000 Other income (expense): Interest income $397,000 Interest expense ($21,000) Other (expense) income, net ($228,000) Total other income (expense) $148,000 Income before income taxes $5,437,000 Income tax expense ($1,844,000) Net income $3,593,000 Net income per share: Basic $180 Diluted $180 Weighted average number of shares outstanding: Basic $19,422,000 Diluted $20,482,000 17 2002/12/28 $75,705,000 2001/12/28 $64,683,000 $19,241,000 $28,057,000 $5,970,000 $8,361,000 $7,782,000 $2,714,000 $1,717,000 ($8,000) $73,834,000 $1,871,000 $17,415,000 $23,196,000 $4,963,000 $6,843,000 $5,056,000 $2,117,000 $734,000 ($799,000) $59,525,000 $5,158,000 $526,000 ($264,000) $414,000 $676,000 $2,547,000 ($880,000) $1,667,000 $95,000 ($440,000) $168,000 ($177,000) $4,981,000 ($1,804,000) $3,177,000 $100 $90 $330 $300 $17,273,000 $18,775,000 $9,515,000 $10,419,000