17d

advertisement

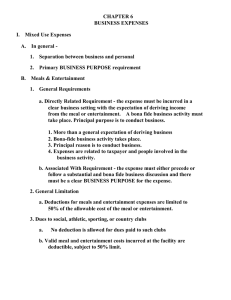

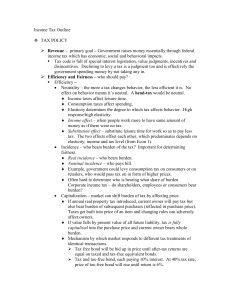

Chapter 17 Tax Consequences of Personal Activities Deductions for Personal Expenses Medical expenses in excess of specified floors 10% of AGI generally 7.5% of AGI for taxpayers 65 or older Cosmetic surgery is not deductible as a medical expense unless necessary to correct damage or deformity Local, state and foreign tax payments Property taxes State/local income or sales taxes (but not both) Foreign taxes can be deducted or credited (usually credited) Federal taxes are not deductible (exception: ½ of SE tax) Subsequent refund of a previously deducted tax is taxable to extent the deduction reduced taxable income. Deductions for Personal Expenses Charitable contributions Deduction limited to 50% of AGI generally Excess may be carried forward for five years Deduction allowed equals: Amount of cash contributed (over value of anything received in return) FMV of assets contributed Casualty & theft losses Cost of property lost or damaged as a result of fire, storm or shipwreck or similar sudden and unexpected event Theft losses include embezzlement, fraud or other similar losses in addition to robbery or other forms of theft Deduction reduced by insurance proceeds if any Each loss reduced by $100 Total deduction equals sum of losses, less 10% of AGI Casualty Loss Example Last year, Norma’s house burned to the ground. She paid $350,000 to acquire the house, and another $75,000 for furnishings. Her loss was complete. She received insurance reimbursement of $375,000. To make matters worse, Norma was at work when she learned of the fire. As she drove home, she was involved in an automobile accident that totaled her car. The car, which cost $32,000, was worth $22,000 at the date of the wreck. She received insurance reimbursement of $15,000 for the car. Norma’s AGI was $100,000. What is her deductible casualty loss? 1st loss-House 2nd loss-Car Lesser of cost/value $425,000 $22,000 Insurance recovery (375,000) (15,000) $50,000 $7,000 (100) (100) $49,900 $6,900 Unrecovered loss $100 floor Casualty loss Total loss $56,800 – 10% AGI = $46,800 casualty loss deduction Deductions for Personal Expenses Mortgage interest expense Interest paid on up to $1,000,000 in acquisition debt Plus interest on up to $100,000 in home equity financing (debt secured by home but used for purposes other than acquisition of the home) Deduction allowed for interest on acquisition debt for up to 2 homes “Home” includes motor homes, house boats and other livable structures Miscellaneous itemized deductions Gambling losses to extent of gambling winnings Tax preparation and tax-related legal fees Legal fees related to protecting or reclaiming property Investment expenses (safe-deposit boxes, asset management fees, etc.) Unreimbursed employee expenses (uniforms, tools, license fees, etc.) Deduction allowed for excess of all such fees over 2% of AGI