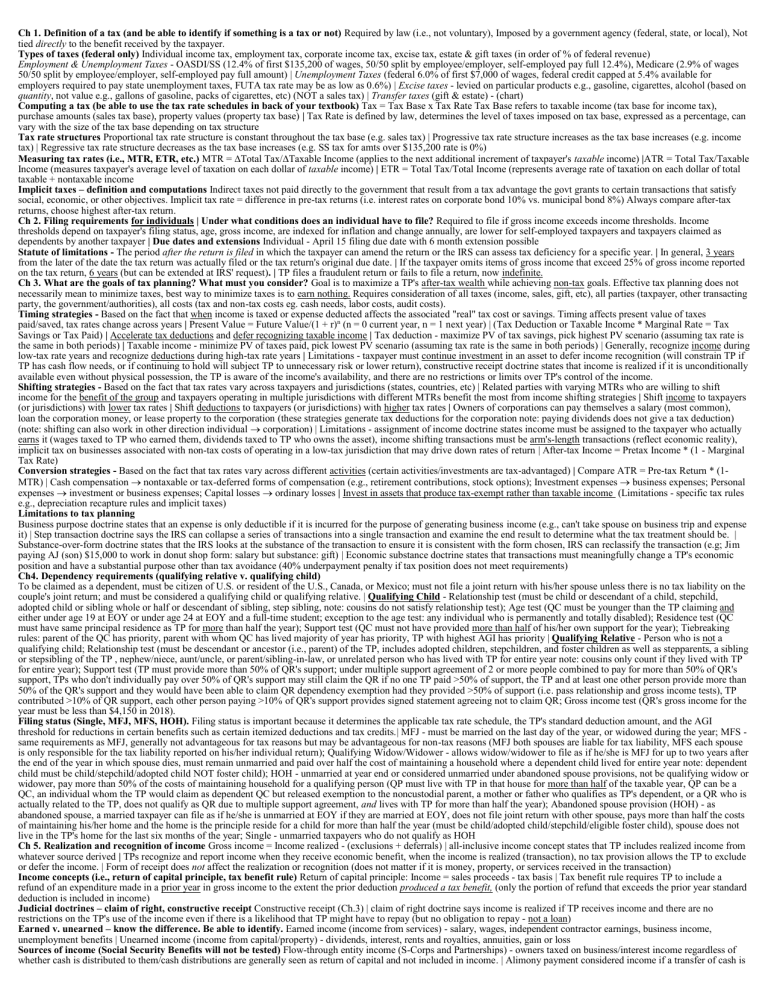

Ch 1. Definition of a tax (and be able to identify if something is a tax or not) Required by law (i.e., not voluntary), Imposed by a government agency (federal, state, or local), Not tied directly to the benefit received by the taxpayer. Types of taxes (federal only) Individual income tax, employment tax, corporate income tax, excise tax, estate & gift taxes (in order of % of federal revenue) Employment & Unemployment Taxes - OASDI/SS (12.4% of first $135,200 of wages, 50/50 split by employee/employer, self-employed pay full 12.4%), Medicare (2.9% of wages 50/50 split by employee/employer, self-employed pay full amount) | Unemployment Taxes (federal 6.0% of first $7,000 of wages, federal credit capped at 5.4% available for employers required to pay state unemployment taxes, FUTA tax rate may be as low as 0.6%) | Excise taxes - levied on particular products e.g., gasoline, cigarettes, alcohol (based on quantity, not value e.g., gallons of gasoline, packs of cigarettes, etc) (NOT a sales tax) | Transfer taxes (gift & estate) - (chart) Computing a tax (be able to use the tax rate schedules in back of your textbook) Tax = Tax Base x Tax Rate Tax Base refers to taxable income (tax base for income tax), purchase amounts (sales tax base), property values (property tax base) | Tax Rate is defined by law, determines the level of taxes imposed on tax base, expressed as a percentage, can vary with the size of the tax base depending on tax structure Tax rate structures Proportional tax rate structure is constant throughout the tax base (e.g. sales tax) | Progressive tax rate structure increases as the tax base increases (e.g. income tax) | Regressive tax rate structure decreases as the tax base increases (e.g. SS tax for amts over $135,200 rate is 0%) Measuring tax rates (i.e., MTR, ETR, etc.) MTR = Total Tax/Taxable Income (applies to the next additional increment of taxpayer's taxable income) |ATR = Total Tax/Taxable Income (measures taxpayer's average level of taxation on each dollar of taxable income) | ETR = Total Tax/Total Income (represents average rate of taxation on each dollar of total taxable + nontaxable income Implicit taxes – definition and computations Indirect taxes not paid directly to the government that result from a tax advantage the govt grants to certain transactions that satisfy social, economic, or other objectives. Implicit tax rate = difference in pre-tax returns (i.e. interest rates on corporate bond 10% vs. municipal bond 8%) Always compare after-tax returns, choose highest after-tax return. Ch 2. Filing requirements for individuals | Under what conditions does an individual have to file? Required to file if gross income exceeds income thresholds. Income thresholds depend on taxpayer's filing status, age, gross income, are indexed for inflation and change annually, are lower for self-employed taxpayers and taxpayers claimed as dependents by another taxpayer | Due dates and extensions Individual - April 15 filing due date with 6 month extension possible Statute of limitations - The period after the return is filed in which the taxpayer can amend the return or the IRS can assess tax deficiency for a specific year. | In general, 3 years from the later of the date the tax return was actually filed or the tax return's original due date. | If the taxpayer omits items of gross income that exceed 25% of gross income reported on the tax return, 6 years (but can be extended at IRS' request). | TP files a fraudulent return or fails to file a return, now indefinite. Ch 3. What are the goals of tax planning? What must you consider? Goal is to maximize a TP's after-tax wealth while achieving non-tax goals. Effective tax planning does not necessarily mean to minimize taxes, best way to minimize taxes is to earn nothing. Requires consideration of all taxes (income, sales, gift, etc), all parties (taxpayer, other transacting party, the government/authorities), all costs (tax and non-tax costs eg. cash needs, labor costs, audit costs). Timing strategies - Based on the fact that when income is taxed or expense deducted affects the associated "real" tax cost or savings. Timing affects present value of taxes paid/saved, tax rates change across years | Present Value = Future Value/(1 + r)n (n = 0 current year, n = 1 next year) | (Tax Deduction or Taxable Income * Marginal Rate = Tax Savings or Tax Paid) | Accelerate tax deductions and defer recognizing taxable income | Tax deduction - maximize PV of tax savings, pick highest PV scenario (assuming tax rate is the same in both periods) | Taxable income - minimize PV of taxes paid, pick lowest PV scenario (assuming tax rate is the same in both periods) | Generally, recognize income during low-tax rate years and recognize deductions during high-tax rate years | Limitations - taxpayer must continue investment in an asset to defer income recognition (will constrain TP if TP has cash flow needs, or if continuing to hold will subject TP to unnecessary risk or lower return), constructive receipt doctrine states that income is realized if it is unconditionally available even without physical possession, the TP is aware of the income's availability, and there are no restrictions or limits over TP's control of the income. Shifting strategies - Based on the fact that tax rates vary across taxpayers and jurisdictions (states, countries, etc) | Related parties with varying MTRs who are willing to shift income for the benefit of the group and taxpayers operating in multiple jurisdictions with different MTRs benefit the most from income shifting strategies | Shift income to taxpayers (or jurisdictions) with lower tax rates | Shift deductions to taxpayers (or jurisdictions) with higher tax rates | Owners of corporations can pay themselves a salary (most common), loan the corporation money, or lease property to the corporation (these strategies generate tax deductions for the corporation note: paying dividends does not give a tax deduction) (note: shifting can also work in other direction individual corporation) | Limitations - assignment of income doctrine states income must be assigned to the taxpayer who actually earns it (wages taxed to TP who earned them, dividends taxed to TP who owns the asset), income shifting transactions must be arm's-length transactions (reflect economic reality), implicit tax on businesses associated with non-tax costs of operating in a low-tax jurisdiction that may drive down rates of return | After-tax Income = Pretax Income * (1 - Marginal Tax Rate) Conversion strategies - Based on the fact that tax rates vary across different activities (certain activities/investments are tax-advantaged) | Compare ATR = Pre-tax Return * (1MTR) | Cash compensation nontaxable or tax-deferred forms of compensation (e.g., retirement contributions, stock options); Investment expenses business expenses; Personal expenses investment or business expenses; Capital losses ordinary losses | Invest in assets that produce tax-exempt rather than taxable income (Limitations - specific tax rules e.g., depreciation recapture rules and implicit taxes) Limitations to tax planning Business purpose doctrine states that an expense is only deductible if it is incurred for the purpose of generating business income (e.g., can't take spouse on business trip and expense it) | Step transaction doctrine says the IRS can collapse a series of transactions into a single transaction and examine the end result to determine what the tax treatment should be. | Substance-over-form doctrine states that the IRS looks at the substance of the transaction to ensure it is consistent with the form chosen, IRS can reclassify the transaction (e.g; Jim paying AJ (son) $15,000 to work in donut shop form: salary but substance: gift) | Economic substance doctrine states that transactions must meaningfully change a TP's economic position and have a substantial purpose other than tax avoidance (40% underpayment penalty if tax position does not meet requirements) Ch4. Dependency requirements (qualifying relative v. qualifying child) To be claimed as a dependent, must be citizen of U.S. or resident of the U.S., Canada, or Mexico; must not file a joint return with his/her spouse unless there is no tax liability on the couple's joint return; and must be considered a qualifying child or qualifying relative. | Qualifying Child - Relationship test (must be child or descendant of a child, stepchild, adopted child or sibling whole or half or descendant of sibling, step sibling, note: cousins do not satisfy relationship test); Age test (QC must be younger than the TP claiming and either under age 19 at EOY or under age 24 at EOY and a full-time student; exception to the age test: any individual who is permanently and totally disabled); Residence test (QC must have same principal residence as TP for more than half the year); Support test (QC must not have provided more than half of his/her own support for the year); Tiebreaking rules: parent of the QC has priority, parent with whom QC has lived majority of year has priority, TP with highest AGI has priority | Qualifying Relative - Person who is not a qualifying child; Relationship test (must be descendant or ancestor (i.e., parent) of the TP, includes adopted children, stepchildren, and foster children as well as stepparents, a sibling or stepsibling of the TP , nephew/niece, aunt/uncle, or parent/sibling-in-law, or unrelated person who has lived with TP for entire year note: cousins only count if they lived with TP for entire year); Support test (TP must provide more than 50% of QR's support; under multiple support agreement of 2 or more people combined to pay for more than 50% of QR's support, TPs who don't individually pay over 50% of QR's support may still claim the QR if no one TP paid >50% of support, the TP and at least one other person provide more than 50% of the QR's support and they would have been able to claim QR dependency exemption had they provided >50% of support (i.e. pass relationship and gross income tests), TP contributed >10% of QR support, each other person paying >10% of QR's support provides signed statement agreeing not to claim QR; Gross income test (QR's gross income for the year must be less than $4,150 in 2018). Filing status (Single, MFJ, MFS, HOH). Filing status is important because it determines the applicable tax rate schedule, the TP's standard deduction amount, and the AGI threshold for reductions in certain benefits such as certain itemized deductions and tax credits.| MFJ - must be married on the last day of the year, or widowed during the year; MFS same requirements as MFJ, generally not advantageous for tax reasons but may be advantageous for non-tax reasons (MFJ both spouses are liable for tax liability, MFS each spouse is only responsible for the tax liability reported on his/her individual return); Qualifying Widow/Widower - allows widow/widower to file as if he/she is MFJ for up to two years after the end of the year in which spouse dies, must remain unmarried and paid over half the cost of maintaining a household where a dependent child lived for entire year note: dependent child must be child/stepchild/adopted child NOT foster child); HOH - unmarried at year end or considered unmarried under abandoned spouse provisions, not be qualifying widow or widower, pay more than 50% of the costs of maintaining household for a qualifying person (QP must live with TP in that house for more than half of the taxable year, QP can be a QC, an individual whom the TP would claim as dependent QC but released exemption to the noncustodial parent, a mother or father who qualifies as TP's dependent, or a QR who is actually related to the TP, does not qualify as QR due to multiple support agreement, and lives with TP for more than half the year); Abandoned spouse provision (HOH) - as abandoned spouse, a married taxpayer can file as if he/she is unmarried at EOY if they are married at EOY, does not file joint return with other spouse, pays more than half the costs of maintaining his/her home and the home is the principle reside for a child for more than half the year (must be child/adopted child/stepchild/eligible foster child), spouse does not live in the TP's home for the last six months of the year; Single - unmarried taxpayers who do not qualify as HOH Ch 5. Realization and recognition of income Gross income = Income realized - (exclusions + deferrals) | all-inclusive income concept states that TP includes realized income from whatever source derived | TPs recognize and report income when they receive economic benefit, when the income is realized (transaction), no tax provision allows the TP to exclude or defer the income. | Form of receipt does not affect the realization or recognition (does not matter if it is money, property, or services received in the transaction) Income concepts (i.e., return of capital principle, tax benefit rule) Return of capital principle: Income = sales proceeds - tax basis | Tax benefit rule requires TP to include a refund of an expenditure made in a prior year in gross income to the extent the prior deduction produced a tax benefit, (only the portion of refund that exceeds the prior year standard deduction is included in income) Judicial doctrines – claim of right, constructive receipt Constructive receipt (Ch.3) | claim of right doctrine says income is realized if TP receives income and there are no restrictions on the TP's use of the income even if there is a likelihood that TP might have to repay (but no obligation to repay - not a loan) Earned v. unearned – know the difference. Be able to identify. Earned income (income from services) - salary, wages, independent contractor earnings, business income, unemployment benefits | Unearned income (income from capital/property) - dividends, interest, rents and royalties, annuities, gain or loss Sources of income (Social Security Benefits will not be tested) Flow-through entity income (S-Corps and Partnerships) - owners taxed on business/interest income regardless of whether cash is distributed to them/cash distributions are generally seen as return of capital and not included in income. | Alimony payment considered income if a transfer of cash is made under written agreement (separation agreement or divorce decree), payment cannot be designated as something other than alimony, payments cannot continue after death of recipient, if spouses are legally separated or divorced, may not live in same household (alimony is not property divisions or child support payments which are fixed by the divorce or separation agreement). Alimony payments are taxable to recipient and deductible to payer for agreements executed before Jan. 1, 2019. | Prizes, Awards, Gross Gambling winnings are included in income unless award is for scientific, literary, or charitable achievement, value of awards/medals/prize money received by Team USA Olympic Athletes are excluded from income (with AGI limits), and also awards for length of service or safety achievement are limited to $400 of tangible property other than cash per employee per year. | Imputed income includes bargain purchases where discount received on the purchase from a related party is taxable based on relationship of the parties: BP by employee from employer is taxable compensation, BP by shareholder from corporation is taxable dividend, BP between family members is deemed to be a gift. | Another imputed income is a below market loan where there is an indirect economic benefit which is a function of the amount of the loan and difference in market interest rate and rate actually charged. Lender and borrower must treat the transaction as if the borrower paid the lender the difference in interest rates and the lender then returned the imputed interest rate to the borrower. Deemed payment of the imputed interest is treated as interest income to lender and interest expense to borrower (does not apply to loans of $10k or less). Imputed interest is included in gross income. | Discharge of indebtedness where lender forgives debt, treated as income except if TP is insolvent both before and after discharge of debt. Exclusions – know them and how to compute (if necessary). Municipal bond interest | gain on sale of personal residence excludes up to $250k or $500k if MFJ and remaining gain taxed at LTCG rate (ownership test- TP must have owned the residence for 2 or more years in last 5 years; use test - property must have been used as TP's primary residence for 2 or more years in last 5 years.) | Scholarships that cover tuition, fees, books, supplies (scholarships > tuition, fees, books, etc Excess funds are taxable income), if recipient is required to perform services in exchange for scholarship, scholarship is taxable. | Investment income from 529 Plans as long as earnings pay for qualified expenditures. | Interest income earned from Series EE bonds spent on tuition and fees (subject to phase out). | Exclusions mitigating double taxation: gifts are wealth transfers made during life, inheritances are wealth transfers made after death (both subject to gift and estate tax, not income tax), life insurance proceeds subject to estate tax, not income tax (does not count if owner cashes in/sells policy). | Foreign earned income has maximum exclusion of $103,900 in 2018, or an itemized deduction for foreign taxes paid, or foreign tax credit for foreign taxes paid (to qualify must be considered resident of foreign country or lived in foreign country for 330 days in consecutive 12-month period that may span 2 tax years) | FEI exclusion computed on daily basis pro rata. | Workers' compensation is excluded. | Payments associated with physical injury or sickness are nontaxable. | Reimbursements of medical expenses from health or accident insurance policy are nontaxable. | Disability insurance if purchased by TP directly, the cost of policy is not deductible and any disability benefits are excluded from gross income. If TP's employer purchases the insurance and premiums paid by employer are taxable compensation to the employee, benefits are excluded. If premiums paid by employer are nontaxable fringe benefits, then benefits are included in gross income. | Annuity exclusion ratio = Original Investment/Expected Value; Excluded Amount = Payment * Exclusion ratio | Fixed annuity expected value = # of payments * payment amount; | Lifetime annuity expected value = Expected return multiple from IRS table * annual payment amount | Property disposition: Sales proceeds less selling expenses = amount realized; less tax basis (investment) = gain (loss) on sale (basis for non-depreciable property is cost/what you paid) Ch 6. Which is preferred, for AGI or from AGI? Why? Deductions for AGI are preferred because deductions above the line reduce taxable income dollar for dollar. Deductions from AGI sometimes have no effect on taxable income at all. For AGI deductions What expenses are deductible for AGI? Be able to identify. Deductions directly related to business activities, deductions indirectly related to business activities, and deductions subsidizing specific activities. | Business activities are motivated by profit and require high level of involvement/effort; investment activities are motivated by profit and do not require high level of involvement/effort. | Business activities generate for AGI deductions and investment activities generate from AGI deductions with the exception of rental and royalty expenses which are deductible for AGI. | Personal activities generate non-deductible expenses. | Indirectly related activities - moving expenses are not deductible except for active-duty members of armed forces; health insurance premiums are deductible for AGI for self-employed taxpayers that are not eligible to participate in an employer-provided plan; 50% of self-employment taxes paid are deductible for AGI, interest income forfeited as penalty for early withdrawal of savings is deductible for AGI When are they deductible? (i.e., under what conditions?) Trade and business expenses are deductible when they are ordinary and necessary (appropriate for generating a profit) Be able to compute deductions discussed in class (i.e., student loan interest) Deduction for interest expense on qualified educational loans intended to encourage and subsidize higher education, loan proceeds must be used on qualified education expenses incurred which include tuition and fees, books and expenses, room and board, etc. Expenses can be incurred by TP, TP's spouse, or TP's dependents. | Maximum deduction = $2500 subject to phase out based on modified AGI (MAGI is income before deducting qualified loan interest) | Deduction = amount paid up to $2500 - phase out amount (phase out % on table, multiply by amount paid up to 2500, subtract from amount paid, = final deduction) From AGI deductions Itemized deductions are generally personal in nature but are allowed to subsidize desirable activities such as home ownership or charitable contributions, or to ease a TP's tax burden when ability to pay has been reduced What expenses are deductible from AGI? Be able to identify/compute itemized deductions. Unreimbursed medical expenses for TP, TP's spouse, or TP's dependents (cosmetic surgery not deductible unless it is reconstructive); medical expense limitation where deduction is limited to amount of unreimbursed medical expenses paid during the year reduced by 7.5% of TP's AGI | Taxes - state, local, and foreign income taxes, real estate taxes, personal property taxes ($10,000 cap on aggregate of itemized deductions for all these taxes) | Mortgage interest only on the first $750k of indebtedness/$375k if MFS (interest on home equity loans eliminated for 2018-2025) | Investment interest paid on loans used to purchase assets is deductible, cannot deduct interest on personal loans or credit cards | Charitable contributions in cash or property and substantiated by written record, value of services not deductible | Capital gain property is an appreciated asset that would generate LTCG if sold, must be held for more than one year, includes stocks/bonds/paintings, business assets not generating ordinary income, personal use assets. If capital gain property, the TP can deduct fair market value. FMV deduction not qualified when donated property is tangible, personal property, and unrelated to the charity's operations. | Ordinary income property includes all assets other than capital gain property (property that if sold would generate income taxed at ordinary rates, held for 1 year or less, trade or business inventory, assets with a value less than the TP's basis.) Deduction amount for OIP is lesser of property's FMV or the property's adjusted basis. Standard deduction. You should know when the standard deduction applies (it applies when the standard deduction > total itemized deductions). Standard deduction for TP claimed as dependent = greater of (1) $1,050 or (2) $350 + earned income 20% deduction for Qualified Business Income (wage test and asset test will not be covered). Focus on which businesses are specified service business and which are not. Know how the deduction is computed for those below the threshold, and what happens to the deduction for those above the threshold. (Thresholds are provided on the exam) Specified service or trade business is any business that provides personal services such as law firms, medical practices, consulting firms, and professional athletes, any business where the principal asset of the business is the reputation or skill of one or more of its employees/owners, any business who services consists of investing, investment management trading, or dealing in securities. Qualified trade or business is all other businesses including architectural or engineering services. Estate Tax Gift Tax Tax paid by Estate administrator Donor Max rate (2018) 37% 37% Assessed on FMV of wealth FMV of wealth (“basis”): transfer upon death transfer by gift Only large transfers are subject to transfer taxes because: (1) annual gift exclusion of $15K (per gift recipient per year), and (2) the unified tax credit ($11.2M for years 2018-2025)