Itemized Deductions - Total Tax Solutions LLC

advertisement

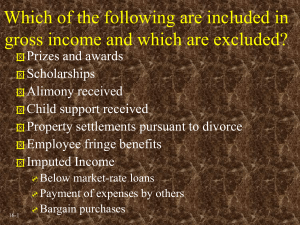

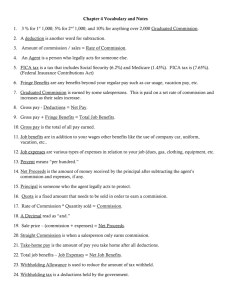

The Tax Return - Itemized Deductions W.F. Boutin EA – Total Tax Solutions LLC Taxpayers itemize their deductions in the hope of exceeding the standard deduction allowed by the tax code for their particular filing status. For every dollar that exceeds the standard deduction, the savings realized is proportionate to the tax bracket they are in for their filing status. Categories found on the SCH A, itemized deductions include: Medical Expenses that exceed 7.5% of the AGI for taxpayers 65 or older, all other taxpayers 10% of the AGI starting in 2013; certain Taxes paid, such as state or local income taxes, foreign income taxes, general sales tax (only if not claiming state and local taxes); real estate tax and personal property tax which must be based upon the value of property and charged on a yearly basis; qualified home mortgage Interest including certain points paid, investment interest (limited to investment income) and qualified mortgage insurance premiums; Charitable Contributions by cash or check and contributions other than cash or check. (NOTE: The deduction of cash must have a bank record or written communication from the charity. Contributions of property such as clothing and household items must be in good used condition or better.); Non-Business Casualty and Theft Losses (subject to a $100 deductible and 10% of the AGI); various Miscellaneous Deductions which fall into two categories: those that are subject to 2% of the AGI before the first dollar is realized such as employee/employment business expenses, tax preparation fees, investment expenses, safe deposit boxes etc., and deductions not subject to the 2% cap such as gambling losses (up to the amount of winnings), impairment related work expenses and unrecovered investments in an annuity etc. There are many more allowed deductions that fall into this miscellaneous category. Most individuals do not succeed in itemizing deductions unless they have the cost of home mortgage interest and real estate taxes. Unless a taxpayer does not have medical insurance, or has a medical catastrophe, most out of pocket expenses for medical do not exceed the 7.5% or 10% of AGI. (Pre-tax health insurance purchased through your employer is not deductible since no taxes were paid on these premiums. We will discuss this further when we talk about employer provided fringe benefit plans.) The most understated deduction for taxpayers who do itemize is for the donation of personal property such as clothing and home furnishings. Most taxpayers fill up trash bags of clothing and drop them off at the nearest collection box when they go food shopping or visit their town recycle center. We recommend that you prepare a detailed description of the goods being donated. Then, drop these bags off at the local thrift store; there you can receive a signed receipt for the donation. When you return home, you can calculate the value of what was donated. Many of these organizations have a donation valuation guide attached to your signed receipt, listing the high and low end value that they receive for this merchandise. (We have links at our website that list various donation value guides) Example: Children’s jeans have a value of $4.20 to $14.40 each. If you included 3 pairs of jeans in your donation, which were in very good condition, the deduction value is $27.90, $9.30 a pair which is the average of the high to low end for that item. We provide each of our clients who itemize a donation value guide each tax season. A couple of bags donated throughout the year can add up to $600 in additional deductions. Next week: The Value of Fringe Benefits! Have a tax question? E-mail taxquery@totaltxsolutions.com About Total Tax Solutions: W.F. Boutin EA registered Total Tax Solutions in the State of NH as a LLC in the summer of 2006 after 10 years experience working for a major tax preparation company and 8 years of teaching various tax courses. The company mission is to deliver an excellent customer service experience year around, to offer knowledgeable advice so that clients can make informed decisions regarding their financial future, and to provide this service with integrity, confidence and professionalism.