File

advertisement

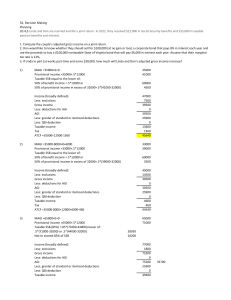

UNDERSTANDING TAXES AND MORTGAGES Agenda Recap of Last Week Understanding Taxes Federal Income Tax Examples Types of Mortgages Taxes: School House Rock Edition https://www.youtube.com/watch?v=6Q3NPgHZzDo “There’s nothing certain in life but death and taxes.” Key Tax Terms Progressive Tax Structure: people with higher taxable income levels pay higher marginal tax rates. Promotes equality of taxpayers’ ability to pay Pay-as-you-go: Taxes will be withheld from your paycheck and paid to the state or federal government Tax Liability: the amount of tax owed Tax Refund: the return of excess amounts of income tax that a taxpayer has paid throughout the past year Tax Deductible: an item or expense for adjusted gross income to reduce amount of taxed owed Types of Taxes 1. Income Taxes 1. 2. 3. Federal State Municipal (City, Local) 2. Social Security and Medicare 1. Taken out from your paycheck. (7.25% in 2014) 3. Sales 1. Differs by state. 2. Excise Taxes: an indirect tax charged on the sale of a particular good. Examples include cigarettes, gasoline, alcohol, cell phones, etc. Calculating Taxable Income Gross Income Less: Deductions for AGI Adjusted Gross Income Less: Deductions from AGI Taxable Income Tax Liability cont. Gross income—total income earned Deductions for AGI (“above line” deductions) Trade/business expenses and production of income expenses AGI (Adjusted Gross Income) Deductions from AGI Expenses that Congress allows taxpayers to reduce the amount they are taxed on Standard deduction and personal dependency Taxable income Deductions from AGI 1. Greater of Itemized Deductions or Standard Deduction 1a. Itemized Deductions Certain expenditures you are allowed to deduct OR…… 1b. Standard Deduction $6,200 per person ($12,400 married file jointly) 2. Personal and Dependency Deduction $3,950 per person claimed on tax return (2014) Types of Itemized Deductions Medical Expenses State and local income taxes, and property taxes Mortgage interest and investment interest Charitable contributions Casualty and theft losses Miscellaneous expenses Gambling loss, hobby expenses, etc. Tax Liability Formula How to File Taxes Online Options eFiling taxes on IRS.GOV TurboTax Types of Mortgages Fixed-Interest Mortgage: interest rate remains the same for the life of the loan and the payment is split into equal monthly payments for the duration. Interest payments are front-loaded so that during the first few years of the loan term, only a small portion of the payment pays off the principal. Most common duration is 30 years, but can differ Adjustable-Interest Mortgage: interest rate changes after a “fixed period” at the beginning of the loan. Initial interest rate during fixed period will be lower than fixed-interest mortgage interest rate Considered riskier because the payment can change from year to year in significant amounts. Works Cited Murphy, Kevin E., and Mark Higgins. Concepts in Federal Taxation 2015. United States: Cengage Learning, 2015. Print. http://www.homebuyinginstitute.com/mortgagetype s.php