Chapter 10

Deductions and Losses:

Certain Itemized Deductions

Individual Income Taxes

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

1

The Big Picture (slide 1 of 3)

• John and Susan Williamson have been

renting an apartment since they were

married.

– They now want to purchase their own home.

• Their current monthly rent is $2,000.

– They are willing to spend $2,500 per month

on an after-tax basis if necessary to purchase

their first home.

2

The Big Picture (slide 2 of 3)

• After months of house hunting, they have found the perfect

home, but they fear it may be too expensive.

• Using a standard mortgage to finance the purchase, the total

cash outlay during the first year of ownership would be as

follows.

Principal payments

Interest payments

Real estate taxes

Total cash outlay

$ 2,000

37,000

4,000

$43,000

Monthly cost ($43,000 ÷ 12) = $ 3,583

3

The Big Picture (slide 3 of 3)

• Alternatively, if they use investments to secure

financing, they could qualify for a lower interest rate.

– Reduces the interest charge from $37,000 to $35,000.

• Their Federal AGI will be $200,000 and their taxable

income will be between $160,000 and $185,000 for

the year.

– They do not itemize their deductions.

• Can John and Susan Williamson afford to pursue

their dream of home ownership?

– Read the chapter and formulate your response.

4

Itemized Deductions

(slide 1 of 2)

• Personal expenditures that are deductible from

AGI as itemized deductions include:

–

–

–

–

–

Medical expenses

Certain taxes

Mortgage and investment interest

Charitable Contributions

Miscellaneous itemized deductions

5

Itemized Deductions

(slide 2 of 2)

• Itemized deductions provide a tax benefit only

to extent that, in total, they exceed the standard

deduction amount for the taxpayer

6

The Big Picture - Example 1

Allowable Itemized Deductions

• Return to the facts of The Big Picture on p. 10-1.

• With the purchase of a home, John and Susan will be able to

itemize their deductions for the first time instead of claiming

the standard deduction.

– Assuming the home mortgage interest expense and real estate taxes

meet the requirements discussed in this chapter, they will be deducted

from AGI.

– Their total itemized deductions will exceed the amount of their

allowable standard deduction.

• Further, other qualifying expenditures (e.g., state income taxes

and charitable contributions) likewise will be deductible as

itemized deductions, providing an explicit tax benefit to the

Williamsons.

7

Medical Expenses

(slide 1 of 6)

• Medical expenses are deductible to the extent

unreimbursed medical expenses, in total,

exceed 10% of AGI

– For taxpayers age 65 and older, the threshold is

7.5% of AGI until 2017, when it increases to 10%

– Prior to 2013, the percentage threshold for regular

income tax purposes was 7.5% of AGI for all

taxpayers

8

Medical Expenses

(slide 2 of 6)

• Example of medical expense deduction

limitation:

– Amy, age 24, has AGI of $10,000 and medical

expenses of $1,500

– Amy’s medical expense deduction = $500

[$1,500 – ($10,000 × 10%)]

9

Medical Expenses

(slide 3 of 6)

• Example of medical expense deduction

limitation:

– Bob, age 67, has AGI of $4,000 and medical

expenses of $1,000

– Bob’s medical expense deduction = $700

[$1,000 – ($4,000 × 7.5%)]

10

Medical Expenses

(slide 4 of 6)

• Expenditures for:

– The diagnosis, cure, mitigation, treatment,

prevention of disease, or

– The purpose of affecting any structure or function

of the body of the taxpayer, spouse, or dependents

– Includes prescription drugs and insulin

11

Medical Expenses

(slide 5 of 6)

• Does not include the cost of items such as :

– Unnecessary cosmetic surgery

– General health items

– Nonprescription drugs

• If cosmetic surgery is deemed necessary, it is

deductible as a medical expense

– Cosmetic surgery is necessary when it ameliorates

• A deformity arising from a congenital abnormality

• A personal injury, or

• A disfiguring disease

12

Medical Expenses

(slide 6 of 6)

• Medical expenditures are deductible in year

paid

– Includes payment by check or credit card

13

The Big Picture - Example 2

Medical Expenses

14

Examples of Deductible and

Nondeductible Medical Expenses

Exhibit 10.1

15

Nursing Home Expenditures

• If primary reason for being in nursing home is

medical, costs (including meals and lodging)

qualify

• If primary purpose of placement in home is

personal, only specific medical costs qualify

(no meals or lodging)

16

Special School Expenditures

• Medical expense deduction may include the

expenses of a special school for a mentally or

physically handicapped individual

– Deduction is allowed if a principal reason for

sending the individual to the school is the school’s

special resources for alleviating the infirmities

– In this case, the cost of meals and lodging, in

addition to the tuition, is a proper medical expense

deduction

17

Capital Medical Expenditures

• May include a pool, air conditioners if they do not

become permanent improvements, dust elimination

systems, elevators, etc.

• Must be medical necessity, advised by a physician,

used primarily by patient, and expense is reasonable

• Full amount of cost is medical expense in year paid

• Maintenance on capital expenditures also medical

expense

18

Capital Improvement to Home

• Deductible medical expense only to extent cost

exceeds increase in value of home

– Appraisal costs related to capital improvements are

also deductible, but not as medical expenses

• Exception: removal of structural barriers to

home of handicapped are deemed to add no

value to home

– Thus, full amount is a medical expense

19

Medical Care for Spouse

and Dependents

• Taxpayer may deduct cost of medical care for

spouse and dependents

– Dependents need not meet gross income or joint

return tests

– Medical expenses of children of divorced parents

can be deducted by non-custodial parent even

though child is claimed as dependent of custodial

parent

20

Medical Transportation

and Lodging

• Transportation costs to and from medical care are

deductible

– Mileage allowance of 23 cents per mile (in 2015) may be

used instead of actual out-of-pocket automobile expenses

• Lodging while away from home for medical care

– Allowable amount is $50 per person per night

• If parent and/or aide needs to accompany patient,

their expenses are also deductible

21

Medical Transportation

and Lodging

• Transportation costs to and from medical care are

deductible

– Mileage allowance of 23 cents per mile (in 2015) may be

used instead of actual out-of-pocket automobile expenses

• Lodging while away from home for medical care

– Allowable amount is $50 per person per night

• If parent and/or aide needs to accompany patient,

their expenses are also deductible

22

Medical Transportation

and Lodging

• Transportation costs to and from medical care are

deductible

– Mileage allowance of 23 cents per mile (in 2015) may be

used instead of actual out-of-pocket automobile expenses

• Lodging while away from home for medical care

– Allowable amount is $50 per person per night

• If parent and/or aide needs to accompany patient,

their expenses are also deductible

23

The Big Picture - Example 9

Medical Expenses

•

Return to the facts of The Big Picture on p. 10-1.

• Because of her disabilities, John’s mother, Martha, moves in with them.

– She becomes their dependent.

• The family physician advises them that Martha needs specialized treatment

for her heart condition.

– John and Martha fly to Cleveland, Ohio, where Martha receives therapy

• Expenses in connection with the trip are as follows:

– Round-trip airfare ($250 each)

– Lodging in Cleveland for two nights ($120 each per night)

$500

$480

• Assuming that the Williamsons itemize their deductions, the medical

expense deduction is as follows:

– Transportation

– Lodging ($50 per night per person)

$500

$200

• Because Martha is disabled, it is assumed that John’s accompanying her is justified.

24

Medical Insurance Premiums

(slide 1 of 2)

• Premiums paid for medical care insurance are

deductible medical expenses

– If employer pays all or part of taxpayer’s medical

insurance premiums the amount paid by employer

is

• Not included in gross income by employee

• Not deductible by the employee as medical expense

25

Medical Insurance Premiums

(slide 2 of 2)

• For self-employed, 100% of insurance premiums are

deductible for AGI

– Includes amounts paid for taxpayer’s spouse and

dependents

– Not allowed if taxpayer is eligible to participate in a

subsidized health plan maintained by any employer of the

taxpayer or the taxpayer’s spouse

• Premiums paid for qualified long-term care insurance

are deductible medical expenses

– Subject to limitations based on age of the insured

26

Medical Insurance Premiums

(slide 2 of 2)

• For self-employed, 100% of insurance premiums are

deductible for AGI

– Includes amounts paid for taxpayer’s spouse and

dependents

– Not allowed if taxpayer is eligible to participate in a

subsidized health plan maintained by any employer of the

taxpayer or the taxpayer’s spouse

• Premiums paid for qualified long-term care insurance

are deductible medical expenses

– Subject to limitations based on age of the insured

27

The Big Picture - Example 10

Medical Insurance Premiums

• Return to the facts of The Big Picture on p. 10-1.

• John Williamson is the sole practitioner in his

unincorporated accounting firm.

• During the year, he paid health insurance premiums

of $8,000 for his own coverage and $7,000 for

coverage for his wife, Susan.

– John can deduct $15,000 as a business deduction (for AGI)

in computing their taxable income

28

Reimbursement by

Medical Insurance

• If reimbursed in same year as expense paid:

– Reimbursement offsets medical expense

– Amount deductible is excess of expenses over

reimbursement

• If reimbursed in the year after medical expenses were

paid:

– Reimbursement is income only to extent medical deduction

decreased taxable income in the earlier year (tax benefit

rule)

– If standard deduction was taken in year expenses were

paid, none of the reimbursement is included in income

29

Reimbursement by

Medical Insurance

• If reimbursed in same year as expense paid:

– Reimbursement offsets medical expense

– Amount deductible is excess of expenses over

reimbursement

• If reimbursed in the year after medical expenses were

paid:

– Reimbursement is income only to extent medical deduction

decreased taxable income in the earlier year (tax benefit

rule)

– If standard deduction was taken in year expenses were

paid, none of the reimbursement is included in income

30

Example of Medical Reimbursements

(slide 1 of 2)

• In 2014 taxpayer, age 35, paid medical

expenses = $4,200; In 2015, reimbursed $800

by insurance company

– For 2015, deductible medical expense is

$3,400 – (10% × AGI)

31

Example of Medical Reimbursements

(slide 2 of 2)

• In 2015, taxpayer, age 35, paid medical

expenses of $4,200; In 2016, reimbursed

$800 by insurance company

– For 2015, deductible medical expense is

$4,200 – (10% × AGI)

– For 2016, reimbursement is income to extent

taxpayer received a tax benefit from medical

expense deduction in 2015

32

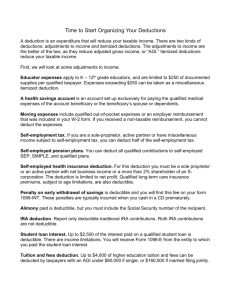

Health Savings Accounts

• Used in conjunction with a high deductible medical

insurance policy

– Employee contributions to HSA are deductible for AGI and

earnings on funds in account are not taxable

– Deductible contributions are limited to the sum of the

monthly limitations. The monthly deductible amount is

limited to the lesser of one twelfth of:

• $3,350 for self-only ($6,650 for family coverage) in 2015

– Withdrawals from HSA are excludible to the extent used

for qualified medical expenses

33

Taxes

(slide 1 of 4)

• State, local, and foreign income and real

property taxes are deductible in the year paid

– Real property taxes do not include taxes assessed

for local benefits

• e.g., Special assessments for streets, sidewalks, curbing,

and other similar improvements

• State and local personal property taxes based

on value (ad valorem) are deductible in the

year paid

34

Taxes

(slide 2 of 4)

• Other taxes such as FICA, excise, etc., are not

deductible

– May be deductible if incurred in business or

production of income activity

• Fees are not deductible as tax

35

Taxes

(slide 3 of 4)

• Real estate taxes for year property is sold must

be apportioned between the buyer and the

seller

– Failure to correctly apportion requires offsetting

adjustments to seller’s amount realized and buyer’s

adjusted basis

36

Taxes

(slide 3 of 4)

• Real estate taxes for year property is sold must

be apportioned between the buyer and the

seller

– Failure to correctly apportion requires offsetting

adjustments to seller’s amount realized and buyer’s

adjusted basis

37

Taxes

(slide 4 of 4)

• Can elect to deduct either state & local income taxes

or sales/use taxes

– For state and local income taxes, deduct amounts paid

during year:

• Amounts withheld

• Estimated tax payments

• Amounts paid in current year for prior year’s liability

– For sales/use taxes, deduct either:

• Actual sales/use tax payments or

• Amount from an IRS table

– Table amount may be increased by sales tax paid on certain specific

items (e.g., purchase of motor vehicles, boats, etc.)

– This deduction alternative was available through 2014

• Many tax professionals believe that Congress will extend this provision

38

The Big Picture - Example 16

Deductible Property Taxes

• Return to the facts of The Big Picture on p. 10-1.

• If the Williamsons purchase their home, the real

estate taxes they pay will be deductible from AGI as

an itemized deduction.

• If they also pay personal property tax on their car, the

payment may be only partially deductible.

– In their state, the motor vehicle registration tax is 2% of the

value of the vehicle plus 40 cents per hundredweight.

– The Williamsons car is valued at $20,000 and weighs 3,000

lbs.

– Their annual registration fee is $412.

• $400 (2% of $20,000) is deductible as a personal property tax.

• The remaining $12, based on the weight of the car, is not

deductible.

39

Interest Expense

• Deduction of interest expense is limited to:

–

–

–

–

Interest on qualified student loans

Investment interest

Qualified residence (home mortgage) interest

Business interest

• Personal interest expense is not deductible

40

Interest on Qualified

Student Loans

• Deductible for AGI, subject to limits

– Maximum deduction is $2,500 per year

– Deduction is phased out for taxpayers with

modified AGI (MAGI) between $65,000 and

$80,000 ($130,000 and $160,000 on joint returns)

– Not allowed for those claimed as a dependent or

for married filing separate returns

41

Qualified Residence Interest

(slide 1 of 4)

• Interest on indebtedness secured by the

principal residence and one other residence

(qualified residences)

• Interest must be on acquisition indebtedness or

home equity loans

42

Qualified Residence Interest

(slide 2 of 4)

• Acquisition indebtedness: amounts incurred to

acquire, construct, or substantially improve the

qualified residences

– Interest paid on aggregate acquisition indebtedness

of $1 million or less ($500,000 for married, filing

separately) is deductible as qualified residence

interest

43

Qualified Residence Interest

(slide 3 of 4)

• Home equity indebtedness: loans secured by

qualified residences

• Interest is deductible only on portion of home

equity loan that does not exceed the lesser of:

– $100,000 ($50,000 for married, filing separate), or

– FMV of home – acquisition indebtedness

44

Qualified Residence Interest

(slide 4 of 4)

• Thus, maximum loans on qualified residences

that will produce qualified residence interest is

$1.1 million

• Interest on mortgage debt exceeding $1.1

million or on mortgage debt relating to

nonqualified residence (e.g., second vacation

home) is nondeductible personal interest

45

The Big Picture - Example 21

Acquisition Indebtedness

• Return to the facts of The Big Picture on p. 10-1.

• John and Susan will need to borrow at least a portion of the

purchase price of their new home

– A standard mortgage likely will qualify as acquisition indebtedness.

– However, the interest on the acquisition indebtedness will be fully

deductible only if

• The amount of the mortgage is $1 million or less (assuming they file a

joint return), and

• The mortgage is secured by the home.

• Recall that they are also considering what appears to be a less

expensive route of using their investments to secure the debt.

– If they choose this alternative, the interest will not be deductible as

qualified residence interest because the loan would not be acquisition

indebtedness.

46

Interest Paid For Services

(slide 1 of 2)

• “Points” paid for the use or forbearance of

money qualify as deductible interest

– Cannot be a service charge if they are to qualify as

deductible interest

• Points generally must be capitalized and

amortized over the life of loan

47

Interest Paid For Services

(slide 2 of 2)

• Exception: Points paid in the acquisition or

improvement of principal residence

– Entire amount of such points are deductible in the

year paid

– Points paid to refinance an existing home

mortgage must be capitalized and amortized over

the life of the new loan

48

Interest Paid For Services

(slide 2 of 2)

• Exception: Points paid in the acquisition or

improvement of principal residence

– Entire amount of such points are deductible in the

year paid

– Points paid to refinance an existing home

mortgage must be capitalized and amortized over

the life of the new loan

49

Investment Interest

• Investment interest on loans whose proceeds

are used to purchase investment property may

be deductible

– e.g., Investment property may include stock,

bonds, and land held for investment

• Deduction of investment interest expense is

limited to net investment income

50

Other Interest Expense Limits

• Interest expense payable to related parties

• Interest expense incurred to purchase tax

exempt securities

• Others

51

Other Interest Expense Limits

• Interest expense payable to related parties

• Interest expense incurred to purchase tax

exempt securities

• Others

52

Classification of Interest Expense

• Whether interest is deductible for AGI or as an itemized

deduction (from AGI) depends on purpose of indebtedness

– If related to a business or the production of rent or royalty income

• Interest is deductible for AGI

– If incurred for personal use, such as qualified residence interest

• Deduction is reported on Schedule A, Form 1040 if taxpayer itemizes

• However, interest on a student loan is a deduction for AGI

– If the taxpayer incurs debt in relation to his or her employment

• Interest is considered to be personal, or consumer, interest

53

Charitable Contributions

(slide 1 of 2)

• Individuals and corporations may deduct

contributions made to qualified domestic

organizations

• Contributor must have donative intent and

expect nothing in return

– If contributor receives tangible benefit, the FMV

of such benefit reduces the amount of the

charitable contribution deduction

54

Charitable Contributions

(slide 2 of 2)

• Exception to tangible benefit rule

– Allows deduction of 80% of amount paid for the

right to purchase athletic tickets from colleges and

universities

55

Contribution of Services

• No deduction is allowed for the contribution of

services

– Unreimbursed expenses related to the services are

deductible

– Out-of-pocket transportation costs or a standard

mileage rate of 14 cents per mile are deductible

– Deductions are also permitted for transportation,

reasonable expenses for lodging, and the cost of

meals while away from home incurred in

performing the donated services

56

Nondeductible Items

• The following items may not be deducted as

charitable contributions:

– Dues, fees, or bills paid to country clubs, lodges, fraternal

orders, or similar groups

– Cost of raffle, bingo, or lottery tickets

– Cost of tuition

– Value of blood given to a blood bank

– Donations to homeowners associations

– Gifts to individuals

– Rental value of property used by a qualified charity

57

Qualified Organizations

• To be deductible, contributions must be to a

qualified domestic nonprofit organization or

state or possession of U.S. or any subdivisions

thereof

– Many (but not all) qualified domestic charities are

listed in IRS Publication #78

58

Qualified Organizations

• To be deductible, contributions must be to a

qualified domestic nonprofit organization or

state or possession of U.S. or any subdivisions

thereof

– Many (but not all) qualified domestic charities are

listed in IRS Publication #78

59

Record-Keeping Requirements

• No deduction is allowed for charitable

contributions unless the taxpayer has

appropriate documentation and substantiation

– The specific type of documentation required

depends on the amount of the contribution and

whether the contribution is made in cash or

noncash property

– Special rules may apply to gifts of certain types of

property (e.g., used automobiles) where Congress

has noted taxpayer abuse in the past

60

Ordinary Income Property

• Defined: assets that would produce ordinary

income or short-term capital gain if sold

• Contribution amount

– FMV of asset less ordinary income (or STCG)

potential; generally the lower of adjusted basis or

FMV

61

Capital Gain Property

• Defined: assets that would produce long-term

capital gain or Section 1231 gain if sold

• Contribution amount

– Generally FMV of asset

62

Exceptions to FMV Deduction

of Capital Gain Property (slide 1 of 3)

• Private nonoperating foundations

– Deduction for contributions to private

nonoperating foundations must be reduced by the

amount of long-term capital gain potential

– Thus, the contribution deduction is limited to the

adjusted basis

63

Exceptions to FMV Deduction

of Capital Gain Property (slide 2 of 3)

• For contributions of tangible personalty

– The charitable deduction may limited to the

adjusted basis if the asset contributed is not used in

charity’s exempt function

– This reduction generally does not apply if

• The property is, in fact, not put to an unrelated use, or

• At the time of the contribution, it was reasonable to

anticipate that the property would not be put to an

unrelated use by the donee

64

Exceptions to FMV Deduction

of Capital Gain Property (slide 3 of 3)

• For contributions of certain types of

intellectual property

– Contribution deduction is limited to the lesser of

the taxpayer’s basis in the property or the

property’s fair market value

– Includes patents, certain copyrights, trademarks,

trade names, trade secrets, know-how, and some

software

65

Example of Contributions

of Tangible Personalty

• Taxpayer contributes painting to local charity:

FMV $100,000 and adjusted basis $10,000

– If charitable organization is a local museum that

hangs the painting for patrons to view, taxpayer

has $100,000 contribution deduction

– If charitable organization is a local church that

sells the painting immediately to obtain funds for

its operation, taxpayer has $10,000 contribution

66

Charitable Contribution

Limitations (slide 1 of 4)

• 50% limit

– In no case can the charitable contribution deduction for a

year exceed 50% of the taxpayer’s AGI

– Contributions of cash, ordinary income property, and

certain capital gain property (where the contribution

amount is adjusted basis) are subject to the 50% limit (50%

assets)

– Generally, applies to contributions to public charities

• e.g., Churches, schools, hospitals, and Federal, state, or local

governmental units

• Also applies to private operating foundations and certain private

nonoperating foundations

67

Charitable Contribution

Limitations (slide 2 of 4)

• 30% limit

– Charitable contribution deduction for certain assets

cannot exceed 30% of the taxpayer’s AGI

• Applies to 30% assets which are:

– Capital gain property for which the contribution amount is

FMV

– Certain contributions to private nonoperating foundations

68

Charitable Contribution

Limitations (slide 3 of 4)

• 30% limit

– Taxpayer can elect to treat capital gain property as

50% assets by limiting the amount of such

contributions to their adjusted bases

– Referred to as the reduced deduction election

• Enables the taxpayer to move from the 30% limitation

to the 50% limitation

69

Charitable Contribution

Limitations (slide 4 of 4)

• 20% limit

– Certain contributions of capital gain property to

private nonoperating foundations

70

Charitable Contributions Carryover

• Contributions that cannot be taken in current

year due to limitations may be carried forward

for 5 years

– Contributions carried forward retain their

classification

• e.g., If the contribution originally involved 30%

property, the carryover will continue to be classified as

30% property in the carryover year

– When using carryovers, current contributions are

used first, then carryovers used on a FIFO basis

71

Example of Charitable Contribution

AGI Limits

• Taxpayer, AGI $100,000, contributed $40,000

cash and long-term stocks with a FMV of

$35,000 and a basis of $8,000 to a University

• 50% limit = $50,000

30% limit = $30,000

– Amount of deduction = $50,000 (40,000 cash +

10,000 stock)

– Contribution carryforward = $25,000 stock (as

30% asset)

72

Miscellaneous Itemized Deductions

• Some expenditures are deductible only to the extent

they exceed 2% of AGI

• Examples include:

–

–

–

–

–

–

–

Professional dues

Uniforms

Tax return prep fees

Job-hunting costs

Certain investment expenses

Hobby losses

Unreimbursed employee expenses

73

Misc. Itemized Deductions Not Subject

to 2% of AGI Floor

• Examples include:

– Gambling losses to the extent of gambling

winnings

– Impairment-related work expenses of a

handicapped person

– Deduction for repayment of amounts under a claim

of right if more than $3,000

– Unrecovered investment in an annuity contract

when annuity ceases by reason of death

74

Itemized Deduction Phaseout

(slide 1 of 3)

• For higher income taxpayers, the otherwise

allowable itemized deductions are reduced by

3% of the amount AGI exceeds the applicable

threshold amount

– The reduction in itemized deductions is limited to

80% of affected itemized deductions

75

Itemized Deduction Phaseout

(slide 2 of 3)

• The limitation applies to the following frequently encountered

itemized deductions:

–

–

–

–

Taxes

Home mortgage interest, including points

Charitable contributions

Unreimbursed employee expenses and all other expenses subject to the

2%-of-AGI floor

• Certain itemized deductions are not subject to phaseout

including:

–

–

–

–

Medical expenses

Investment interest expense

Wagering losses, and

Casualty and theft losses

76

Itemized Deduction Phaseout

(slide 3 of 3)

• The applicable threshold amounts in 2015 for the itemized

deduction phaseout are as follows:

Filing status

AGI Threshold

Single

$258,250

Married, filing jointly

309,900

Head of household

284,050

Married, filing separately

154,950

• These threshold amounts are adjusted for inflation annually

77

Refocus On The Big Picture (slide 1 of 2)

•

•

Because qualified residence interest and real estate taxes are deductible, the aftertax cost of a home purchase is reduced by the tax savings associated with these

itemized tax deductions.

Given the Williamsons’ projected taxable income, they are in the 28% Federal and

6% state tax brackets for an aggregate marginal tax bracket of 34%.

– As a result, the after-tax cost of financing the purchase of the home will be:

•

Nondeductible principal payments

Deductible qualified residence interest and

real estate taxes [($37,000 + $4,000) X (1- .34)]

Total

$ 2,000

27,060

$29,060

After-tax monthly cost ($29,060 ÷ 12)

$ 2,422

Because the Williamsons will be able to itemize their deductions if they purchase a

new home and will be able to deduct most of their monthly house payment, the

home purchase will be affordable.

78

Refocus On The Big Picture (slide 2 of 2)

• What if the Williamsons choose to finance the purchase of

their home using their investments as security for the loan?

– What may appear to be a cost-effective approach ends up being more

costly on an after-tax basis.

• With this approach, the interest expense is not deductible.

– It is not qualified residence interest or investment interest.

• Therefore, the after-tax cost of financing the home using this

approach makes the home unaffordable.

Nondeductible principal and interest payments

Deductible real estate taxes [$4,000 X (1 - .34)]

Total

$37,000

2,640

$39,640

After-tax monthly cost ($39,640 ÷ 12)

$ 3,303

79

If you have any comments or suggestions concerning this

PowerPoint Presentation for South-Western Federal

Taxation, please contact:

Dr. Donald R. Trippeer, CPA

trippedr@oneonta.edu

SUNY Oneonta

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

80