PowerPoint Slides for Chapter 16

Which of the following are included in gross income and which are excluded?

Prizes and awards

Scholarships

Alimony received

Child support received

Property settlements pursuant to divorce

Employee fringe benefits

16-1

Imputed Income

Below market-rate loans

Payment of expenses by others

Bargain purchases

Which of the following are included in gross income and which are excluded?

Gifts and inheritances

Life insurance proceeds

Welfare payments

Social Security benefits

Medical insurance payments

Workmen’s compensation

Compensation for injuries

Unemployment benefits

Punitive damages

Payment for lost wages

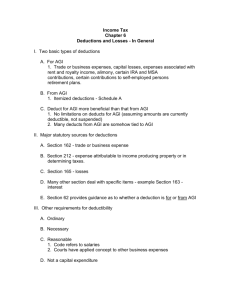

Deductions ‘for’ AGI

Trade or business deductions

Moving expenses (with limitations)

Net Capital Losses up to $3,000

Alimony paid (but not child support)

50% of self-employment tax paid and 40% of a self-employed person’s medical insurance premiums

Net operating loss deduction

IRA contributions

16-3

Up to $2,500 of post-secondary tuition, phased out for higher income taxpayers

Itemized Deductions

Medical expenses

Payments to health care practitioners, medical facilities, insurance premiums, medical aids, prescription drugs

Only unreimbursed costs

Deductible in excess of 7.5% of AGI

16-4

Charitable contributions

Cash or FMV of property contributed to a qualified tax-exempt organization

Subject to many limitations

deduction for gifts to public charities may not exceed 50% of AGI

16-5

Itemized Deductions continued

Interest Deductions

Trade or business interest deducted for AGI

Investment interest expense

Deduction limited to amount of net investment income

Qualified residence interest

Deduction limited to interest on up to $1 million of acquisition debt plus $100,000 of home equity debt

Available for a primary and one secondary residence

16-6

Itemized Deductions continued

Taxes

Income taxes

State, local, and foreign, NOT federal

Real property taxes

Personal property taxes based on value

Other state, local and foreign business-related taxes deducted for AGI

What common tax we all pay is not deductible?

Itemized Deductions continued

16-7

Personal Casualty and Theft losses

A casualty loss is a loss of property caused by some sudden, unusual or unexpected external force, such as a natural disaster

Theft means an illegal taking of property, not just loss due to carelessness

Deduction subject to a $100 per event floor and a reduction of 10% of AGI

Casualty and theft losses of business property deductible for AGI

16-8

Itemized Deductions continued

Miscellaneous itemized deductions

Deductible only in excess of 2% of AGI

Include:

Unreimbursed business expenses

Investment expenses

Tax return preparation fees

hobby expenses

Gambling losses

Deductible only against gambling winnings

16-9

Other Issues

Use of property for both personal and businessrelated purposes may introduce considerable complexity into the calculation of individual taxable income

Two common examples:

office in the home

vacation home

16-10

Vacation Home

Treatment of income and expenses of a vacation home depends on extent of rental and personal use

If rented 14 or fewer days of year and used personally the remainder of the year, the property is treated as a personal residence. Rental income is not reported and rental expenses are not deductible

16-11

Vacation Home continued

If rented more than 14 days:

And used personally for more than 14 days or more than 10% of the number of rental days:

Income reported as taxable

Allocable portion of expenses deductible, limited to rental income

And used personally for less than 14 days or 10% or less than the number of rental days:

Income reported as taxable

Allocable portion of expenses deductible

16-12

Sale of Personal Residence

Up to $250,000 ($500,000 MFJ) of gain excluded from taxation

Dwelling must have been owned and used as taxpayer’s principal residence for 2 of last 5 years

Exclusion applies to only one sale every 2 years

Reduced exclusion available if sold due to change in employment, health reasons, or unforeseen circumstances

• Reduced exclusion = maximum X lesser of ownership period exclusion or time since prior sale two years

Tax Subsidies for Higher

Education

Tax credits

HOPE scholarship credit

Lifetime learning credit

Interest rules

Exclude from income interest earned on Series EE savings bonds used for tuition and fees

Itemized deduction allowed for interest paid on qualified education loans

16-13

Education savings account

Maximum nondeductible contribution of $2,000 per year

Withdrawals nontaxable if used for beneficiary’s education expenses