CHAPTER 6 BUSINESS EXPENSES I. Mixed Use Expenses

advertisement

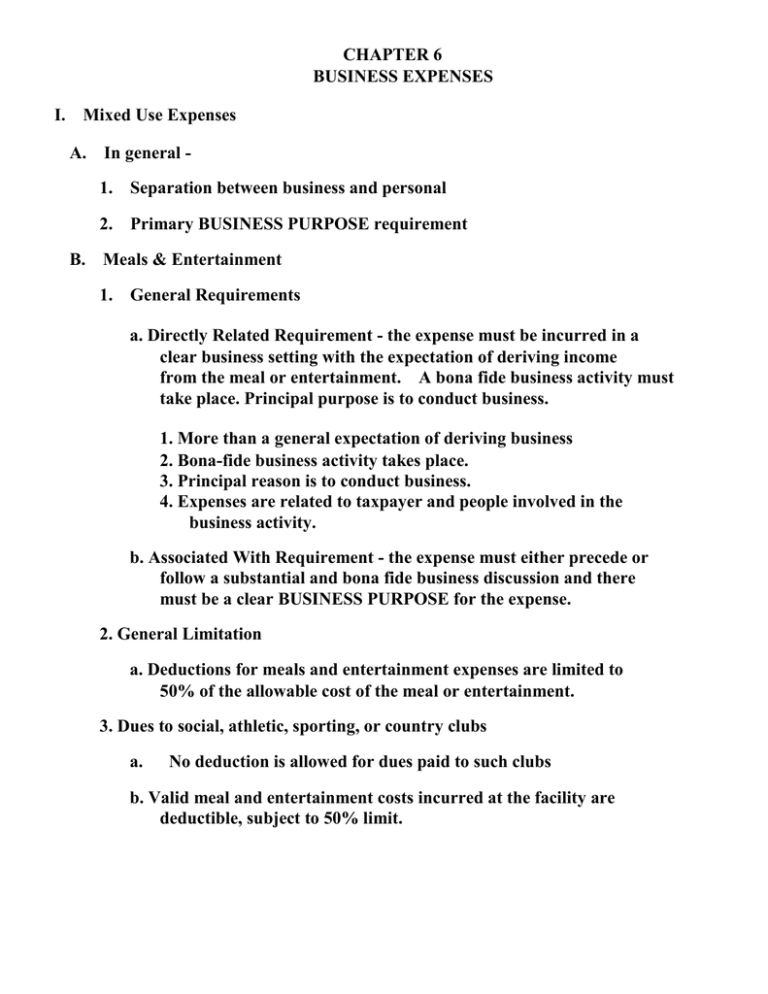

CHAPTER 6 BUSINESS EXPENSES I. Mixed Use Expenses A. In general 1. Separation between business and personal 2. Primary BUSINESS PURPOSE requirement B. Meals & Entertainment 1. General Requirements a. Directly Related Requirement - the expense must be incurred in a clear business setting with the expectation of deriving income from the meal or entertainment. A bona fide business activity must take place. Principal purpose is to conduct business. 1. More than a general expectation of deriving business 2. Bona-fide business activity takes place. 3. Principal reason is to conduct business. 4. Expenses are related to taxpayer and people involved in the business activity. b. Associated With Requirement - the expense must either precede or follow a substantial and bona fide business discussion and there must be a clear BUSINESS PURPOSE for the expense. 2. General Limitation a. Deductions for meals and entertainment expenses are limited to 50% of the allowable cost of the meal or entertainment. 3. Dues to social, athletic, sporting, or country clubs a. No deduction is allowed for dues paid to such clubs b. Valid meal and entertainment costs incurred at the facility are deductible, subject to 50% limit. Chapter 6 4. Exceptions to the 50%/directly related/associated with requirements a. Reimbursed expenses - person receiving the reimbursement is not subject to the limitation. 1) Entity taking the deduction is subject to the 50% limit. b. Entertainment for employee's benefit. c. Moving Expenses of Employees - employer not subject to limit d. Promotional Goods C. Auto Expenses 1. Deduction allowed for business use - Going from one business location to another business location. a. Commuting - personal, not deductible 2. A taxpayer’s mileage or cost of travel is considered business related if the travel is: a. Out of town b. From the taxpayer’s home to his or her temporary workplace c. From the taxpayer’s regular workplace to a temporary workplace d. From the taxpayer’s regular workplace (or temporary workplace) to a second job Note: Mileage between the taxpayer’s second job and home is considered personal, and on days when the taxpayer does not work at his or her regular job, the travel to and from the second job is considered commuting. - Chapter 6 3.Determining Business Miles - Figure 6-1 - Chapter 6 4. Allowable Methods a. Standard Mileage Rate Method 1) May deduct 56 cents per mile in 2014 (56.5 cents in 2013) for cost of operating the auto (includes depreciation). 2) Direct out of pocket costs (non-operating) allowed in addition to mileage - tolls/parking. 3) Can only use if only 5 or fewer business cars are involved. i.e. if you have more than 5 business cars, you must use actual costs. 4) Must document business usage. b. Actual Cost Method 1) Deduct all costs of operating the auto proportionate to the business use. 2) Must document business usage and costs. D. Travel Expenses 1. Expenses incurred while "away from home overnight" for a BUSINESS PURPOSE are deductible. a. Transportation Costs - Fully deductible if primary purpose of the trip is business. i.e. more than 50% of the days must be devoted to business. 1) If primary purpose is personal, no deduction allowed for transportation costs. NOTE: Transportation costs are an all or nothing proposition b. Other Costs (lodging, meals, taxis, incidentals) - The costs attributable to business days are always deductible, regardless of the purpose of the trip. c. Spouse's expenses - only deductible if there is a bona-fide BUSINESS PURPOSE for the spouse to be there and spouse must be an employee of the taxpayer. d. Travel related to production of income activities and personal activities is not deductible. e. Travel as a form of education is not deductible. - Chapter 6 E. Business Gifts 1. $25 per donee limit - includes direct and indirect gifts. F. Substantiation - Because of the potential for abuse of meals, entertainment, auto, travel, and business gifts, they are subject to strict documentation requirements. You must substantiate with written records: 1. Amount of the expense 2. time and place of the travel or entertainment; date or description of a gift 3. business purpose 4. business relationship of person entertained or receiving a gift G. Education expenses 1. To deduct education expenses, the expense must either a. be a job requirement (either by law or by the employer) for continued employment (not for new employment) or b. maintain or improves skills required in taxpayer's trade or business 2. Expenses of an employee are deducted as miscellaneous itemized deductions (2% AGI limit). Self-employed taxpayers can deduct as an ordinary & necessary business expense. 3. Deduction for adjusted gross income for qualified higher education expenses is allowed. a. Maximum deduction is $4,000 for taxpayers with AGI < $65,000 ($130,000 married couple). Taxpayers with AGI < $80,000 ($160,000 married couple) are allowed a maximum deduction of $2,000. c. Taxpayers with adjusted income above the threshold are not allowed a deduction. d. Qualified higher education expenses are defined in the same manner as for the AOTC tax credit (Chapter 8). e. A taxpayer cannot take an education tax credit and a deduction for the same expenses. - Chapter 6 II. Other Business Expenses A. Employee Compensation 1. Main Problem - reasonableness requirement a. Related Parties 2. Compensation limit on publicly held corporations (Not covered) - CEO and 4 highest paid employees deductible compensation is limited to $1,000,000. B. Bad Debts - In general, only the specific charge-off method of accounting for bad debts is allowed (allowance accounting is not generally allowed) 1. Business Bad Debt - A debt that arose in a transaction related to a taxpayer's trade or business. a. Business Bad Debts are fully deductible as an ordinary and necessary expense in the year of partial or total worthlessness. b. Amount of Deduction - CAPITAL RECOVERY Concept limits the deduction to the taxpayer's BASIS in the debt. 1) Cash Basis Taxpayers - No basis, hence no deduction. 2) Accrual Basis Taxpayers - Income has been previously recognized. Thus, a basis equal to the income previously recognized is allowed as a deduction. a) Tax Benefit Rule for subsequent recoveries 2. Nonbusiness (Investment) Bad Debt - A debt that is not related to the taxpayer's trade or business. a. Nonbusiness bad debts are only deductible in the year in which the actual worthlessness is determined. They are deductible as shortterm capital losses. 1) $3,000 capital loss limitation b. Related Party bad debts - Forgiveness of debt may be a gift. - Chapter 6 C. Qualified Production Activities Deduction -1. For 2007 – 2009, the production activities deduction is equal to 6% of the lesser of the taxpayer’s qualified production activities income or taxable income (before the qualified production activities deduction). Individuals use AGI instead of TI. 2. The deduction amount increases to 9% for 2010 and thereafter. 3. The QPAD cannot exceed 50% of w-2 wages paid by the taxpayer as an employer during the year. D. Insurance 1. Insurance paid is generally deductible 2. Life insurance premiums - group-term life premiums deductible. In order to deduct other life insurance premiums, the payment of the expense must be considered as compensation to the employee. E. Taxes 1. Most taxes are deductible. Federal income tax not deductible. 2. Sales tax paid on capital expenditures must be added to the basis of the asset purchased. 3. Real Estate Taxes on property bought/sold during the year - deduction is allowed only for portion of the year the taxpayer held the property. 4. Assessments for local benefits - must be capitalized. F. Legal Fees 1. Legal fees are only deductible if they have a Business Purpose or if they are related to taxes. - Chapter 6 IV. Deductions For AGI (Exhibit 6-1) A. FOR AGI Deductions v. FROM AGI Deductions 1. No Income limitations 2. No minimum allowable amount EXHIBIT 6-1 LIST OF DEDUCTIONS ALLOWED FOR ADJUSTED GROSS INCOME Trade or Business Expenses (Losses) Reimbursed Employee Business Expenses Capital Loss Deduction Rental and Royalty Expenses Alimony Paid Deduction for Contributions to a Retirement Plan (other than an employer provided plan) Moving Expenses Interest on qualified student loans Net Operating Loss Deduction 50% of the self-employment tax paid on business income A self-employed person's medical insurance premiums QPAD Deduction for classroom materials of eligible educator Interest reported as income that has been repaid as a result of cashing in a certificate of deposit before its due date (early withdrawal penalty) Certain deductions of life tenants and income beneficiaries of property Certain required repayments of supplemental unemployment insurance benefits Reforestation Expenses Certain portion of lump-sum distributions from pension plans subject to the special averaging convention B. Reimbursed Employee Business Expenses 1. Treatment depends on type of reimbursement plan a. Accountable Plan - one that requires an adequate accounting of expenses and the return of excess reimbursements. 1) Treatments - (Exhibit 6-4) b. Nonaccountable Plan - No adequate accounting for expenses and/or excess reimbursements are not returned. 1) Treatments - (Exhibit 6-4) Reimbursements are treated as compensation; NO FOR AGI DEDUCTIONS! C. Other FOR AGI Deductions - Reporting 1. Trade or Business Expenses 2. Rental and Royalty Expenses - Chapter 6 - EXHIBIT 6-4 TREATMENT OF EMPLOYEE BUSINESS EXPENSES Type of Plan Gross Income Effect Deduction For AGI Deduction From AGI NONE NONE NONE Accountable Plans Reimbursement = Actual Expenses Reimbursement < Actual Full amount of reimbursement Expenses is included in gross income Reimbursement > Actual Excess reimbursement is Expenses included in gross income Reimbursed expenses ; no 50% rule for meals and entertainment Unreimbursed expenses as miscellaneous itemized; 50% rule applies for meals and entertainment. 2% overall limit for miscellaneous deductions applies NONE NONE Reimbursement Received Full Amount of reimbursement is included in gross income NONE All employee business expenses are deductible as miscellaneous itemized deductions; 50% rule applies for meals and entertainment. 2% overall limit for miscellaneous deductions applies. No Reimbursement NONE Same As Above Nonaccountable Plans NONE Chapter 6 D. Self-Employed Taxpayers 1. Medical insurance premiums (not allowed if taxpayer and/or spouse is covered by an employer provided plan. 2. One-half of Self-Employment Tax - 15.3% a. Only 92.35% [100% - 1/2(15.3%)] of SE Income is subject to the SE Tax because of the deduction. E. Retirement Contributions - IRA's 1. All taxpayers are allowed to contribute up to $5,500 of their earned income each year to an IRA. If a taxpayer contributes to more than one IRA account, the total contributed to all accounts cannot exceed $5,500. Earnings on IRA's are not taxed until they are withdrawn by the taxpayer. a. Non-working spouse - May contribute a total of $11,000 to two separate IRA's. No one IRA can receive more than $5,500. b. In addition, taxpayers who are at least 50 years old can make additional “catch-up” contributions of $1,000. Maximum IRA/Roth IRA Contributions Tax Year Taxpayers < 50 Taxpayers ≥ 50 2014 2. $ 5,500 $ 6,500 Deductibility of Contribution a. If neither the taxpayer nor the taxpayer's spouse is covered by a qualified pension plan, all contributions are deductible for AGI. b. If both taxpayers are covered by a qualified pension plan, the deduction is phased-out over a $10,000 range of AGI. 1) Unmarried - $60,000 - $70,000 2) Married - $96,000 - $116,000 NOTE: If the taxpayer's AGI is below the range, all contributions are deductible. If it is above the range, none of the contribution is deductible. - Chapter 6 c. If one spouse is not covered by a qualified pension plan, a deduction is allowed for contributions made by that spouse. However, the deduction is phased out over a $10,000 range of AGI beginning $181,000. 1) Note that one spouse can get a full deduction under this rule even though the participating spouse gets no deduction. 2) No deduction for either spouse is allowed if AGI ≥ $191,000. 3. Roth IRA's a. No deduction for contributions b. No tax on earnings when withdrawn (qualified distribution) c. Maximum contributions phased-out 1) Unmarried - $114,000 - $129,000 ($15,000 range) 2) Married - $181,000 - $191,000 ($10,000 range) 4. NOTE: Total contributions to all IRAs cannot exceed $5,000 5. Education IRA's (Coverdell IRA) a. Nondeductible contribution of up to $2,000 per beneficiary b. Individual must be < 18 years old. c. Earnings not taxed if used to pay qualified education expenses. d. Contribution amount phase-outs 1) Unmarried - $95,000 - $110,000 2) Married - $190,000 - $220,000 E. Interest on Education Loans a. Up to $2,500 of interest paid on a qualified higher education loan can be deducted for AGI b. Phase-out of deduction: 1) Unmarried - $60,000 - $75,000 2) Married -- $120,000 - $150,000 c. Phase-out is based on lesser of $2,500 or qualified interest paid. - Chapter 6 F. Moving Expenses 1. To deduct moving expenses, commuting distance from old residence to new job must > 50 miles farther than the commuting distance was to the old job. You must also be employed 39 weeks in the 12-month period following the move (78 weeks in 2 years for self-employed). 2. Deductible moving expenses are limited to: a. cost of moving household goods and personal effects to new residence. b. transportation and lodging costs of moving taxpayer and family to new residence (no meals are deductible). -