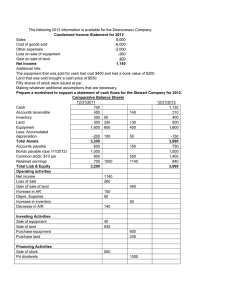

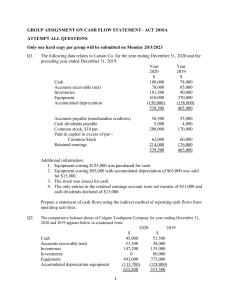

The following 2012 information is available for the Desreumaux Company: Sales 9,000

advertisement

The following 2012 information is available for the Desreumaux Company: Condensed Income Statement for 2012 Sales 9,000 Cost of goods sold -6,000 Other expenses -2,000 Loss on sale of equipment -260 Gain on sale of land 400 Net Income 1,140 Additional Info: The equipment that was sold for cash had cost $400 and had a book value of $300. Land that was sold brought a cash price of $530. Fifty shares of stock were issued at par. Making whatever additional assumptions that are necessary, Prepare a worksheet to support a statement of cash flows for the Stewart Company for 2012. Comparative Balance Sheets 12/31/2011 12/31/2012 Cash 700 1,130 Accounts receivable 450 310 Inventory 350 400 Land 300 500 Equipment 1,600 1,800 Less: Accumulated depreciation -200 -150 Total Assets 3,200 3,990 Accounts payable 600 750 Bonds payable (due 1/1/2012) 1,000 1,000 Common stock, $10 par 900 1,400 Retained earnings 700 840 Total Liab & Equity 3,200 3,990 Operating activities Net income Investing Activities Financing Activities