Accounting, Business & Economics Exam - Daffodil University

advertisement

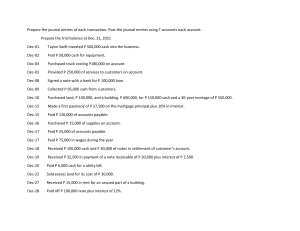

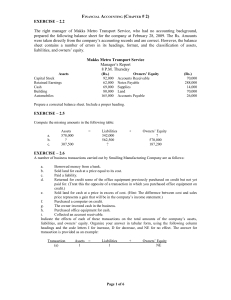

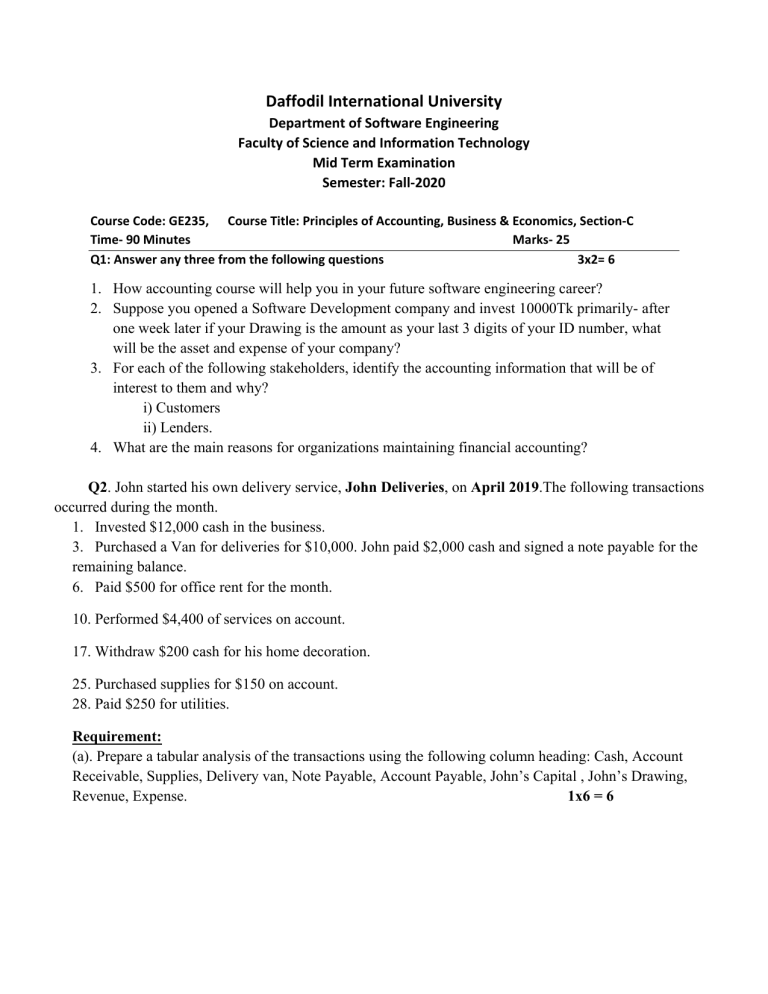

Daffodil International University Department of Software Engineering Faculty of Science and Information Technology Mid Term Examination Semester: Fall-2020 Course Code: GE235, Course Title: Principles of Accounting, Business & Economics, Section-C Time- 90 Minutes Marks- 25 Q1: Answer any three from the following questions 3x2= 6 1. How accounting course will help you in your future software engineering career? 2. Suppose you opened a Software Development company and invest 10000Tk primarily- after one week later if your Drawing is the amount as your last 3 digits of your ID number, what will be the asset and expense of your company? 3. For each of the following stakeholders, identify the accounting information that will be of interest to them and why? i) Customers ii) Lenders. 4. What are the main reasons for organizations maintaining financial accounting? Q2. John started his own delivery service, John Deliveries, on April 2019.The following transactions occurred during the month. 1. Invested $12,000 cash in the business. 3. Purchased a Van for deliveries for $10,000. John paid $2,000 cash and signed a note payable for the remaining balance. 6. Paid $500 for office rent for the month. 10. Performed $4,400 of services on account. 17. Withdraw $200 cash for his home decoration. 25. Purchased supplies for $150 on account. 28. Paid $250 for utilities. Requirement: (a). Prepare a tabular analysis of the transactions using the following column heading: Cash, Account Receivable, Supplies, Delivery van, Note Payable, Account Payable, John’s Capital , John’s Drawing, Revenue, Expense. 1x6 = 6 Q3. The Orient Software Development Company was started on July 1, 2018 by Mr. Smith. A summary of July transaction is presented below. 1. Invested $10,000 cash to start the company. 2. Purchased equipment for $5,000 cash. 3. Paid $400 cash for July office rent. 4. Paid $500 for supplies. 5. Incurred $250 of advertising costs in the Daily Star Newspaper on account. 6. Received $5,100 in cash from customers for service performed. 7. Withdraw $1,000 cash for personal use. 8. Paid employee salaries $2,000. 9. Paid utility bills $140. 10. Provided service on account to customers $750. 11. Collected cash of $120 for services billed in transaction (10). Instruction: Mr. Smith uses the following account: Cash, Account Receivable, Supplies, Equipment, Account Payable, Capital, S. Drawing, S. Revenue, and Expenses. (a) Journalize the July transactions. 4 (b) Open ledger account and post the July transactions. 5 (c) Prepare a trial balance at July 30, 2018. 4 Best of Luck