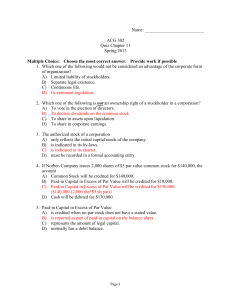

The share capital may be issued in exchange of labor performed or services rendered, tangible or intangible property, actual cash paid, and unpaid liabilities of the issuing corporation. The value of the issued share capital is equal to the fair market value except for unpaid liabilities where the basis is the amount of the liability set off. When shares are sold with par value, it is recorded to the extent of the par value and the excess is also reflected. If it has no par value, it is only credited to the ordinary shares account. When a share capital is retired, the procedures to be followed depends on the retirement price in relation to par value. If the price is equal to the par value, the share capital will be debited and cash will be credited. If it is lower, cash will be credited along with the share premium on share retirement which has a value equal to the remaining amount of share capital. If it is higher than the par value, the excess cash can be credited to the additional paid-in capital account, allocated between share premium and accumulated profits, or charged only to accumulated profits.