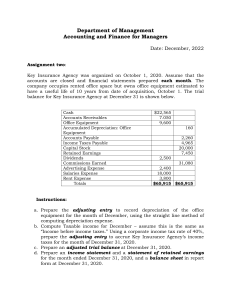

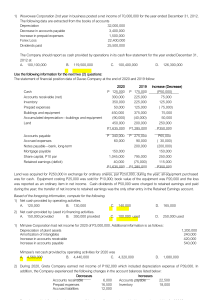

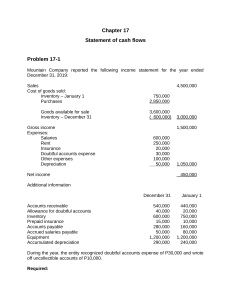

GROUP ASSIGNMENT ON CASH FLOW STATEMENT– ACT 2010A ATTEMPT ALL QUESTIONS Only one hard copy per group will be submitted on Monday 20/3/2023 Q1. The following data relates to Larson Co. for the year ending December 31, 2020 and the preceding year ended December 31, 2019. Year Year 2020 2019 $ $ Cash 100,000 78,000 Accounts receivable (net) 78,000 85,000 Inventories 101,500 90,000 Equipment 410,000 370,000 Accumulated depreciation (150,000) (158,000) 539,500 465,000 Accounts payable (merchandise creditors) Cash dividends payable Common stock, $10 par Paid-in capital in excess of par-Common Stock Retained earnings 58,500 5,000 200,000 55,000 4,000 170,000 62,000 214,000 539,500 60,000 176,000 465,000 Additional information: 1. Equipment costing $125,000 was purchased for cash. 2. Equipment costing $85,000 with accumulated depreciation of $65,000 was sold for $15,000. 3. The stock was issued for cash. 4. The only entries in the retained earnings account were net income of $51,000 and cash dividends declared of $13,000. Prepare a statement of cash flows using the indirect method of reporting cash flows from operating activities. Q2. The comparative balance sheets of Colgate Toothpaste Company for year ending December 31, 2020 and 2019 appears below in condensed form: 2020 2019 $ $ 45,000 53,500 51,300 58,000 147,200 135,000 0 60,000 493,000 375,000 (113,700) (128,000) 622,800 553,500 Cash Accounts receivable (net) Inventories Investments Equipment Accumulated depreciation-equipment 1 Accounts payable Bonds payable, due 2023 Common stock, $10 par Paid-in capital in excess of par common stock Retained earnings 61,500 0 250,000 42,600 100,000 200,000 75,000 236,300 622,800 50,000 160,900 553,500 The income statement for the current year is as follows: Sales Cost of merchandise sold Gross profit Operating expenses: Depreciation expense 24,700 Other operating expenses 75,300 $623,000 348,500 274,500 100,000 174,500 Income from operations Other income: Gain on sale of investment Other expense: Interest expense 5,000 12,000 (7,000) 167,500 64,100 103,400 Income before income tax Income tax Net income Additional information for the current year is as follows: (a) Fully depreciated equipment costing $39,000 with no salvage value, was scrapped. (b) New equipment was purchased for $157,000. (c) Bonds payable for $100,000 were retired by payment at their face amount. (d) 5,000 shares of common stock were issued at $15 each for cash. (e) Cash dividends declared were paid $28,000. (f) All sales are on account. Prepare a statement of cash flows, using the direct method of reporting cash flows from operating activities. 2