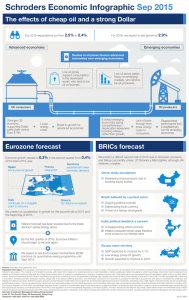

Schroders Economic Infographic Sep 2015

advertisement

Schroders Economic Infographic Sep 2015 The effects of cheap oil and a strong Dollar Our 2015 expectations cut from 2.5% to 2.4%. For 2016, we expect to see growth of 2.9%. Emerging economies Advanced economies Decline in oil prices favours advanced economies over emerging economies. Low oil prices support consumption in the developed world, who tend to be oil consumers. Low oil prices weigh heavy on emerging markets, who tend to be oil producers. Oil consumers Stronger US economy supporting Dollar particularly versus Euro & Yen Oil producers Lower energy costs Boost to growth for advanced economies $-linked emerging economies losing competitiveness / depreciation elsewhere boosting inflation rather than growth Lack of passthrough from lower energy costs to consumers Disappointing performance and a stagflationary turn for emerging economies Eurozone forecast BRICs forecast Eurozone growth slowed to 0.3% in the second quarter from 0.4% at the start of the year. Germany France Spain experienced lower stagnated led Eurozone growth domestic demand We predict a difficult second half of 2015 due to domestic concerns and falling commodity prices. 2016 looks a little brighter, although still relatively unstable. China: shaky foundations Weakening financial sector tied to bursting equity bubble Italy continues on a sluggish path to recovery Greece Q2 data bounceback We predict an acceleration in growth for the second half of 2015 and the beginning of 2016. Inflation forecast has been lowered due to the sharp decline in global energy prices. By the first quarter of 2016, Eurozone inflation should begin to recover again. We expect to see the European Central Bank (ECB) continue its quantitative easing programme until Sept 2016. Brazil: battered by a perfect storm Ongoing political scandal Depreciating local currency Threat of a ratings downgrade India: political deadlock a concern A disappointing reform process Inflation pressures remain weak therefore more scope to cut interest rates Russia: same old story GDP expected to contract by 4.1% Low energy prices hit growth Growth expected to improve in 2016 Source: Schroders as at September 2015. Important Information: Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document. The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products. Potential investors should be aware that such investments involve market risk and should be regarded as long-term investments. Derivatives carry a high degree of risk and should only be considered by sophisticated investors. This material including the website has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited. Schroder Investment Management (Hong Kong) Limited Level 33, Two Pacific Place, 88 Queensway, Hong Kong Telephone +852 2521 1633 Fax +852 2530 90950915/HKEN