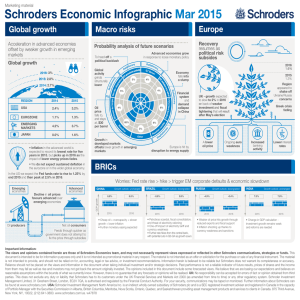

Macro risks Probability analysis of future scenarios

advertisement

Marketing material Schroders Economic Infographic Mar 2015 Global growth Macro risks Europe Acceleration in advanced economies offset by weaker growth in emerging markets Probability analysis of future scenarios Recovery resumes as political risk subsides Def lat ion r for longer Sec ar ula lowe y l i rs O tag na tio 4% 1.1% 1.3% EMERGING MARKETS 4.2% 3.7% JAPAN 0.0% 1.6% • Inflation in the advanced world is expected to record its lowest rate for five years in 2015, but picks up in 2016 as the impact of lower energy prices fades. • We do not expect sustained deflation in the eurozone or in the wider global economy. In the US we expect the Fed funds rate to rise to 1.25% by end 2015 and then peak at 2.5% in 2016. Emerging economies Oil producers Decline in oil prices favours advanced over emerging economies Advanced economies Net oil consumers Feeds through quicker as government does not attempt to fix the price through subsidies 6% 4% 65% se li n 6% 3% e Growth in developed markets offsets lower growth in emerging markets O the r Greek crisis fading e EUROZONE Oil price falls to, and stays at, $30 per barrel bl 3.2% UK - growth expected to slow to 2% in 2016 on back of weaker investment and fiscal tightening that will result after May’s election ru m 2.4% Financial system and demand collapse in China Region appeared to shake off Ukraine/Russia concerns s Ru s ia n ry USA ationary Defl 2015 Ba 2014 2015 1.3% Economy falls into a slump E 4% 5% REGION 2016 1.6% iral China hard land ing y sp nar tio fla de Global activity grinds structurally lower Refla tion ary G7 B oom Z ry iona flat Re ty austeri ons and b a EZ n 3% na Global growth Advanced economies grow in response to loose monetary policy To head off a political backlash tio fla ag t S Europe is hit by disruption to energy supply A lower oil price Ongoing euro weakness Lower interest rates Increased banking activity BRICs Worries: Fed rate rise > hike > trigger EM corporate defaults & economic slowdown CHINA Growth outlook: unchanged 6.8% 6.5% 2015 2016 • Cheap oil + overcapacity + slower growth = lower inflation • Further monetary easing expected BRAZIL Growth outlook: downgraded -0.6% 0.9% 2015 2016 • Petrobras scandal, fiscal consolidation, and threat of electricity rationing • One-off impact of electricity tariff and currency weakness • Further rate hikes from the central bank, with potential cuts in Q3-Q4 as growth sours RUSSIA Growth outlook: downgraded -4.9% -0.4% 2015 2016 • Weaker oil price hits growth through reduced exports and fiscal support • Inflation shooting up thanks to currency weakness and sanctions INDIA Growth outlook: unchanged 7.5% 2015 7.8% 2016 • Change in GDP calculation investment growth remains weak and reforms are needed Source of data: Schroders Important Information: Schroders has expressed its own views in this document and these may change. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. No responsibility can be accepted for errors of fact or opinion. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results, prices of shares and the income from them may fall as well as rise and investors may not get back the amount originally invested. Issued by Schroder Investment Management Limited, 31 Gresham Street, London EC2V 7QA, which is authorised and regulated by the Financial Conduct Authority. For your security, communications may be taped or monitored.