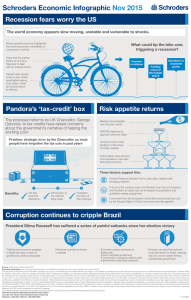

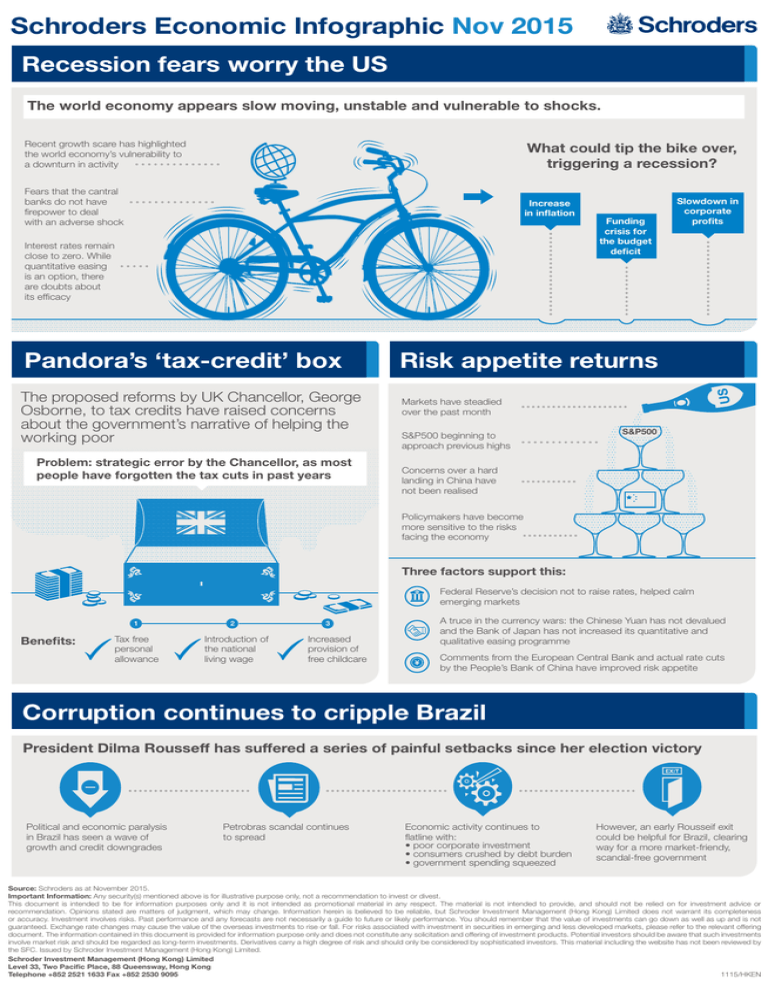

Schroders Economic Infographic Nov 2015 Recession fears worry the US

advertisement

Schroders Economic Infographic Nov 2015 Recession fears worry the US The world economy appears slow moving, unstable and vulnerable to shocks. Recent growth scare has highlighted the world economy’s vulnerability to a downturn in activity What could tip the bike over, triggering a recession? Fears that the cantral banks do not have firepower to deal with an adverse shock Increase in inflation Interest rates remain close to zero. While quantitative easing is an option, there are doubts about its efficacy Pandora’s ‘tax-credit’ box The proposed reforms by UK Chancellor, George Osborne, to tax credits have raised concerns about the government’s narrative of helping the working poor Problem: strategic error by the Chancellor, as most people have forgotten the tax cuts in past years Funding crisis for the budget deficit Slowdown in corporate profits Risk appetite returns Markets have steadied over the past month S&P500 beginning to approach previous highs S&P500 Concerns over a hard landing in China have not been realised Policymakers have become more sensitive to the risks facing the economy Three factors support this: Federal Reserve’s decision not to raise rates, helped calm emerging markets Benefits: Tax free personal allowance Introduction of the national living wage Increased provision of free childcare A truce in the currency wars: the Chinese Yuan has not devalued and the Bank of Japan has not increased its quantitative and qualitative easing programme Comments from the European Central Bank and actual rate cuts by the People’s Bank of China have improved risk appetite Corruption continues to cripple Brazil President Dilma Rousseff has suffered a series of painful setbacks since her election victory Political and economic paralysis in Brazil has seen a wave of growth and credit downgrades Petrobras scandal continues to spread Economic activity continues to flatline with: • poor corporate investment • consumers crushed by debt burden • government spending squeezed However, an early Rousseif exit could be helpful for Brazil, clearing way for a more market-friendy, scandal-free government Source: Schroders as at November 2015. Important Information: Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document. The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products. Potential investors should be aware that such investments involve market risk and should be regarded as long-term investments. Derivatives carry a high degree of risk and should only be considered by sophisticated investors. This material including the website has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited. Schroder Investment Management (Hong Kong) Limited Level 33, Two Pacific Place, 88 Queensway, Hong Kong Telephone +852 2521 1633 Fax +852 2530 90951115/HKEN