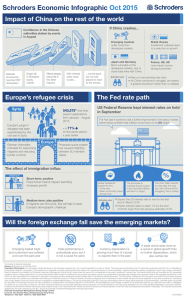

Schroders Economic Infographic Oct 2015

advertisement

Schroders Economic Infographic Oct 2015 Impact of China on the rest of the world If China crashes... Confidence in the Chinese authorities shaken by events in August Markets shocked by surprise CNY devaluation Sharp fall in Shanghai equity market Effects already being felt in the steel industry With interest rates close to zero... ...central bank are not well placed to react to the shocks Europe’s refugee crisis Syria 543,575* first time asylum applications from January - August 2015 Europe’s surge in refugees has been exacerbated by the civil war in Syria German chancellor criticised for welcoming migrants and reducing border controls Emerging markets suffer more than developed markets Brazil, Russia Investment cutbacks lead to a reduction in growth Japan and Germany Most vulnerable of the developed markets, due to close trade links with China France, UK, US Less impact across strong economies Schroders view • Risk of a hard landing has risen • As China continues to struggle, we expect a gradual slowdown rather than a collapse The Fed rate path US Federal Reserve kept interest rates on hold in September The Fed said it wanted to see a further improvement in the labour market before being confident that inflation would return to its 2% target =a 71% on the same period a year earlier Europe Proposed quota system has caused infighting between EU member states The effect of immigration influx: Short-term: positive Fiscal boost means migrant spending increases growth Medium-term: also positive If migrants can find work, this will help to ease Europe’s demographic challenge % Global headwinds trouble the Fed - China risks - Weak commodity prices - Strong US $ Schroders view The Fed looks to overheat the job market in the hope that inflation will return to target Fed chair Yellen expects to raise rates this year but, with China and EM struggling, this is unlikely • Expect the US interest rate to rise for the first time in March 2016 • Expect interest rates to reach 1% by the end of 2016, lower than the previous estimate of 2% Will the foreign exchange fall save the emerging markets? Emerging market trade and currencies have suffered a lot over the past year Trade performance is undoubtedly poor, but it is not a cause for panic Currency depreciation is proving much less of a boost to exports than in the past A trade revival rests more on a revival in global growth than on further depreciation, which also carries risk *According to Eurostat estimates Source: Schroders as at October 2015. Important Information: Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document. The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products. Potential investors should be aware that such investments involve market risk and should be regarded as long-term investments. Derivatives carry a high degree of risk and should only be considered by sophisticated investors. This material including the website has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited. Schroder Investment Management (Hong Kong) Limited Level 33, Two Pacific Place, 88 Queensway, Hong Kong Telephone +852 2521 1633 Fax +852 2530 90951015/HKEN