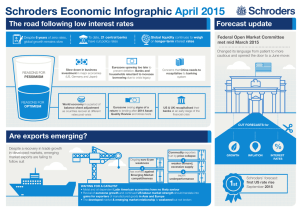

Schroders Economic Infographic April 2015 The road following low interest rates Forecast update

advertisement

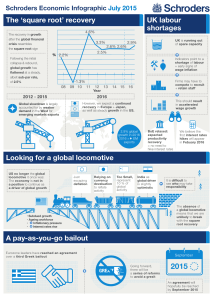

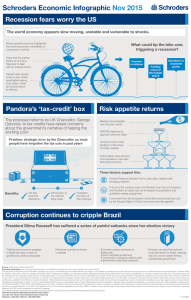

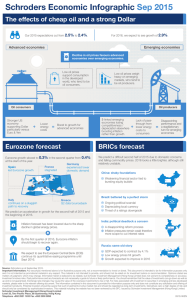

Schroders Economic Infographic April 2015 The road following low interest rates To date, 21 central banks have cut policy rates Despite 6 years of zero rates, global growth remains slow Forecast update Global liquidity continues to weigh on longer-term interest rates Federal Open Market Committee met mid March 2015 Changed its language from patient to more cautious and opened the door to a June move: REASONS FOR PESSIMISM Slow down in business investment in major economies (US, Germany and Japan) Eurozone upswing too late to prevent deflation. Banks and households reluctant to increase borrowing due to crisis legacy Concerns that China needs to recapitalise its banking system World economy in a period of balance sheet adjustment as countries recover at different rates post-crisis Eurozone seeing signs of a return to lending after 2014 Asset Quality Review and stress tests US & UK recapitalised their banks at an early stage of the financial crisis REASONS FOR OPTIMISM CUT FORECASTS for Are exports emerging? Despite a recovery in trade growth in developed markets, emerging market exports are failing to follow suit Commodity exporters hurt by price collapse Ongoing euro & yen weakness has worked against Emerging Market competitiveness % GROWTH INFLATION INTEREST RATES weaker demand, excessive supply export underperformance WAITING FOR A CATALYST • Metal and oil dependent Latin American economies have no likely saviour • Revival of eurozone growth and continued US labour market strength should translate into gains for exporters of manufactured goods in Asia and Europe • The developed market & emerging market relationship is weakened but not broken 1st Schroders’ forecast: first US rate rise September 2015 Source of data: Schroders Important Information: Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document. The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products. Potential investors should be aware that such investments involve market risk and should be regarded as long-term investments. Derivatives carry a high degree of risk and should only be considered by sophisticated investors. This material including the website has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited. Schroder Investment Management (Hong Kong) Limited Level 33, Two Pacific Place, 88 Queensway, Hong Kong Telephone +852 2521 1633 Fax +852 2530 9095 0415/HKEN