Talking Point Schroders EM forecast update: an uneven recovery

advertisement

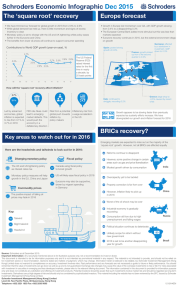

December 2015 Schroders Talking Point EM forecast update: an uneven recovery Keith Wade, Chief Economist Another quarter, another downgrade for emerging market growth, but there is some good news on the horizon. Extending our forecast period out to 2017, we begin to see growth improving outside of China, with India continuing its gradual gains, while Brazil and Russia should begin to stage recoveries after a testing period. China: stimulus will not stop the slowdown Though we still await the official growth target for 2016, it has been heavily hinted that 6.5% is the new goal. This growth rate would mean China reaches the objective set in 2010 of doubling GDP and incomes by 2020. Unfortunately, we do not believe China is capable of safely growing at 6.5% a year for the rest of this decade. The slowdown we have witnessed in economic growth is driven by a host of structural factors, rather than being cyclical in nature. With none of these problems resolved, there is no reason the deceleration should plateau at 6.5% for the next four years. Indeed, we expect a marked deceleration in 2016 compared to this year and a continued, slower decline thereafter. Stimulus can, of course, be ramped up further, but given how much stimulus we have seen this year, it is unlikely this will be enough to deliver acceleration in growth. Monetary policy has struggled to reduce the effective lending rate at a time of deflation and in any case, there is falling demand for credit. The one positive from all this excess capacity is that the attendant deflationary pressures should keep Consumer Price Index (CPI) inflation contained well below the 3% target, providing ample room for monetary easing. Finally, the possibility of currency devaluation continues to be a matter of much debate. The renminbi remains overvalued by some 15 – 20% on a real effective exchange rate basis, and a move to a free float would undoubtedly see a large depreciation. However, the authorities for now appear wedded to a cautious approach, with an eye on the likely political and financial stability consequences of such a move. Our base case scenario remains a gradual weakening of the currency over the next two years, though we would attach a growing weight to a larger one-off devaluation as growth slows and domestic exposures to the yuan/US dollar exchange rate are reduced. Brazil: more pain, little gain The political situation has continued to deteriorate in Brazil, such that policymaker focus now is almost entirely on the fallout from the Petrobras corruption scandal. Without any economic reform efforts or indeed anything resembling coherent policy, we are forced to downgrade; 2016 is set to be another very disappointing year for growth. However, a recovery should be underway in 2017. On the fiscal and supply side concerns, the political situation all but guarantees a lack of productive legislation until a new government comes to power. This means investment and consumption decisions are likely to be deferred. However, market forces are beginning to generate an improvement in other metrics. For example, unit labour costs have finally begun to decline as unemployment builds, which ought to lead to an improvement on the trade balance, as seems to be happening. Unfortunately, if Brazil is to rely on this kind of adjustment, SchrodersTalking Point Page 2 rather than market reforms, we will need to see much more destruction of domestic demand before the process is complete. India: a dimming hope We applied a small downgrade to the outlook but still expect India to grow faster than any other emerging market economy. We have still had no substantive reform progress, but one encouraging development was the policy announcement for gas price liberalisation. This will greatly improve the incentives for natural gas investment. Though the immediate economic impact will be limited, it strengthens the medium-term outlook but, more importantly, reassures that the government remains committed to liberalising and reforming India’s economy. For now, growth looks set for a modest acceleration, likely driven by consumption rather than investment. Private sector banks are reportedly happy to provide consumer credit and see little demand for corporate lending, so we expect this to be a key growth driver in India in 2016. Russia: rumble resolved? Russia’s Q3 GDP data has beat both expectations and the previous quarter, contracting 4.1% compared to 4.6% previously. This is still an extremely poor economic performance, but it does mark a likely inflection point, particularly in combination with data from the industrial side of the economy, where production has been recovering gradually. The consumption side continues to deteriorate, as might be expected given rising unemployment and falling wages, but by compressing import demand this may actually help the net export contribution and the current account. Meanwhile, the fall in the oil price has taken most of its toll, and barring further large falls we should not see an additional drag on growth in 2016 and 2017. Furthermore, government spending is set to remain somewhat supportive given the planned 3% budget deficit. As a result, we forecast a gradual recovery over the next two years, with growth essentially flat next year and growing 1.5% in 2017 once balance sheets are repaired and investment begins to grow from a lower base. Important Information Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The views and opinions contained herein are those of the author(s), and do not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document. The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products. Potential investors should be aware that such investments involve market risk and should be regarded as long-term investments. Derivatives carry a high degree of risk and should only be considered by sophisticated investors. This material, including the website, has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited. SchrodersTalking Point Schroder Investment Management (Hong Kong) Limited Level 33, Two Pacific Place, 88 Queensway, Hong Kong Telephone +852 2521 1633 Fax +852 2530 9095 Page 3