Global growth Macro risks Europe BRICs

advertisement

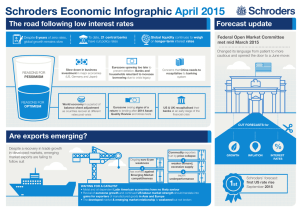

Schroders Economic Infographic Mar 2015 Global growth Macro risks Europe Acceleration in advanced economies offset by weaker growth in emerging markets Probability analysis of future scenarios Recovery resumes as political risk subsides JAPAN 0.0% 1.6% • Inflation in the advanced world is expected to record its lowest rate for five years in 2015, but picks up in 2016 as the impact of lower energy prices fades. • We do not expect sustained deflation in the eurozone or in the wider global economy. In the US we expect the Fed funds rate to rise to 1.25% by end 2015 and then peak at 2.5% in 2016. Emerging economies Oil producers Decline in oil prices favours advanced over emerging economies Advanced economies Net oil consumers Feeds through quicker as government does not attempt to fix the price through subsidies 65% 6% as el ine UK - growth expected to slow to 2% in 2016 on back of weaker investment and fiscal tightening that will result after May’s election Greek crisis fading bl e Def lat i 3.7% nger er for lo low Oil 4.2% 2015 1.3% Region appeared to shake off Ukraine/Russia concerns 3% Growth in developed markets offsets lower growth in emerging markets Other ru ian s s tio Ru fla ag St Europe is hit by disruption to energy supply A lower oil price Ongoing euro weakness Increased banking activity Lower interest rates BRICs Worries: Fed rate rise > hike > trigger EM corporate defaults & economic slowdown CHINA Growth outlook: unchanged BRAZIL Growth outlook: downgraded RUSSIA Growth outlook: downgraded INIDA Growth outlook: unchanged 6.8% 6.5% -0.6% 0.9% -4.9% -0.4% 7.5% 2015 2016 2015 2016 2015 2016 2015 7.8% GDP growth EMERGING MARKETS ationary 1.3% Defl 1.1% 6% 4% Financial system and demand collapse in China ing EUROZONE Oil price falls to, and stays at, $30 per barrel l China hard lan d 3.2% 4% 5% pira 2.4% EZ ry s USA Economy falls into a slump na 2015 om tio 2014 G7 B o 2016 1.6% ary 4% B REGION 3% ti o n fla 2014: 2.7% n usterity ns a ndo ba a EZ m 2015: 2.8% Refla nary atio na ry 2016: 3% fl Re de Global activity grinds structurally lower on Secu ar lar y sta gn at io Global growth Advanced economies grow in response to loose monetary policy To head off a political backlash • Cheap oil + overcapacity + slower growth = lower inflation • Further monetary easing expected • Petrobras scandal, fiscal consolidation, and threat of electricity rationing • One-off impact of electricity tariff and currency weakness • Further rate hikes from the central bank, with potential cuts in Q3-Q4 as growth sours • Weaker oil price hits growth through reduced exports and fiscal support • Inflation shooting up thanks to currency weakness and sanctions 2016 • Change in GDP calculation investment growth remains weak and reforms are needed Important Information: Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document. The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products. Potential investors should be aware that such investments involve market risk and should be regarded as long-term investments. Derivatives carry a high degree of risk and should only be considered by sophisticated investors. The fund is authorized by the SFC but such authorization does not imply official approval or recommendation. Schroder does not provide any securities or investment products for offer, solicitation or trading within The People’s Republic of China (PRC). Should illegitimacy arise thereof, contents of this document shall not be construed as an offer or solicitation or trading for such securities or products. All items mentioned herein are sold through financial products issued by commercial bankers in the PRC under regulations by the China Banking Regulatory Commission (CBRC). Investors should read the relevant documents clearly before invest in the mentioned funds. Please consult the relevant commercial bankers in the PRC and/or professional consultants if necessary. This material including the website has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited. Schroder Investment Management (Hong Kong) Limited Level 33, Two Pacific Place, 88 Queensway, Hong Kong Telephone +852 2521 1633 Fax +852 2530 9095 0315/CNEN