PRUDENTIAL INDICATORS 2011/12 – 2013/14

advertisement

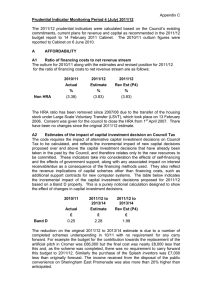

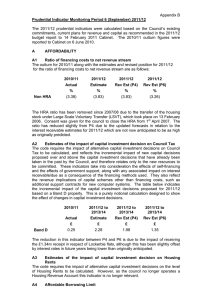

Appendix H PRUDENTIAL INDICATORS 2011/12 – 2013/14 All of the prudential indicators for the period 2011/12 to 2013/14 have been calculated based on the Council’s existing commitments, current plans for revenue and capital as recommended in the 2011/12 budget report included elsewhere on this agenda which is due for approval by Full Council on 23 February 2011. A AFFORDABILITY A1 Ratio of financing costs to net revenue stream The actual for 2009/10 and estimates for 20010/11 to 2013/14 for the ratio of financing costs to net revenue stream are as follows: Non HRA 2009/10 2010/11 2011/12 2012/13 2013/14 Actual Estimate (P9) Estimate Estimate Estimate % % % % % (4.57) (3.43) (3.83) (3.64) (3.67) The ratio of financing costs to net revenue streams is currently forecast to remain fairly constant over the next 3 years. Although there is a forecast reduction in the average amount available to invest year-on-year, this is offset by an anticipated improvement in investment returns as the economy starts to recover. As this ratio is negative it still represents a very healthy position for the Council as it reflects the fact that interest receivable exceeds interest payable. A2 Estimates of the impact of capital investment decision on Council Tax The code requires the impact of alternative capital investment decisions on Council Tax to be calculated, and reflects the incremental impact of new capital decisions proposed over and above the capital investment decisions that have already been taken in the past by the Council, and therefore relates only to the new resources to be committed. These indicators take into consideration the effects of self-financing and the effects of government support, along with any associated impact on interest receivable/due as a consequence of the financing methods used. They also reflect the revenue implications of capital schemes other than financing costs, such as additional support contracts for new computer systems. The table below indicates the incremental impact of the capital investment decisions proposed for the period 2011/12 to 2013/14 based on a Band D property. This is a purely notional calculation designed to show the effect of changes in capital investment decisions. 2011/12 to 2013/14 Estimate Band D A3 £ £2.28 Estimates of the impact of capital investment decision on Housing Rents Not applicable as the Council no longer operate a Housing Revenue Account. Appendix H A4 Affordable Borrowing Limit Section 3 of the Local Government Act 2003 requires the Council to determine and keep under review how much it can afford to borrow. The amount determined is termed the “Affordable Borrowing Limit”. The Council must ensure when setting this limit that its capital investment plans remain within sustainable limits, and that the impact upon its future council tax levels is acceptable. The Council is proposing that the limit is set at the Authorised Borrowing Limit (D1), which reflects a continuation of current practice. The limit includes both external borrowing and other forms of liability, such as credit arrangements, and must be set for the forthcoming financial year and two successive years. 2011/12 2012/13 2013/14 Estimate Estimate Estimate £,000 £,000 £,000 9,325 9,556 9,792 Affordable Borrowing Limit B PRUDENCE B1 Net borrowing and the Capital Financing Requirement The capital financing requirement measures the Council’s underlying need to borrow for a capital purpose. The Code states the following as an indicator for prudence: “In order to ensure that over the medium term net borrowing will only be for a capital purpose, the local authority should ensure that net external borrowing does not, except in the short term, exceed the total of capital financing requirement in the preceding year plus the estimates of any additional capital financing requirement for the current and next two financial years.” The Council met this indicator for 2009/10. It should be noted that, following the repayment of the council’s borrowing, the CFR has been reduced to zero. C CAPITAL EXPENDITURE C1 Capital Expenditure The actual capital expenditure for 2009/10 and the estimates for current and future years take into account current plans and future commitments as set out within the budget report included elsewhere on this agenda. The expenditure includes growth bids which are subject to approval. Non HRA 2009/10 2010/11 2011/12 2012/13 2013/14 Actual Estimate (P9) Estimate Estimate Estimate £,000 £,000 £,000 £,000 £,000 3,500 6,433 8,672 5,584 100 Appendix H C2 Capital Financing Requirement Non HRA 2009/10 2010/11 2011/12 2012/13 2013/14 Actual Estimate (P9) Estimate Estimate Estimate £,000 £,000 £,000 £,000 £,000 0 0 0 0 0 The estimated capital financing requirement takes into account capital expenditure, the application of useable capital receipts, direct charges to revenue for capital expenditure, the application of capital grants and the use of third party contributions towards project costs. In summary, an increase in the capital financing requirement will reflect capital expenditure which is not resourced immediately representing an increase in the underlying need to borrow for capital purposes. Likewise a reduction in the capital financing requirement will reflect future applications of capital receipts or grants and contributions or future charges to revenue. The repayment of Councils debt in 2006/07 resulted in the Capital Financing Requirement being reduced to nil. There are currently no plans to undertake future long-term borrowing. D EXTERNAL DEBT D1 External Debt – Authorised Limit It is recommended that the Council approve the following limits for its total external debt gross of investments. The estimates are based on assumed actual borrowing, new supported debt, maturing and replacement debt. In addition headroom for temporary borrowing and borrowing in advance of need has been incorporated. Authorised Limit D2 2009/10 2010/11 2011/12 2012/13 2013/14 Actual Estimate (P9) Estimate Estimate Estimate £,000 £,000 £,000 £,000 £,000 9,100 9,100 9,325 9,556 9,792 External Debt – Operational Boundary The operational boundary is based on the same estimates as the authorised limit but reflects a more prudent additional headroom figure. Operational Boundary D3 2009/10 2010/11 2011/12 2012/13 2013/14 Actual Estimate (P9) Estimate Estimate Estimate £,000 £,000 £,000 £,000 £,000 5,100 5,100 5,328 5,458 5,592 Actual External Debt The Council’s actual external debt at 31 March 2010 was nil. This reflects the position at one point in time and is therefore not directly comparable to the authorised limit and operational boundary. Appendix H E TREASURY MANAGEMENT E1 Adopt the CIPFA Code of Practice for Treasury Management The Council has adopted the CIPFA Code of Practice for Treasury Management in the Public Services. E2/3 Upper Limits for Fixed/Variable Interest Rate Exposure These indicators allow the Council to manage the extent to which it is exposed to changes in interest rates. It is recommended that the Council set an upper limit on both fixed and variable interest rate exposures (on both debt and investments) for 2011/12, 2012/13 and 2013/14 of 100% of the outstanding principal sums. This will mean both Indicators will be set at 0 on a net basis (100% debt less 100% investments at fixed/variable rates). This is a continuation of current practice enabling all investments (and any new debt) to be at fixed or variable rates, giving the Council maximum flexibility over the forthcoming years. Interest Rate Exposures 2010/11 2011/12 2012/13 2013/14 Revised Estimate Estimate Estimate % % % % 0 100 100 100 100 Upper limit on investments (89.5) (100) (100) (100) (100) Net Fixed Exposure (89.5) 0 0 0 0 0 100 100 100 100 Upper limit on investments (10.5) (100) (100) (100) (100) Net Variable Exposure (10.5) 0 0 0 0 Existing level at 31/3/10 Estimate % Fixed Interest Rates Upper limit on debt Variable Interest Rates Upper limit on debt E4 Maturity Structure of Borrowing It is recommended that the Council set upper and lower limits for the maturity structure of its borrowings as follows: Amount of projected borrowing that is fixed rate maturing in each period as a percentage of total projected borrowing that is fixed rate Upper Limit Lower Limit Under 12 months 100% 0% 12 months and within 24 months 100% 0% 24 months and within 5 years 100% 0% 5 years and within 10 years 100% 0% 10 years and above 100% 0% Appendix H The upper limits recommended above have again been set to allow the Council maximum flexibility. However this indicator is not currently relevant due to the Councils debt free status. E5 Total principal sum invested for period longer than 1 year. The indicator for the upper limit for longer-term investments is recommended to be £15 million for 2011/12 onwards, which is a continuation of current practice. Conclusions The prudential indicators for the period 2011/12 to 2013/14 for approval are shown above and will continue to form part of the overall budget monitoring process for 2011/12. The ratio of financing costs to net revenue expenditure remains at acceptable levels with the forecasts showing that investment income still exceeds borrowing costs (hence the negative ratio shown for the General Fund financing costs under indicator A1 above). A number of the treasury management indicators reflect the fact the Council is currently debt free and assumes no plans to undertake any long term borrowing. The capital programme remains both affordable and manageable. The Authorised Limit provides a realistic and prudent limit which the Council must ensure is not exceeded, whilst the Operational Boundary gives the Council the flexibility to borrow to finance future capital schemes if required.