Presentation - RW Ventures

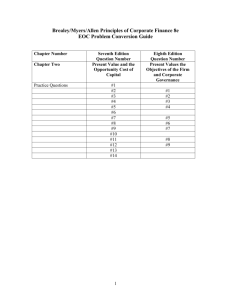

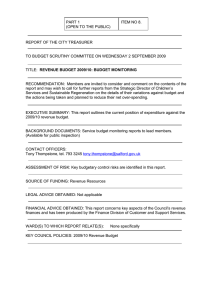

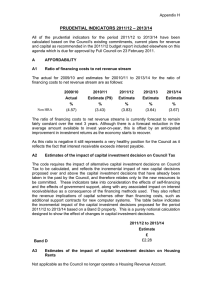

advertisement

London School of Economics City Reformers Group Workshop Public Finance and Debt — Cities March 22, 2011 Municipal Finance: CURRENT CHALLENGES AND OPPORTUNITIES Robert Weissbourd, RW Ventures, LLC Overview The Big Picture: New Governance for a New Economy City Budgets: Challenges and Opportunities Revenues Expenditures Summary Government Is Broken Image from The Center for Public Integrity o Unaccountable o Inaccessible o Insular o Inefficient o Bureaucratic o Top-down … and Proliferating • Fragmented • Uncoordinated • Legacy Governments … and Out of Date Gross Domestic Product % Change Over Last 50 Years Source: The Wall Street Journal, May 20, 1999. Source: Newsweek, Manyika, Lund and Auguste, “From the Ashes,” 8.16.2010 The dynamic, knowledge-based economy requires a new, more nimble style of governing. From Government to Governance Governance: Non-profits Businesses Citizens Government Universities & Research Centers o Collaborative o Flexible o Open o Innovative o Risk-taking o “Of the People” o Intentional Governance in the Next Economy Build on your assets Compete on value added – tax-value proposition Invest strategically to encourage long-term growth Inclusive Governance Cities in Crisis: A Look at City Budgets Year-to-Year Changes in Cities’ General Fund Revenues and Expenditures Distinguish Two Challenges: Long-term structural deficits vs. Recessionary deficits Source: Christopher W. Hoene & Michael A. Pagano, National League of Cities, Research Brief on American Cities, October 2010 Sources of Revenue Primary Sources of Revenue Average Sources of City Revenue 3.8% Taxes 15.3% Fees 1.8% State and Federal Government Interest, Investment Returns Sale of Assets Financing 30.5% 14.6% 0.5% 1.7% 5.9% 25.9% Federal Government Property Taxes Individual Income Taxes Other Taxes Miscellaneous Revenue State Government Sales Taxes Corporate Income Taxes Charges & Fees Revenue Strategies Primary Sources of Revenue Revenue Increase Strategies Taxes • Introduce new/increased taxes • Expand tax coverage: e.g. include services in sales tax Fees • Improve fee collection • Introduce new fees State and Federal Government • Currently, limited opportunities • New Federalism • Leveraging private sector financing Interest, Investment Returns • Portfolio management – risk/reward Sale of Assets Financing • Privatize asset management • Sell excess inventory • Enhanced Bonds: BABs, securitization, etc. • Improvement Districts • TIF Districts Public Private Partnerships Photographer: Frank Polich/Bloomberg Photo Source: BusinessWeek Sources of Expense Average City Expenditures by Character and Object Intergovernmental expenditure Current operations Capital outlay Assistance and 1.5% subsidies Interest on debt Primary Areas of Expenditure Labor 0.7% Program Operation 26.4% Capital Outlays 56.9% Assistance and Subsidies 10.9% Debt Repayment Insurance benefits and repayments Salaries and 0.4% wages 3.1% Intergovernmental Expenditure Strategies Primary Areas of Expenditure Labor Expenditure Reduction Strategies • Cut benefits, wages or jobs Program Operation • Inclusive Government/Government 2.0 • Digitalization of health records • Outsourcing Capital Outlays • Implement availability payment-based public private partnerships Assistance and Subsidies • Reduce inter-jurisdictional fiscal/tax competition Debt Repayment • Refinance debt Intergovernmental • Consolidate units of government • Pool purchasing power • Share services with nearby jurisdictions Summary: City Financing Options Revenue Increase Options • Introduce new/increased taxes • Expand tax coverage: e.g. include services in sales tax • Improve fee collection • Introduce new fees • Privatize asset management • Sell excess inventory • Portfolio management – risk/reward • Enhanced Bonds: BABs, securitization, etc. • Improvement Districts • TIF Districts • New Federalism • Leveraging private sector financing Expenditure Reduction Options • Cut benefits, wages or jobs • Inclusive Government/Government 2.0 • Program Efficiencies: e.g. digitalization of health records • Outsourcing • Implement availability payment-based public private partnerships • Reduce inter-jurisdictional fiscal/tax competition • Refinance debt • Consolidate units of government • Pool purchasing power • Share services with nearby jurisdictions London School of Economics City Reformers Group Workshop Break Out Group 4: Public Finance and Debt — Cities March 22, 2011 Municipal Finance: CURRENT CHALLENGES AND OPPORTUNITIES Robert Weissbourd, RW Ventures, LLC