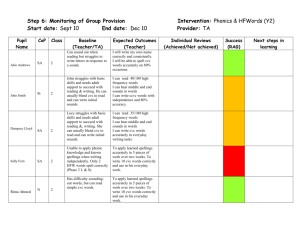

CORPORATE VENTURE CAPITAL:

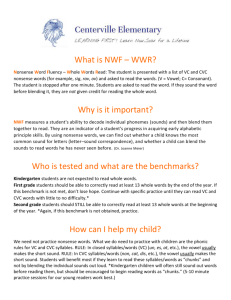

advertisement