The Corporate Venturing Experience

advertisement

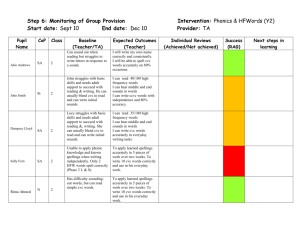

Corporations and the Financing of Innovation: The Corporate Venturing Experience Paul A. Gompers Harvard Business School May 3, 2002 Agenda Corporations and venture capital: The History. Key lessons. Results. The continuing challenge. Corporate Venture Capital Three Very Most waves of venture capital. volatile inflows. recent wave was particular strong. U.S. and foreign. Lots of Earlier Exploration in Fortune 100 25 20 15 10 5 0 1961-62 1965-66 1969-70 1973-74 1977-78 1981-82 1985-86 1989-90 1993-94 1997-98 The First Wave Many VC-backed winners in 1960s: DEC, Raychem, Memorex, Scientific Data Systems, etc. Big firms sought to emulate. Most common mechanism was “New Venture Division”: >25% of Fortune 500. Rapid Decline Dramatic growth in VC in early 1980s; much publicity around Apple, Genentech, Compaq, etc. Corporations again set up internal and external programs. By 1986, external corporate programs were 12% of VC pool. The Second Wave Dramatic growth in VC in early 1980s; much publicity around Apple, Genentech, Compaq, etc. Corporations again set up internal and external programs. By 1986, external corporate programs were 12% of VC pool. Similar Pattern Decline in public market values and activity in 1987; dramatic drop in VC fundraising. Almost 40% of corporate programs abandoned in 4 years. Corporate funds fell to 5% of venture pool by 1992 The Third Wave High returns to independent venture funds in mid-1990s. Opportunities and challenges posed by the Internet and other information technologies. Over 100 programs launched since 1996 alone. Lessons from the First Two Waves Cyclical element: venture capital went into and out of fashion. But three key design problems limited the success of corporate programs. Multiple objectives. Unstable structure. Inadequate incentives. Problem 1: Multiple Objectives Many programs sought to accomplish multiple objectives: Window on new technologies. Identifying acquisition candidates. Generating financial returns. Outsiders often saw these multiple goals as a sign of weakness. Lesson 1: The Importance of Clearly Defined Objectives Traditional venture funds have a simple goal: to make profits. Corporate programs, by definition, have more complex objectives. Corporate venture programs must: Clearly define their goals in advance. Think about implications of the goals. Insure that all understand goals. Problem 2: Poor Structures Corporate venture programs were often quickly abandoned as a result of: Failure to first understand VC. Top management turn-over and/or infighting. Resistance from R&D personnel and corporate lawyers. Lesson 2: The Need for a Strong Foundation Finding the right partners was crucial. Venture funds have a formal legal structure, with a clearly understood mission; corporate programs often didn’t. The apparent lack of permanence limited their ability to find investments or partners. A formal structure and a strong internal champion are important. Problem 3: Inadequate Incentives Corporations were reluctant to commit to large payoffs to their venture mangers and internal entrepreneurs. Successful risk-taking was often scarcely rewarded; while failure was Heavily punished. Recruitment and retention were frequent concerns. Lesson 3: The Importance of Aligning Incentives A powerful aspect of the venture capital model is that when an investment is successful, everyone is successful. Corporations were often limited in designing compensation by worries about fairness. Corporate programs must define in advance clear rules that govern the compensation of its venture investors. Data VentureOne 32,364 investments. Information: Amount. Location. Stage. Investors. CVC. Independent VC. Top CVC Groups in 2000 Corporate Sponsor Electronic Data Systems General Electric Andersen Consulting Comdisco Time Warner Times Mirror Visa International Intel Corporation AT&T Hikari Tsushin News Corporation ValueVision International Comcast PECO Energy Siemens Capital Under Management $1,500 1,500 1,000 500 500 500 500 450 348 332 300 300 250 225 210 CVC Activity Year 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 Number of Rounds 53 91 139 129 152 179 202 233 249 214 198 193 65 101 229 391 936 Dollar Volume of Rounds 193 369 708 1,449 7,968 Fraction of VC that is CVC 12% Percent of Investments 11% 10% 9% 8% 7% 6% 5% 4% 1987 1988 1989 1990 1991 Year 1992 1993 1994 CVC vs. Independent VC Entire Sample Status at Time of Investment: Start-Up Development Beta Shipping Profitable Re-Start Location of Firm: All Western U.S. California All Eastern U.S. Massachusetts Industry of Firm: Medical Computer Hardware Communications Computer Software/On-Line Services Other Corporate Corporate VC and Independent VC Only Strategic Fit VC Only 9.8% 30.5 4.1 45.5 7.6 2.4 7.1% 33.6 5.5 44.4 6.9 2.5 6.4% 35.9 6.4 42.9 5.6 2.8 10.4% 31.2 4.1 44.8 7.3 2.3 59.7% 51.6 24.1 12.8 63.7% 53.7 25.2 14.0 59.6% 51.3 29.1 16.5 60.8% 52.7 23.4 12.6 25.5% 16.7 14.5 15.1 28.1 25.9% 17.0 14.2 15.1 27.9 24.2% 16.2 22.1 14.0 23.5 24.2% 16.8 15.5 16.2 27.3 CVC vs. Independent VC Entire Sample Round of Investment: Mean Median Age of Firm at Time of Investment: Mean Median Amount Invested in Venture Round: Mean Median Corporate Corporate VC and Independent VC Only Strategic Fit VC Only 2.4 2 2.8 3 2.9 3 2.4 2 3.9 3.0 4.0 3.3 4.2 3.4 3.8 2.8 6.1 4.3 6.2 4.5 6.0 4.7 5.7 4.2 Fraction of Corporate VC Investments in Related Industry Fraction of CVC in Related Industries 78% 76% 74% 72% 70% t 68% 66% 64% 62% 1987 1988 1989 1990 1991 Year 1992 1993 1994 What determines relatedness? Control for: Stage. Location. Firm age. Time trend. Increasing relatedness over time. Early stage is more related. Fraction of CVC in Related Industries Was the Corporate Investment In A Related Industry? Age of Firm at Time of Financing Time Trend Firm is in Development Stage? Firm is in Beta Stage? Firm is in Shipping Stage? Firm is in Profitable Stage? Firm is in Re-Start Stage? Firm Based in California? Firm Based in Massachusetts? Log Likelihood 2-statistic p-Value Number of Observations 0.0105 [1.16] 0.0351 [2.38] 0.524 [2.96] 0.697 [3.02] 0.184 [1.02] -0.180 [-0.72] 0.456 [1.54] -2878.1 67.71 0.000 2,032 0.0116 [1.28] 0.0358 [2.42] 0.506 [2.86] 0.6860 [2.97] 0.179 [0.99] -0.176 [-0.70] 0.463 [1.56] 0.098 [1.05] 0.362 [2.92] -2880.8 70.01 0.000 2,032 Success of CVC vs. Independent VC Notion that CVC is less successful that independent VC firms. Independent VCs take advantage of corporations by showing them only the bad deals. Is that true? Look at success as defined by IPO or acquisition as a fraction of investments. CVC vs. Independent VC Entire Sample Status at End of Analysis: Initial Public Offering Completed Registration Statement Filed Acquired Still Privately Held Liquidated 31.1% 0.7 29.0 20.6 18.7 Corporate VC Only 35.1% 0.2 29.0 21.1 14.6 Independent VC Only 30.6% 0.7 30.3 19.7 18.7 Corporate VC and Strategic Fit 39.3% 0.3 27.5 18.3 14.7 Determinants of CVC Success Are CVC investments less successful? CVC What vs. independent VC. determines success? Relatedness. Stage. CVC, Relatedness, and Success Age of Firm at Time of Financing Round Number Corporate Venture Investment? Independent Venture Investment? Corporate Investment and Strategic Fit? Firm Based in California? Firm Based in Massachusetts? Firm is in Development Stage? Firm is in Beta Stage? Firm is in Shipping Stage? Firm is in Profitable Stage? Firm is in Re-Start Stage? Log Likelihood 2-statistic p-Value Number of Observations Observations are Investments Did Firm Go Public? Did Firm Go Public, Register, Or Have Favorable Acquisition? -0.02 [5.52] -0.02 [0.50] -0.02 [6.17] -0.02 [6.13] 0.13 [11.39] 0.13 [11.18] 0.13 [11.48] 0.13 [11.29] 0.15 [2.54] -0.19 [1.31] 0.12 [2.15] -0.23 [1.64] -0.003 [0.09] -0.002 [0.07] 0.07 [2.54] 0.07 [2.56] 0.52 [3.15] 0.57 [3.55] 0.30 [9.29] 0.29 [8.96] 0.23 [7.44] 0.22 [6.98] 0.36 [7.83] 0.36 [7.75] 0.24 [5.26] 0.23 [5.04] 0.44 [7.73] 0.42 [7.27] 0.38 [6.99] 0.35 [6.41] 0.25 [2.83] 0.22 [2.50] 0.14 [1.60] 0.11 [1.24] 0.38 [6.28] 0.36 [5.95] 0.30 [5.20] 0.28 [4.82] 1.32 [17.08] 1.30 [16.61] 1.10 [14.77] 1.08 [14.27] -0.56 [4.20] -0.56 [4.19] -0.43 [3.64] -0.45 [3.71] -14743.6 -14252.0 -15477.4 -14973.7 2409.9 2362.4 2065.5 2025.7 0.000 0.000 0.000 0.000 24,515 23,740 24,515 23,740 Conclusions CVC is an important element of financing new firms. Corporate venture capital groups seem to be learning over time. CVC investments appear to be quite successful. Especially those in related industries. Four Key Recommendations Think about related investments. Corporations must be sensitive to legacy of mistrust by independent VCs. Need to carefully articulate structure. Building a strong structure and addressing incentive issues are key.