Keeping Global Oil and Gas Flowing

advertisement

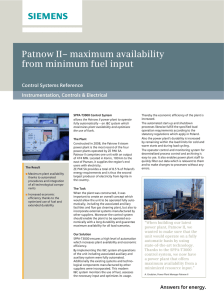

54 OIL & GAS Keeping Global Oil and Gas Flowing With oil and gas operators working hard to supply the growing global appetite for hydrocarbons and eager to improve their operating efficiencies and carbon footprints, Siemens has responded with a comprehensive suite of solutions tailored to the industry that highlights its leadership in holistic system solutions as well as in innovative technology and engineering. Tom Blades, CEO of Siemens Energy Sector’s Oil & Gas Division, based in Abu Dhabi, explains why we are currently in an era of “difficult” oil. Text: Ward Pincus, Photos: Bahr Karim When the future of the global oil and gas industry is discussed, the focus is almost always on the rate of demand growth – with a particular eye to emerging economies like China and India. However, for some in the industry, the depletion rate of existing reserves is the real issue. That’s because depletion occurs at three times the rate of demand growth, i.e., while annual global demand is expected to grow by 1.5 percent, the annual decline in output of existing wells is 5 percent. Thus, in the next ten years, the world will have to find 55 million barrels a day of new oil – 40 million barrels of which is just to counter depletion – compared to the 85 million barrels of oil currently produced. Operators are therefore continually pressed to take steps to sustain or enhance the volume of oil coming from their existing fields, and to bring to market in a commercially viable way both remotely located and “unconventional” hard-to-produce oil and gas. All of this is expensive and extremely difficult from a technology and engineering perspective. To gain a deeper understanding of this complex industry, as well as the challenges for operators and Siemens’ leadership role, Living Energy had the opportunity recently to talk with Tom Blades, a 33-year veteran of the energy industry, shortly before he steps down as Chief Executive Officer of Siemens Energy Sector’s Oil & Gas Division. In the following interview, Blades discusses why we are in an era of “difficult” oil and how Siemens is bringing its engineering expertise, its distinctive competency in electrical systems, and its holistic approach to systems solutions that are helping oil and gas operators address their biggest challenges. Why do you say we are now in a time of “difficult” oil? Living Energy · Issue 6/February 2012 BLADES: In the last 100 years, we produced 1 trillion barrels of oil; by comparison, in just the next 30 years, we’ll produce the next 1 trillion barrels. Demand is rising by 1.5 percent a year. Meeting that demand is one challenge. But the bigger challenge is to counteract the effects of depletion. Some of these reserves have been around for years, and they are getting old and tired. The pressure begins to drop and the oil doesn’t flow as easily as it once did. We now have to use enhanced recovery methods to try to convince the oil to flow. The bottom line is that the depletion effect on worldwide oil production Living Energy · Issue 6/February 2012 is roughly 5 percent a year. That’s a very big number, more than 4 million barrels a day. So if you look ten years ahead, we’re going to need 15 million barrels a day to meet rising demand, and 40 million barrels a day to meet the depletion curve. That’s the challenge; that’s what the industry is faced with today. How does this relate to “peak” oil? BLADES: What this means is that over the next ten years, we’re looking for a combined total of 55 million barrels of additional production over and above the 85 million produced today. That’s a horrific number! That’s like swimming in water with the tide against you. At some stage, the tide will be stronger than we can swim. When we get to the point where we can no longer meet the demand of depletion in such a way as to increase overall net total oil production, that’s where production will peak. It doesn’t mean we’re running out of oil, it’s just that the resources – of people, equipment, technology – that we can bring to bear are outpaced by the fall in pressure of oil reservoirs. So how quickly are oil companies swimming against this tide? BLADES: This figure, called the u 56 OIL & GAS OIL & GAS low the seabed. That’s a lot of money going into every barrel of production. This is “difficult” oil; it shows that there are possibilities to meet demand, but they require much technology and many dollars per barrel. Tom Blades Tom Blades, CEO of Siemens Energy Sector’s Oil & Gas Division, at the Abu Dhabi National Exhibition Centre with the iconic Capital Gate tower in the background. Background A British citizen, Blades is a graduate of SALFORD UNIVERSITY (UK) and ÉCOLE CENTRALE, LYON (France), and has a degree in electrical engineering. Professional Experience Blades has held senior management positions at several prominent compa- nies in the oil and gas industry since 1978. ➔ Joined Siemens Energy Sector in 2009. ➔ Has worked in Europe, Asia, and North America. ➔ Based in Abu Dhabi (United Arab Emirates). “Siemens speaks to the entire oil and gas value chain.” reserve replacement ratio, varies among operators. Take three big international oil companies (IOCs): ExxonMobil, BP, and Shell. In the last five years or so, they have been able to meet 95 to 98 percent of their production – in other words, they produce more oil than they can find in terms of new reserves. And in order for them to do that, they spent US$20 billion. So this expenditure lets three large IOCs maintain the status quo. On the other hand, you have some strong national oil companies (NOCs), such as Petrobras, that have discovered huge reserves – large deep-sea reserves. They will increase their production from 2.3 million to an expected 5.5 million barrels a day in ten years. But to get there, they will spend more than US$200 billion. Why? Because it’s in deep water – water 6,000 to 10,000 feet deep and reservoirs that are 5,000 to 10,000 feet be- How much of the oil out there is “difficult” and how much is “easy”? BLADES: Let’s look at 2020, where we expect demand of 100 million barrels a day. Roughly half will come from OPEC; another 20 million barrels will come from other “easy” oil sources, and 10 million more will come from the former Soviet Union. This is all “easy” oil. The remaining 20 million barrels will be “difficult” oil – deepwater production, production from the Arctic, enhanced oil recovery, biofuels, shale gas, oil sands – a cocktail of difficult and really unconventional sources. How does Siemens support oil and gas operators? BLADES: What is really unique about Siemens is that we speak to the entire oil and gas value chain; we are one of the only companies with a complete portfolio. The Siemens Energy Oil & Gas Division was assembled in 2007, when it was decided that Siemens needed to make a statement in this industry. We not only have our own products, but we bundle them and also provide system solutions and after-sales service, maintenance, and upgrades. What specific customer concerns is Siemens helping to address? BLADES: Like our customers, we are focused on the challenges of depletion, production in difficult terrain, unconventional oil and gas, CO2 mitigation and energy efficiency. More specifically, being able to make “difficult” oil easier is the first challenge for IOCs and select NOCs such as Petrobras. The challenge of meeting depletion is greater for NOCs. Efficient operations and lower CO2 emissions are challenges for every operator. As such, our all-electric approach is designed for any and every Living Energy · Issue 6/February 2012 operator to reduce their costs and reduce their emissions. What is the all-electric approach? BLADES: One major concern for operators is how to address the industry’s voracious energy appetite. Of the energy produced, 20 percent is used by the industry itself. It consumes more energy than any other industry on the planet. In the past, the industry was not focused on efficiencies, but that’s changing. For example, a low-efficiency environment would see an operator running many gas turbines across a field. These turbines operate with efficiency in the low 20 percent range. If we replace those turbines with electric motors, with efficiencies touching 60 percent, that not only means energy savings, but also, the whole operation becomes more commercially viable and at the same time produces fewer CO2 emissions. This is what we call the all-electric approach. That’s the holistic approach that customers come to Siemens for, and it reflects one of our strengths: to look at a whole system, model it, and then suggest the optimal ways to use energy to be more efficient. What other Siemens innovations are currently being developed or have recently been launched? BLADES: We are serving our customers by leveraging our strength in electrical expertise, a strength that is really unparalleled on the planet. All-electric systems are one thing; another example is EMSAGD, or electromagnetic steam-assisted gravity depletion, designed to address the challenge of heavy oil in Canada in a more sustainable way than conventional techniques. For offshore fields we are offering integrated floating, production, storage, and offloading (FPSO) systems that guarantee to operators the performance of both the components and the entire system. Another recent product addition is the SGT-750 industrial gas turbine, which addresses energy consumption Living Energy · Issue 6/February 2012 concerns by delivering 40 percent efficiency as mechanical drive. Another area of research that builds on our existing expertise is carbon capture and storage, including the oxyfuel process that uses pure oxygen, rather than air, in combustion. The resulting exhaust is steam and almost pure CO2, which can then be captured, compressed, and injected underground for storage or use in aging oil fields to enhance recovery. How is this expertise reflected in other areas, such as deep-sea operations? BLADES: The all-electric approach also has major advantages for operators in deep water. While land-based reservoirs have a 5 percent depletion rate, subsea reservoirs give up much, much earlier because of the hydrostatic pressure, so depletion rates are 20 percent. Therefore, in addition to today’s investment to get oil flowing from these deep-water environments, operators will need a lot of pump power down the road to really extract the oil required from the reservoirs to make them commercially viable and to keep the oil flowing in the long term. All of these pumps require electrical power. To deal with this, at Siemens we are marinizing the components (turbocompressors, transformers, switchgear, variable speed drives, control systems, etc.) in a subsea power grid that works on the seabed; then we call on all the other parts of Siemens Energy to access transmission technology to get power from land out to sea, as well as to get the oil and gas back to land. Getting power to the deep-sea fields requires technology that is available within Siemens. We are a world leader in highvoltage DC transmission, which is what’s required for efficient transmission of power over long distances. How will this change the way offshore production is done? BLADES: Today, we see lots of surface activity with FPSO facilities, but the vision of the future is that you will see 57 nothing. Power comes from land via a cable, and pipelines bring hydrocarbons back to land. This is not only less capital-intensive from an initial capital outlay perspective, it also has lower costs operationally. The third advantage is that it is inherently safer. No longer will we have 3 kilometers of umbilicals – flexible pipes that carry the oil from the seafloor to the floating installations – snaking their way through the water; no longer will we have expensive structures exposed to hurricane winds. Everything is nicely on the seabed, contained and electrically controlled. It all mitigates the chance of mishaps. The CEO of Siemens’ Oil & Gas Division is primarily based in the UAE, not in Europe. Why is that? BLADES: The Oil & Gas Division evolution is to decentralize our global facilities. We’re building our factories in areas where we generate revenues, and we are globalizing our salespeople, our technology people, and our project management people. We want to be close to our customers, to be part of our customers’ strategic thinking, and to be involved early in their project planning. But the only way to be involved early is to be in a local office. You have to be able to drop by when a customer wants to bounce or share ideas. Globalization and regionalization are important to our strategy and part of the added value that we provide to our customers. p Ward Pincus writes on energy, green technologies, healthcare, banking, and finance for publications in North America, Europe, and the Middle East. He is a former correspondent for the Associated Press. Further Information www.siemens.com/energy/oil-gas