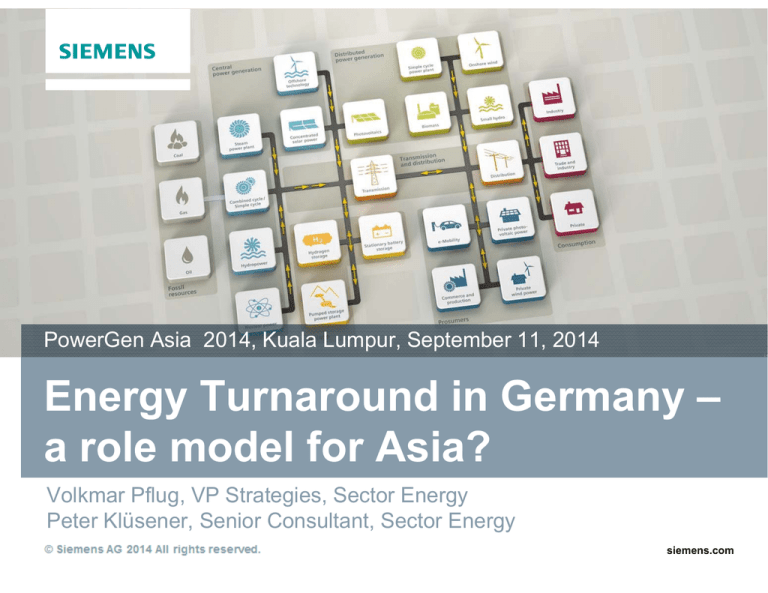

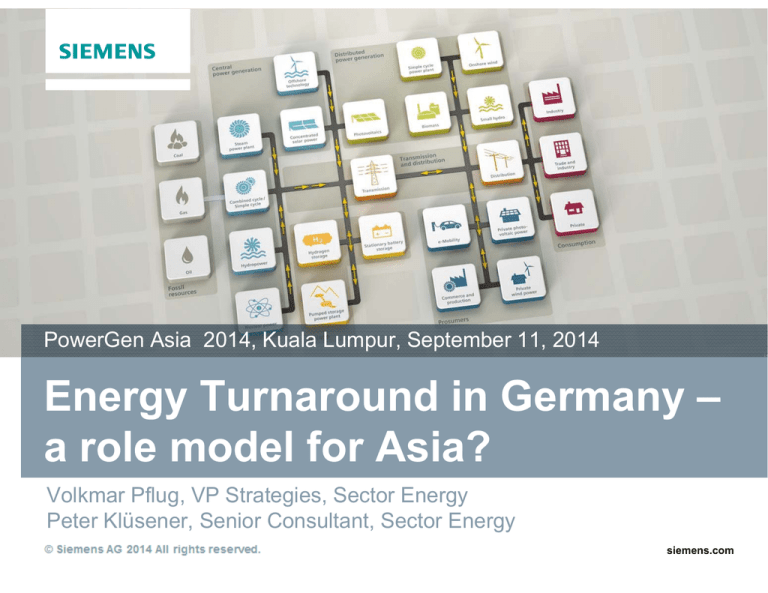

PowerGen Asia 2014, Kuala Lumpur, September 11, 2014

Energy Turnaround in Germany –

a role model for Asia?

Volkmar Pflug, VP Strategies, Sector Energy

Peter Klüsener, Senior Consultant, Sector Energy

4 All rights reserved.

© Siemens AG 2013

siemens.com

Table of content

1

Targets of German Energy Policy

2

Current Situation in Germany

3

Challenges of the Energy System

4

Role Model for Asia?

© Siemens AG 2014 All rights reserved.

Page 2

September 2014

PowerGen Asia 2014

1

Targets of German Energy Policy

Ambitious targets and far-reaching

legislation are part of the German “Energiewende”

Targets of German “Energiewende”

Energy Mix in Power Generation

Renewables

24%

2013 ̴ 950 Mt CO2e

(-22% vs. 1990)

Mt CO2e

Share of gross power

generation

Energy Efficiency

GHG-Emissions

1.253

250

-40%

35%

80%

Fossil

896

385

50%

Power

20%

5%

2020

2030

2050

Share of Renewables in power

generation 35% by 2020, 50% by 2030

and 80% by 2050

Share of renewables in net power

consumption 2012: 24%

Nuclear phase-out by 2022

Sector

357

1990

214

2020

179

2030

-50%

September 2014

251

50

179

71

2050

Primary Energy

Consumption

0

2008

2050

GHG emission reduction compared to Reduction of primary energy

baseline 1990: -40% by 2020, -60& by

consumption by 50% versus 2008 up

2030 and -80% by 2050

to 2050.

Decarbonization of power sector as

Improvement of energy productivity

a long-term goal, but targets not

by 2.1% p.a.

specified

© Siemens AG 2014 All rights reserved.

Page 3

150

100

538

60%

2013

+2.1% p.a.

564

61%

Nuclear 15%

-80%

752

Energy

productivity

200

-55%

50%

Other

Index (2008 = 100)

PowerGen Asia 2014

2

Current Situation in Germany

The energy mix in power sector shifted significantly,

Renewables mainly replaced Nuclear power

Gross electricity generation (in TWh)

Nuclear power plant capacity (GW, gross)

first step: shut down of 8 reactors (-8.8 GW) as

an immediate response on Fukushima accident

21.5

12.7

11.3

10.0

2013 Total: 628 TWh *)

Gas

Hard Coal

8.5

19.8%

4.3

147 TWh

10.6%

32%

0.0

2010

2012

2014

2016

2018

2020

23.2%

Renewables

2022

Energy mix in power generation (TWh)

Renewables

627

100

607

624

628

119

139

147

25.8%

Lignite

15.5%

/Waste

21%

Solar

37%

Wind

10%

5.1%

Biomass

Hydro

Oil, Other

Nuclear

Fossil

386

Nuclear

380

386

384

141

108

100

97

2010

2011

2012

2013

*) w/o Hydro Pump Storage

Source:BDEW; Arbeitsgemeinschaft Energiebilanzen, BMWi

© Siemens AG 2014 All rights reserved.

Page 4

September 2014

PowerGen Asia 2014

2

Current Situation in Germany

Record level of wind and solar PV installations since

more than one decade

Installed capacity for Wind and Solar (GW)

70.5

Solar PV

63.9

Wind

54.1

44.7

36.3

20.4

2.1

2013 Renewable Installations:

23.5

2.9

26.4

29.9

6.1

4.2

32.4

36.9

25.0

17.6

• Nearly 37 GW of Solar PV (about 5 7 GW of annual capacity additions in

the last 4 years)

10.6

27.2

18.4

25.7

33.7

23.8

31.6

22.2

29.1

20.6

2005

2006

2007

2008

2009

2010

2011

2012

2013

• nearly 34 GW of Wind power (thereof

0.6 GW offshore so far)

2013 Global Solar PV installed capacity

Germany

Total 140 GW

37 GW

(26%)

• Germany is the biggest Solar PV

market in terms of cumulated

installed capacity. But new

installation in China of about 12 GW

in 2013 have set a new record.

103 GW

(74%)

Rest of World

© Siemens AG 2014 All rights reserved.

Page 5

September 2014

Source: BNetzA, BDEW, IEA, EPIA

PowerGen Asia 2014

2 Current Situation in Germany

High standard of power sector in terms of

sustainability and reliability

Carbon intensity in power sector (in kgCO2/kWh)

0.8

1.200

-1.7%

0.7

1.050

-1.2%

0.6

0.55

0.5

Shift from Coal to Gas,

increasing Nuclear

0.4

0.3

0.550

Renewables installations,

ongoing shift from Coal to Gas

(together counterbalance

decreasing Nuclear)

0.600 0.620

0.440

0.2

1990

1995

2000

2005

2010

2015

Germany EU

USA South China Russia

Korea

Non-availability (in minutes per year)

1.320

526

16

Germany

51

37

Austria

Italy

Record level of availability in

German power system compared

to other countries

66

France

USA

China

Source: IEA, BDEW

© Siemens AG 2014 All rights reserved.

Page 6

September 2014

PowerGen Asia 2014

3

Challenges of the Energy System

Flexible backup power required to compensate the

fluctuation of wind and solar power

Impact of Wind Power (example week February 2012)

Wind Power 2012:

03.01.2012, 17h

Maximum feed-in: 24.1 GW, about 35% of total load

Fluctuation between 0.1 and 24.1 GW per hour

Total supply 45 TWh (= 7.3% of annual generation)

Mo

Mo

Di

Do

Di

Mi

Sa

14.09.2012, 13h

Mi

Do

Fr

Fr

Sa

So

Combined Wind and Solar Power:

Maximum feed-in: 31.8 GW, about 45% of total load

So

Impact of Solar PV (example week May 2012)

Maximum hourly load ramps: +/- 5.9 GW per hour

25.05.2012, 13h

Solar Power 2012:

Maximum feed-in 24.4 GW, about 30% of total load

Fluctuation between 0 and 24.4 GW per hour

Mo

Di

Mi

Do

© Siemens AG 2014 All rights reserved.

Page 7

September 2014

Fr

Sa

So

Total supply 28.5 TWh (= 4.6% of annual generation)

Source: enervis, EPEX

PowerGen Asia 2014

3

Challenges of the Energy System

Collapse of CO2 allowance price pushed power

generation by coal and therefore emissions again

CO2 allowance spot price (€/t CO2)

25

Carbon pricing in Europe:

20

• European Emission Trading System

(ETS) established since 2005

Oversupply of certificates caused

collapse of CO2 price

15

• In general too generous offering of

certificates resulted in a quite low CO2 price

in history

10

5

• Oversupply as a consequence of non

required certificates due to low energy

demands in recent past caused a collapse

of CO2 price

0

1/1/11 7/1/11 1/1/12 7/1/12 1/1/13 7/1/13 1/1/14 7/1/14

Generation shifting to coal again

372

in TWh

527

3%

29%

7% 2%

-19%

302

305

317

323 CO2 Emission

(in MtCO2)

+6%

627

607

624

628

17%

20%

23%

24%

22%

14%

5%

18%

14%

16%

12%

4%

4%

15%

11%

42%

43%

44%

46%

1990

2010

2011

2012

2013

Page 8

September 2014

Nuclear

• Carbon price too low to really stimulate

clean technologies by itself

Gas

Oil/Other

59%

© Siemens AG 2014 All rights reserved.

Renewables

• Current carbon price promotes power

generation from coal, while gas plants

suffer from low load factors

Coal

Source: BMWi, BDEW

PowerGen Asia 2014

3

Challenges of the Energy System

First step of nuclear phase-out completed without

impact on supply security due to comfortable capacity

Development of spark spread for CCPP (€/MWh)

Constellations:

• Renewables push back conventional plants

in merit order

• Lowered load factors of conventional plants in

recent past and they will even more decrease

• Average wholesale price reduced (esp. peak

load price at noon time caped by solar PV)

• Spark spread for conventional plants

insufficient or even negative

Secured capacity / system load balance (GW gross)

175

170

184

195

.

206

Renewabl

Fossil

Nuclear

85

85

max. load

89 84 GW

22

13

13

13

2010

2011

83

2012 2013

© Siemens AG 2014 All rights reserved.

Page 9

September 2014

81

2013: No gap in dispatchable capacity after first

wave of shut-down of Nuclear power plants

2022: Reserve margin expected to get stressed

when all Nuclear plants decommissioned

2022

Source: BDEW, own analysis

PowerGen Asia 2014

3

Challenges of the Energy System

EEG levy in Germany is projected to reach a maximum

level of 7.28 €ct/kWh after 2020

EEG levy – Historic development and projection up to 2030

[€ct/kWh]

10

8

7,20

6,95 7,10 7,15 7,28 7,20 7,02

6,92 6,78

6,67 6,80

6,44

6,24

6,08

5,74

5,28

5,11

6

4,10

4

2

3,53 3,59

2,05

1,02 1,16 1,31

0,51

0,88

0,69

0,25

0,42

0,35

0,20

0

2000

2005

2010

2015

Source:BDEW, BNetA, BMU, Prognos, Siemens own calculations

© Siemens AG 2014 All rights reserved.

Page 10

September 2014

PowerGen Asia 2014

2020

2025

2030

Challenges of the Energy System

Affordability: Power Prices in Germany already far

above European average

Power prices in Germany and other European countries in 2012 (€ct/kWh)

26.0

23.3

Households

+38%

21.9

21.3

18.9

13.9

13.9

16.8

15.0

14.2

13.1

9.1

8.5

17.0

19.2

+20%

14.2

Industry

3

Deutschland

13.0

8.3

EU27

Belgien

Bulgarien

11.2

13.3

13.8

11.3

14.3

12.5

10.2

5.2

Frankreich

Griechen- GroßItalien

land britannien

Polen

Spanien

Tschechien

Türkei

USA

German Households are paying already 38% and Industry 20% above European average

© Siemens AG 2014 All rights reserved.

Page 11

September 2014

Source: BDEW, Eurostat, Arbeitsgemeinschaft Energiebilanzen, Siemens

PowerGen Asia 2014

4

Role Model for Asia?

Lessons need to be considered to make the German

‚Energiewende‘ a role model for Asia

Issues with German Energy Transition

Lessons learnt for Asia

Overinvestment in Renewables through feed-in

tariffs imposed long-term burdens for subsidies on

electricity consumers

Secure affordability of energy/electricity prices

through optimized energy mix and proper market

regulation

Surge of electricity prices due to high Renewables

subsidies and grid expansion

Energy policy needs to create market mechanisms

to foster investment in reliable low-carbon back

up capacities

Collapse of CO2 price pushed power generation to

Coal again resulting in increasing CO2 emission

Insufficient revenues from power-only market for

conventional power plants lack of investment in

reliable power generation capacity

Missing incentives for required flexible gas-fired

power plants for stabilization of power system

Integration of record level of Renewables would

require expansion of transmission grid capacity

Stabilize power system through sufficient

investment motivation in flexible gas-fired power

plant capacity

Provide adequate power transmission capacity

fast enough to link renewables resources and

consumer areas

Coal-to-gas shift to be promoted as a huge lever

for reduction of CO2 emissions (economics

stimulated by a stable CO2 price)

© Siemens AG 2014 All rights reserved.

Page 12

September 2014

PowerGen Asia 2014

Disclaimer

This document contains forward-looking statements and information – that is, statements related to future, not past,

events. These statements may be identified either orally or in writing by words as “expects”, “anticipates”, “intends”,

“plans”, “believes”, “seeks”, “estimates”, “will” or words of similar meaning. Such statements are based on our current

expectations and certain assumptions, and are, therefore, subject to certain risks and uncertainties. A variety of factors,

many of which are beyond Siemens’ control, affect its operations, performance, business strategy and results and could

cause the actual results, performance or achievements of Siemens worldwide to be materially different from any future

results, performance or achievements that may be expressed or implied by such forward-looking statements. For us,

particular uncertainties arise, among others, from changes in general economic and business conditions, changes in

currency exchange rates and interest rates, introduction of competing products or technologies by other companies, lack

of acceptance of new products or services by customers targeted by Siemens worldwide, changes in business strategy

and various other factors. More detailed information about certain of these factors is contained in Siemens’ filings with the

SEC, which are available on the Siemens website, www.siemens.com and on the SEC’s website, www.sec.gov. Should

one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results

may vary materially from those described in the relevant forward-looking statement as anticipated, believed, estimated,

expected, intended, planned or projected. Siemens does not intend or assume any obligation to update or revise these

forward-looking statements in light of developments which differ from those anticipated.

Trademarks mentioned in this document are the property of Siemens AG, it's affiliates or their respective owners.

© Siemens AG 2014 All rights reserved.

Page 13

September 2014

PowerGen Asia 2014