Siemens Wind Power / August 2014

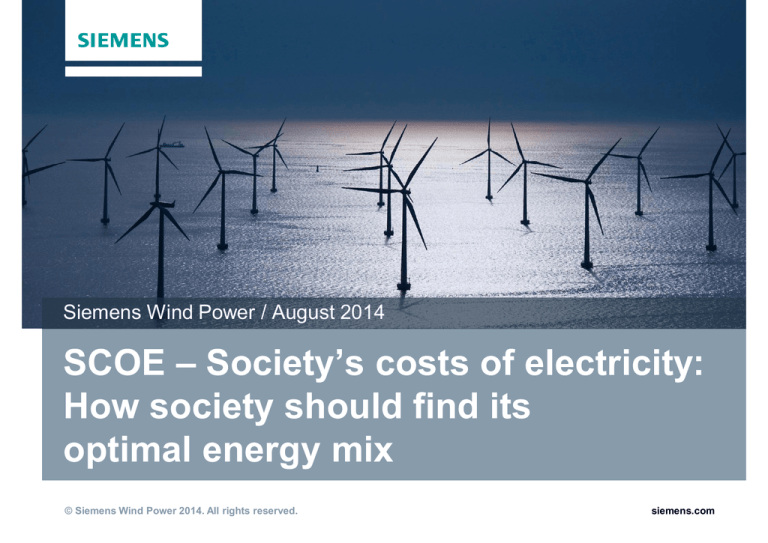

SCOE – Society’s costs of electricity:

How society should find its

optimal energy mix

© Siemens Wind Power 2014. All rights reserved.

siemens.com

Can society afford

(offshore) wind power?

?

© Siemens Wind Power 2014. All rights reserved.

Page 2

14-12-01

Siemens Wind Power August 20, 2014

Levelized Cost of Electricity –

The standard yardstick for comparing technologies

© Siemens Wind Power 2014. All rights reserved.

Page 3

14-12-01

Siemens Wind Power August 20, 2014

Introduction

LCOE is too short-sighted for deciding on an

economy’s power mix

Judging electricity sources only by

levelised cost of energy (LCOE)

stems from ages where electricity

production was by definition bigscale and localised at load

centers.

Social

costs

Hidden

Subsidies

LCOE

LCOE

Transmission

needs

With new energy sources

entering the scene, this approach

falls short.

In this analysis, we try to shed

a fair light to total-economy

costs and benefits of energy

production, comparing Wind

Offshore vs its alternatives.

Geopolitical

risks

Variability

Employment

effects

© Siemens Wind Power 2014. All rights reserved.

Page 4

14-12-01

Siemens Wind Power August 20, 2014

Approach

Revealing the true cost and the macro-economic

costs of energy: SCOE – Society‘s costs of electricity

SCOE Components

Examples

•

Fuel + OPEX + CAPEX + CO2

•

•

UK: Reduced tax on fossil fuels

Waste disposal and desaster costs

•

Grid reinforcements needed for

renewable integration

•

Capacity payments to gas plants for

providing backup

LCOE

„Ex-works“

electricity price

Hidden subsidies

Transmission costs

Variability costs

System costs +

LCOE

•

Decline of house prices around power

plants & wind farms

Social costs

•

Job creation: Direct, indirect (suppliers)

and induced (by additional consumption)

Economy &

employment

•

Hedging against fuel price risk for

imported fuels

True cost of

electricity

Geopolitical impact

SCOE: Society’s

costs of electricity

Macro-economic

cost of electricity

© Siemens Wind Power 2014. All rights reserved.

Page 5

14-12-01

Siemens Wind Power August 20, 2014

SCOE Analysis United Kingdom

Projection for 2025

SCOE: Society's costs of electricity [EUR/MWh]

Legend LCOE Split: CAPEX OPEX

Fuel

CO2

Projection for United Kingdom in 2025 - Average Scenario

Nuclear

LCOE

Coal

Gas

Photovoltaics

Wind On

Wind Off

79,2

115,3

82,9

105,2

55,4

95,0

0,0

58,4

26,0

0,0

0,0

0,0

59,8

2,5

0,5

0,0

0,0

0,0

Transmission

0,0

0,0

0,0

6,6

2,0

2,0

Variability

0,9

0,5

0,0

15,2

14,3

13,4

140,0

118,3

83,5

127,0

71,6

110,4

0,1

0,1

0,1

0,0

4,8

0,0

-33,0

-10,5

0,0

-49,4

-16,1

-49,4

- thereof CO2

Cost subsidies

LCOE +

System costs

Social impact

Employment effects

Geopolitical impact

SCOE

0,0

1,7

5,4

0,0

0,0

0,0

107,2

109,6

89,0

77,6

60,4

60,9

E W ST SCC / CWN / 2014-08-26 / Projection for United Kingdom in 2025 - Average Scenario

With certain pre-requisites in place, Offshore can be among the most competitive

electricity sources in the UK by 2025, while Gas is the most competitive backup.

© Siemens Wind Power 2014. All rights reserved.

Page 6

14-12-01

Siemens Wind Power / CWN / E W ST SCC

SCOE Analysis Germany

Projection for 2025

Legend LCOE Split: CAPEX OPEX

SCOE: Society's costs of electricity [EUR/MWh]

Fuel

CO2

Projection for Germany in 2025 - custom Scenario

Nuclear

LCOE w/o CO2

Coal

Gas

Photovoltaics

Wind On

Wind Off

79,2

80,3

67,3

100,2

55,4

95,0

0,0

23,4

10,4

0,0

0,0

0,0

47,4

0,0

0,4

0,0

0,0

0,0

Transmission

0,0

0,0

0,0

3,2

2,8

Variability

1,0

0,5

0,0

15,4

14,5

13,6

127,6

80,8

67,8

126,4

73,1

111,4

0,1

0,1

0,1

0,0

4,0

0,0

-34,1

-6,2

0,0

-49,3

-19,4

-49,0

0,3

2,5

5,9

0,0

0,0

0,0

93,8

77,2

73,8

77,1

57,8

62,3

- thereof CO2

Cost subsidies

LCOE +

system costs

Social impact

Employment effects

Geopolitical impact

SCOE

10,8

E W ST SCC / CWN / 2014-08-26 / Projection for Germany in 2025 - custom Scenario

With certain pre-requisites in place, Offshore can be among the most competitive

electricity sources in Germany by 2025, while Gas is the most competitive backup.

© Siemens Wind Power 2014. All rights reserved.

Page 7

14-12-01

Siemens Wind Power / CWN / E W ST SCC

The analysis will try to bring some substantiation

into a set of hypotheses

0

1

2

3

4

5

6

Mid-term, Wind Offshore can significantly reduce the gap to grid parity.

Wind Offshore – like other renewables – requires an early refurbishment of

transmission grids and intermittency leveling facilities like backups or storage.

Conventional technologies‘ costs that have not been fully addressed to their

cost base, giving them an ill-founded advantage.

A fair price of CO2 emissions would make wind energy‘s environmental

benefits far more obvious.

While Wind Onshore is already close to grid parity, its expansion is reaching

limits.

Wind power creates more local employment and positive GDP impacts than

other energy sources.

Wind power is a natural hedge against fuel price changes and allows geopolitical

independency

© Siemens Wind Power 2014. All rights reserved.

Page 8

14-12-01

Siemens Wind Power August 20, 2014

0

The analysis will try to bring some substantiation

into a set of hypotheses

0

1

2

3

4

5

6

Mid-term, Wind Offshore can significantly reduce the gap to grid parity.

Wind Offshore – like other renewables – requires an early refurbishment of

transmission grids and intermittency leveling facilities like backups or storage.

Conventional technologies‘ costs that have not been fully addressed to their

cost base, giving them an ill-founded advantage.

A fair price of CO2 emissions would make wind energy‘s environmental

benefits far more obvious.

While Wind Onshore is already close to grid parity, its expansion is reaching

limits.

Wind power creates more local employment and positive GDP impacts than

other energy sources.

Wind power is a natural hedge against fuel price changes and allows geopolitical

independency

© Siemens Wind Power 2014. All rights reserved.

Page 9

14-12-01

Siemens Wind Power August 20, 2014

0

Reducing the gap to grid parity

Wind Offshore is only at the start of its learning curve

with a lot of cost reductions to come

Technology lifetime

Installed global capacity

Years

GW

Coal

113

Gas

75

Nuclear

63

Photovoltaics

38

Wind Onshore

Wind Offshore

33

23

Coal

1970

Gas

1600

Nuclear

401

Photovoltaics

113

Wind Onshore

Wind Offshore

318

7

Status:Data as of end 2013

Although being the youngest electricity source and having had only limited

chance yet to gain experience, Wind Offshore shows significant cost reductions.

© Siemens Wind Power 2014. All rights reserved.

Page 10

14-12-01

Siemens Wind Power August 20, 2014

0

Offshore can achieve major cost reductions by using

the scale potential of offshore

Onshore

Feature

Offshore

Today

Future

Turbine rating [MW]

3

6

10

Rotor diameter [m]

101

154

195

Swept area [m²]

8.012

18.627

29.865

Load factors [%]

40

54

54

Annual energy production [GWh]

10,5

28,4

47,3

Powered homes

2.262

6.106

10.177

Note: Turbines for IEC Class I (High wind speed)

Airbus 380

Soccer field

Assumptions: Household consumption per year: 4648 kWh

© Siemens Wind Power 2014. All rights reserved.

Page 11

14-12-01

Siemens Wind Power August 20, 2014

0

Reducing the gap to grid parity

Offshore cost reduction is effective in multiple areas

Image courtesy of Bladt Industries A/S

Turbines

Foundations

Grid access

Operations &

Maintenance

§ Reduce

component cost

§ Standardize offshore

foundation design

§ Reduce grid access

complexity

§ Increase turbine

component quality

§ Increase energy

production efficiency

§ Industrialise

manufacturing

§ Innovative grid

solutions

§ Reduce O&M hours

and visits frequency

§ Drive scale effects

and industrialisation

Wind Offshore will be able to realise scale effects in terms of size and utilisation

that will exceed onshore performance, resulting in better efficiency.

© Siemens Wind Power 2014. All rights reserved.

Page 12

14-12-01

Siemens Wind Power August 20, 2014

0

Forecasting Wind Offshore with learning curve

methodology will lead to LCOE of 70-90 EUR/MWh in

2030 – fully in line with the range of Gas & Coal

Offshore Levelised Cost of Electricity (LCOE)

EUR/MWh

250

Assumed underlying onshore

wind offshore learning curve

i.e. same rate of cost improvement (11,5%)

for each doubling of capacity

200

LCOE range Gas/Coal

incl CO2

150

Prognos/Fichtner 2013:

120km, 50m

Prognos/Fichtner 2013:

120km, 50m

100

Conservative progression

(9,5% learning rate)

Prognos/Fichtner 2013:

120km, 50m

Datapoints pilot projects

near shore

Optimistic progression

(13,5% learning rate)

50

project data points typical conditions

0

1990

1995

2000

2005

2010

2015

Annual installations

GW

0,0

2020

15,0

0,0

0,1

1,3

2025

12,9

2030

11,1

4,0

Source: Own analysis based on learning curve approach, supported by datat from Prognos/Fichtner 2013: Cost reduction potentials of offshore wind power in Germany

http://www.offshore-stiftung.com/60005/Uploaded/SOW_Download|EN_ShortVersion_CostReductionPotentialsofOffshoreWindPower.pdf

© Siemens Wind Power 2014. All rights reserved.

Page 13

14-12-01

Siemens Wind Power August 20, 2014

1

The analysis will try to bring some substantiation

into a set of hypotheses

0

1

2

3

4

5

6

Mid-term, Wind Offshore can significantly reduce the gap to grid parity.

Wind Offshore – like other renewables – requires an early refurbishment of

transmission grids and intermittency leveling facilities like backups or storage.

Conventional technologies‘ costs that have not been fully addressed to their

cost base, giving them an ill-founded advantage.

A fair price of CO2 emissions would make wind energy‘s environmental

benefits far more obvious.

While Wind Onshore is already close to grid parity, its expansion is reaching

limits.

Wind power creates more local employment and positive GDP impacts than

other energy sources.

Wind power is a natural hedge against fuel price changes and allows geopolitical

independency

© Siemens Wind Power 2014. All rights reserved.

Page 14

14-12-01

Siemens Wind Power August 20, 2014

Transmission and backup requirements

Renewables requires changes in the architecture of

the onshore energy grid.

Total

Comments

Grid investments onshore

mEUR

3.838

OPEX costs p.a.

mEUR

38 1 % of CAPEX p.a.

Grid lifetime

Years

40

Discount rate

%

10

Annual electricity production offshore

TWh

Additional grid costs

EUR/MWh

219

1,97

Source: National Grid 2011, The Crown Estate: Offshore Transmission Network Feasibility Study

http://www.nationalgrid.com/NR/rdonlyres/4FBE15A0-B244-4BEF-87DC-8D0B7D792EAE/

49346/Part1MainBodysection191.pdf

Comments: Assumption offshore load factors: 50%

Existing electricity grids have been designed for high-capacity conventional

power plants close to load centers. A greater share of renewables will now

demand for an early one-time refurbishment of transmission grids, allowing for

more decentralised and production-optimised grid designs. This is a one-time

investment, like building the grids was a century ago.

© Siemens Wind Power 2014. All rights reserved.

Page 15

14-12-01

Siemens Wind Power August 20, 2014

1

Transmission and backup requirements

Renewables requires changes in the architecture of

the energy grid.

Surplus on electricity from Grid reinforcement

Total

Additional grid costs p.a.

mEUR

Annual electricity production by renewablesTWh

Additional grid costs

EUR/MWh

946

269

3,5

Wind

Offshore

Share

Coal transport

North Sea Southern

Germany2

183

66

2,8

5,0

Transmission capacity needed

until 2022 in Germany

Sources

1 DENA Netzstudie II, Dez 2010

http://www.dena.de/fileadmin/user_upload/Publikationen/Erneuerbare/Dokumente/Endbericht_dena-Netzstudie_II.PDF

2 VBG PowerTech 9/2007: Steinkohlekraftwerke: Konzepte und Faktoren der Standortauswahl

http://www.steag-energyservices.com/fileadmin/user_upload/steagenergyservices.com/downloads/veroeffentlichungen/

Assumptions: Wind Offshore has a share of all grid costs proportional to its installed capacity

Installed capacities 2020: Offshore 14 GW, Wind Onshore 37 GW, Photovoltaics: 18 GW

Capacity factors: Wind Offshore 54%, Wind Onshore 42%, Photovoltaics 11%

Transporting electricity is cheaper than transporting the base fuel!

Planned transmission lines

In construction/consented

Existing electricity grids have been designed for high-capacity conventional

power plants close to load centers. A greater share of renewables will now

demand for an early one-time refurbishment of transmission grids, allowing for

more decentralised and production-optimised grid designs. This is a one-time

investment, like building the grids was a century ago.

© Siemens Wind Power 2014. All rights reserved.

Page 16

14-12-01

Source: DENA Netzenwicklungsplan 2013

http://www.netzentwicklungsplan.de/NEP_2013_Teil_I.pdf

Siemens Wind Power August 20, 2014

1

Transmission and backup requirements

In a state-of-the-art grid, the geographical distribution of

wind farms reduces intermittency

Wind farms spread over a distance

show less interdependency in output

than single turbines

A North Sea super grid can allow for further

compensation of intermittency

Power Output correlation of ~2000 UK wind sites

Distance between recording sites [km]

Source: http://www.eci.ox.ac.uk/publications/downloads/sinden06-windresource.pdf

Source: http://allenandyork.wordpress.com/2011/09/

Geographical distribution of wind farms allows an inter-grid compensation of

intermittency: “There is always wind blowing somewhere!”.

A European initiative for a super-grid will help to level out production and deman

© Siemens Wind Power 2014. All rights reserved.

Page 17

14-12-01

Siemens Wind Power August 20, 2014

1

1

Transmission and backup requirements

In many countries, wind offshore is close to load

centers.

Source: SEDAC - Socioeconomic Data and Applications Center of NASA 2000

http://www.nasa.gov/images/content/712130main_8246931247_e60f3c09fb_o.jpg

40 % of the world population live within 100 km from the shore. For many big

cities like in the US, China and Latin America, offshore wind requires less

investment into transmission than onshore.

© Siemens Wind Power 2014. All rights reserved.

Page 18

14-12-01

Siemens Wind Power August 20, 2014

1

Calculation of intermittency compensation

Offshore wind has far less fluctuation in power

output than other renewables

Offshore winds have less spread in wind speeds vs

the average, resulting in a more stable power

© output.

Siemens Wind Power 2014. All rights reserved.

Page 19

14-12-01

An offshore turbine operates at rated power for 2200

hrs per year, while low wind onshore only reaches

640 hrs.

Siemens Wind Power August 20, 2014

1

Calculation of intermittency compensation

Rationale for calculating intermittency compensation

costs: Gas is the most efficient backup mid-term

Wind output

MW

1 GW of wind installed

1000

Demand

750

500

250

Wind output

0

0

Backup capacity of ~ 880 MW Gas needed

2000

4000

6000

8000

Cumulated hours p.a.

Gas backup output

MW

1000

Compensation of Gas

plant for CAPEX/fixed

OPEX for the amount

of time where it is not

running at 60% load

factor

Demand

Gas output

750

500

250

0

0

2000

4000

6000

8000

Cumulated hours p.a.

To estimate intermittency costs, a gas backup capacity of 88% of installed wind

capacity is assumed. The gas power plant is compensated for the time being idle

by a payment for their CAPEX and fixed OPEX ~ 15 EUR/MWh.

© Siemens Wind Power 2014. All rights reserved.

Page 20

14-12-01

Siemens Wind Power August 20, 2014

4

An 80% renewables scenario in Germany cannot be

realised without significant share of offshore wind;

offshore wind helps to reduce residual capacities.

Even with PV and wind onshore built to their

technical limits, they can only deliver 80 % of

the renewable electricity needed

Colours: Residual power standard deviation (GW)

Annual Electricity demand and potential supply for

Germany in an 80% renewable scheme

Primary energy

demand

supply

100

66

95

162 TWh

20%

Renewable

Mix with minimal

residual power

Standardabweichung

der Residuallast (GW )

demand

Share of wind in renewables portfolio

37 GW Offshore Wind

needed to close the gap

Gap

Other

To minimise the need for residual capacity to

compensate intermittency, an even higher

offshore wind share is advised

390 TWh

80%

= 800 TWh p.a.

Renewable

Electricity

248 TWh

Technical

maximum wind

onshore: 198

GW

Technical

maximum

photovoltaics:

275 GW

64

90

62

85

60

80

58

56

75

54

70

52

65

Primary

energy

demand

Gap to

80%

renewable

supply

Electricity

supply

Source: Fraunhofer IWES 2013: Energiewirtschaftliche Studie

zur Bedeutung der Offshore-Windenergie. Kurzfassung

http://www.fraunhofer.de/content/dam/zv/de/forschungsthemen/energie/

Energiewirtschaftliche-Bedeutung-von-Offshore-Windenergie.pdf

50

60

48

55

50

0

46

20

40

60

80

AnteilShare

Offshore

der W indstromerzeugung

ofanoffshore

in total wind(%)

100

Residual capacity needs can be minimised

with a mix of 20% PV, 30% wind onshore and

50% wind offshore

© Siemens Wind Power 2014. All rights reserved.

Page 21

14-12-01

Siemens Wind Power August 20, 2014

2

The analysis will try to bring some substantiation

into a set of hypotheses

0

1

2

3

4

5

6

Mid-term, Wind Offshore can significantly reduce the gap to grid parity.

Wind Offshore – like other renewables – requires an early refurbishment of

transmission grids and intermittency leveling facilities like backups or storage.

Conventional technologies‘ costs that have not been fully addressed to their

cost base, giving them an ill-founded advantage.

A fair price of CO2 emissions would make wind energy‘s environmental

benefits far more obvious.

While Wind Onshore is already close to grid parity, its expansion is reaching

limits.

Wind power creates more local employment and positive GDP impacts than

other energy sources.

Wind power is a natural hedge against fuel price changes and allows geopolitical

independency

© Siemens Wind Power 2014. All rights reserved.

Page 22

14-12-01

Siemens Wind Power August 20, 2014

1

Different nature of cost-base and price-base

subsidies: We don‘t count renewable price subsidies

as they don‘t distort the cost base

Structure of cost-base subsidies

e.g. government carrying costs caused by producer

Structure of price-base subsidies

e.g. feed-in-tariff or price premium

Line of visibility

Line of visibility

4,0

4,0

0,0

4,0

5,0

1,0

2,0

3,0

3,0

2,0

True costs Cost-base

subsidy

2,0

1,0

Apparent

costs

Profit

Price

• Cost-base subsidies create an apparent or visible cost

base that seems lower than the true cost (when

addressed by cause)

• Example: The disposal costs for nuclear waste are not

fully carried by the plant operator; hence he does not

show the full costs he causes

True

costs

Cost- Apparent

base

costs

subsidy

Profit

Real

price

Subsidy Subsidised

price

• Pure price-base subsidies have true costs at the same

level as apparent costs (no hidden costs).

• The subsidy is used to lower the real price to a

competitive price level

• There are no hidden costs behind the line of visibility

SCOE is focusing on comparing the true costs of electricity generation. That is

why cost-base subsidies are included, but price-based subsidies are not.

© Siemens Wind Power 2014. All rights reserved.

Page 23

14-12-01

Siemens Wind Power August 20, 2014

2

Conventional technologies‘ costs have been

receiving subsidies up to today that lower their

apparent cost base.

Global direct subsidies estimates

Per-Country direct Subsidies to conventional fuels

2010

2010

Fossile Fuels

16,8

Renewables

7,0

Global

Germany

United Kingdom

EUR/MWh

EUR/MWh

EUR/MWh

Hard Coal

Natural Gas

Nuclear Power

43,7

2,5

0,4

0,5

33,4

45,1

Sources:

Sources:

BNEF Press Release July 29, 2010: Subsidies …

Energy consumption: Eurostat 2010

Subsidies: OECD (http://www.oecd.org/site/tadffss/),

Financial Times (http://www.ft.com/intl/cms/s/0/fda9ea9a-ac29-11e2-a06300144feabdc0.html#axzz2V9jJs2J9)

FÖS 2011 (http://www.foes.de/pdf/2012-08-Was_Strom_wirklich_kostet_lang.pdf)

Only subsidy components considered that lower cost base of technology

IEA 2012, Key world energy statistics

Assumptions: Net efficiency gas: 60%, coal: 45%

Conventional energy sources have received several kinds of governmental

support during their introduction phase to allow for quick and efficient scale-up.

Many of these subsidy mechanisms are still in place.

To create a level playing ground, all subsidies have to be made transparent.

© Siemens Wind Power 2014. All rights reserved.

Page 24

14-12-01

Siemens Wind Power August 20, 2014

Climate Change Prevention

A fair CO2 price of 40 EUR/t would give coal a cost

surplus of 22 EUR/MWh

Lifecycle CO2

emission

Cost for CO2

Cost

Increase

kg/MWh

EUR/MWh

EUR/MWh

Nuclear

12

Coal

781

Gas

429

0,1

0,5

+0,4

7,8

31,2

4,3

17,1

+23,4

+12,9

Photovoltaics

41

0,4

1,6

+1,2

Wind Onshore

11

0,1

0,4

+0,3

Wind Offshore

12

0,1

0,5

+0,4

Today: 10 EUR/t CO2

Future: 40 EUR/t CO2

Sources:

IPCC 2014, Working Group III: "Climate Change 2014:Mitigation of Climate Change", Annex III, page 10:

http://report.mitigation2014.org/drafts/final-draft-postplenary/ipcc_wg3_ar5_final-draft_postplenary_annex-iii.pdf

Assumption of 40 EUR/to as a lower end of fair CO2 price: McKinsey 2007:

http://www.epa.gov/oar/caaac/coaltech/2007_05_mckinsey.pdf

© Siemens Wind Power 2014. All rights reserved.

Page 25

14-12-01

Siemens Wind Power August 20, 2014

3

2

Especially nuclear plant operators are not held

responsible for all costs in their value chain

“At Pennsylvania’s Three Mile Island in

1979, one reactor partially melted in the worst

U.S. accident, earning a 5 rating. Its $973

million repair and cleanup took almost 12

years to complete” (Bloomberg, 30.03.2011)

In addition to the currently known subsidies, there are hidden cost risk due to

environmental damage or catastrophies which tax payers have to come up for.

We assumed a virtual insurance fee against nuclear desasters of 14 EUR/MWh.1

Sources: 1 Versicherungsforum Leipzig 2011: Berechnung einer risikoadaquaten Versicherungspramie zur Deckung der Haftpflichtrisiken,

die aus dem Betrieb von Kernkraftwerken resultieren

http://www.bee-ev.de/_downloads/publikationen/studien/2011/110511_BEE-Studie_Versicherungsforen_KKW.pdf

© Siemens Wind Power 2014. All rights reserved.

Page 26

14-12-01

Siemens Wind Power August 20, 2014

3

The analysis will try to bring some substantiation

into a set of hypotheses

0

1

2

3

4

5

6

Mid-term, Wind Offshore can significantly reduce the gap to grid parity.

Wind Offshore – like other renewables – requires an early refurbishment of

transmission grids and intermittency leveling facilities like backups or storage.

Conventional technologies‘ costs that have not been fully addressed to their

cost base, giving them an ill-founded advantage.

A fair price of CO2 emissions would make wind energy‘s environmental

benefits far more obvious.

While Wind Onshore is already close to grid parity, its expansion is reaching

limits.

Wind power creates more local employment and positive GDP impacts than

other energy sources.

Wind power is a natural hedge against fuel price changes and allows geopolitical

independency

© Siemens Wind Power 2014. All rights reserved.

Page 27

14-12-01

Siemens Wind Power August 20, 2014

The CO2 emissions assigned to burning fuel are not

capturing the whole story

Fuel

generation

During mining:

• Energy and auxiliary

materials for well

operations

Fuel

distribution

• fuel consumption

for transportation

• Pipeline leakage

Power plant

construction

Power plant

operations

• Auxiliary power,

• Energy and raw

people and material

materials for

transport and

construction

logistics

• Operations of

auxiliary equipment

and transport to site

Burning fuel

• Chemical

conversion of

carbon share of fuel

to CO2

Direct emissions

base for CO2

certificate trade

Lifecycle emissions

determining impact on CO2 concentration in the atmosphere

© Siemens Wind Power 2014. All rights reserved.

Page 28

14-12-01

Siemens Wind Power August 20, 2014

Environmental impact

We use two different approaches to measure the

impact of carbon dioxide

1•

Fair value of CO2 view:

2•

Powerplant operators view

•

Regardless of local legislation, we address a price to

CO2 emissions that is considered high enough to

compensate the adverse effects

•

•

Calculation: Lifecycle emissions per MWh x

fair CO price (=40 EUR/to)

Based on assumptions of CO2 prices given by local

authorities (e.g. national governments, EU), we

calculate what an operator needs to pay for his direct

emissions

•

Calculation: Direct emissions per MWh x certificate

price (depending on location)

UK Example

2025

Price tag

EUR/to CO2 80

2

724 kg/MWh @ 80,7 EUR/to

70

58

60

EUR/MWh el

50

1

40

781 kg/MWh @ 40 EUR/to

30

20

31

10

EUR/MWh el

0

0

200

400

600

800

CO2 Emissions kg/MWh

Even if self-imposed CO2 prices are not in place, the environmental damage comes at a cost.

Therefore we use a fair value as a second referencein case the self-imposed mechanisms fall

short.

© Siemens Wind Power 2014. All rights reserved.

Page 29

14-12-01

Siemens Wind Power August 20, 2014

3

Climate Change prevention

Government aims to put a fair price to CO2 will make

especially coal-fired power plants less competitive.

Carbon price floor targets United Kingdom

EUR/t CO2

100

CO2 lifetime

average price for a

power plant going

online in this year*

90

80

70

Fair CO2 price

87

81

Marginal costs of

CO2 reduction

measures to keep

global warming

below 2°C:

87

67

60

62

50

40-50 EUR/t2

40

CO2 carbon

price floor

per year

37

30

20

2 Source: McKinsey,

http://www.epa.gov/oar/caaac/c

oaltech/2007_05_mckinsey.pdf

10

0

2010

2015

2020

2025

2030

Source: UK Department of Energy and Climate Change: Updated short-term traded carbon values used for UK public policy appraisal, Oct 2012

https://w w w .gov.uk/government/uploads/system/uploads/attachment_data/file/41794/6667-update-short-term-traded-carbon-values-f or-uk-publ.pdf

* A power plant going online in 2025 will pay CO2 taxes from 2025-2055 (30 years lifetime).

For LCOE, the lifetime discounted value of CO2 emission is considered, not only the one in the starting year.

Recently low CO2 certificate prices are not reflecting actual cost of CO2, but are a

result of too optimistic demand forecast. Corrective action required by EU

governments to reach fair pricing of CO2.

© Siemens Wind Power 2014. All rights reserved.

Page 30

14-12-01

Siemens Wind Power August 20, 2014

4

The analysis will try to bring some substantiation

into a set of hypotheses

0

1

2

3

4

5

6

Mid-term, Wind Offshore can significantly reduce the gap to grid parity.

Wind Offshore – like other renewables – requires an early refurbishment of

transmission grids and intermittency leveling facilities like backups or storage.

Conventional technologies‘ costs that have not been fully addressed to their

cost base, giving them an ill-founded advantage.

A fair price of CO2 emissions would make wind energy‘s environmental

benefits far more obvious.

While Wind Onshore is already close to grid parity, its expansion is reaching

limits.

Wind power creates more local employment and positive GDP impacts than

other energy sources.

Wind power is a natural hedge against fuel price changes and allows geopolitical

independency

© Siemens Wind Power 2014. All rights reserved.

Page 31

14-12-01

Siemens Wind Power August 20, 2014

4

In onshore, the industry already demonstrated an

impressive track record of cost reduction, with grid

parity in reach

Learning curve: Onshore Levelised Cost of Electricity (LCOE)

EUR/MWh

350

300

Assumed underlying onshore

wind learning curve

i.e. same rate of cost improvement (13%)

for each doubling of capacity

250

200

LCOE range Gas/Coal

incl CO2

Conservative progression

(10 % learning rate)

150

Siemens forecast

(Low wind)

100

50

Real wind power data points

0

1980

1985

1990

1995

2000

Siemens forecast

(high wind)

2005

Annual installations actuals and forecast

GW

0,4

0,2

1,3

2010

32,8

4,0

2015

37,3

Variable cost range

Gas/Coal incl CO2

2020

38,9

2025

46,8

Optimistic progression

(16% learning rate)

2030

49,6

11,3

Source: own analysis by learning curve methodology of known LCOE datapoints and market installation actuals and forecasts

© Siemens Wind Power 2014. All rights reserved.

Page 32

14-12-01

Siemens Wind Power August 20, 2014

4

But high wind sites are already utilised to a great

extent. Mid/low wind sites can still be extended, but

will have higher costs.

Distribution of installations in Germany

Status: End 2012

Wind resources Germany

Power

density

MW/km²

Installed fleet: ~ 31 GW (End 2012)

Source: Fraunhofer IWES 2013: Windenergie Report Deutschalnd 2012,

http://windmonitor.iwes.fraunhofer.de/bilder/upload/Windenergie_Report_Deutschland_2012.pdf

Mean wind speed

m/s

Total potential: ~ 198 GW (=2% of land usage)

Source: BWE 2012, Potenzial der Windenergienutzung an Land

http://www.wind-energie.de/sites/default/files/download/publication/studie-zum-potenzial-der-windenergienutzungland/bwe_potenzialstudie_kurzfassung_2012-03.pdf

© Siemens Wind Power 2014. All rights reserved.

Page 33

14-12-01

Siemens Wind Power August 20, 2014

Some studies assume that property values decline

around onshore wind farms; social acceptance is

also influenced by visual impact

Hypotheses

One of the major obstacles to wind

onshore is reluctance against the

visual impact

Findings

House prices decline around wind

farms by ~3% in a 5 km radius1

Result

Result

Per MWh, the house price

decline accounts for ~4-5 EUR

5 km

9d

7d

Wind farm,

12 turbines

d= rotor diameter

Visually impacted area

1 Source:

Note:

Heintzelman/Tuttle 2011: Values in the Wind.

http://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID1887196_code1021813.pdf?abstractid=1803601&mirid=3

Other recent sources say there are no relations between wind farms and house prices. To have a safe assumption, we used one of the more pessimistic cases.

© Siemens Wind Power 2014. All rights reserved.

Page 34

14-12-01

Siemens Wind Power August 20, 2014

4

4

Social Impact

Visual impact by wind farms will rise significantly if

current offshore plans are replaced by onshore wind

UK Onshore Wind Farm Density Today

UK Onshore Wind Farm Density 2030

with all offshore plans moved onshore

Average distance between wind farms: 31,3 km

Average distance between wind farms: 12,4 km

Land area from where wind farms visible: 15%

Land area from where wind farms visible: 99%

50km

50km

10km

10km

Legend:

visually affected are of one single wind farm

Assumptions

Legend:

visually affected are of one single wind farm

Assumptions

Onshore additional installations

Of fshore plans move onshore

Average onshore w indfarm size

Average turbine rating

Visibility around w ind farm

0

0

12,0

2,3

5,0

(0% of 5,85 GW)

(0% of 35 GW)

turbines

MW

km

Onshore additional installations

Of fshore plans move onshore

Average onshore w indfarm size

Average turbine rating

Visibility around w ind farm

5,85

35

12,0

3,0

5,0

(100% of 5,85 GW)

(100% of 35 GW)

turbines

MW

km

© Siemens Wind Power 2014. All rights reserved.

Page 35

14-12-01

Siemens Wind Power August 20, 2014

4

Social Impact

Visual impact by wind farms will rise significantly if

current offshore plans are replaced by onshore wind

DE Onshore Wind Farm Density Today

DE Onshore Wind Farm Density 2030

with all offshore plans moved onshore

Average distance between wind farms: 14,1 km

Average distance between wind farms: 11,7 km

Land area from where wind farms visible: 72%

Average wind farms visible: 1,1

Legend:

visually affected are of one single wind farm

Assumptions

50km

50km

10km

10km

Legend:

visually affected are of one single wind farm

Assumptions

Onshore additional installations

Of fshore plans move onshore

Average onshore w indf arm size

Average turbine rating

Visibility around w ind f arm

0

0

12,0

2,3

5,0

(0% of 10 GW)

(0% of 15 GW)

turbines

MW

km

Onshore additional installations

Of fshore plans move onshore

Average onshore w indfarm size

Average turbine rating

Visibility around w ind farm

10

15

12,0

3,0

5,0

(100% of 10 GW)

(100% of 15 GW)

turbines

MW

km

© Siemens Wind Power 2014. All rights reserved.

Page 36

14-12-01

Siemens Wind Power August 20, 2014

Social Impact

Studies show that consumers are willing to accept

higher electricity prices for lower visual impact.

People’s willingness to pay to get offshore wind farms out of sight is expected to

reflect the onshore situation to the same extent.

Sources:

1 Ladenburg/Dubgaard 2007: Willingness to Pay for Reduced Visual Disamenities from Off-Shore Wind Farms in Denmark.

http://www.webmeets.com/files/papers/ERE/WC3/881/Willingness%20to%20Pay%20for%20Reduced%20Visual%20Disamenities%20from%20OffShore%20Wind%20Farms%20in%20Denmark.pdf

2 Navrud, S. (2004): MILJØKOSTNADER AV VINDKRAFT I NORGE Sammendragsrapport til SAMRAM-programmet.Norges Forskningsråd.Notat .Institutt for Økonomi og

Ressursforvaltning.Universitetet for Miljø- og Biovitenskap (UMB).

© Siemens Wind Power 2014. All rights reserved.

Page 37

14-12-01

Siemens Wind Power August 20, 2014

4

5

The analysis will try to bring some substantiation

into a set of hypotheses

0

1

2

3

4

5

6

Mid-term, Wind Offshore can significantly reduce the gap to grid parity.

Wind Offshore – like other renewables – requires an early refurbishment of

transmission grids and intermittency leveling facilities like backups or storage.

Conventional technologies‘ costs that have not been fully addressed to their

cost base, giving them an ill-founded advantage.

A fair price of CO2 emissions would make wind energy‘s environmental

benefits far more obvious.

While Wind Onshore is already close to grid parity, its expansion is reaching

limits.

Wind power creates more local employment and positive GDP impacts than

other energy sources.

Wind power is a natural hedge against fuel price changes and allows geopolitical

independency

© Siemens Wind Power 2014. All rights reserved.

Page 38

14-12-01

Siemens Wind Power August 20, 2014

Localisation of supply chain

Due to component size and high lot sizes, Wind

Offshore is more suitable and in need for localisation

Units to be installed for annual production of 10 TWh

Drivers of localisation

# Units

Nuclear

1,0

Coal

2,0

Low unit # and relatively simple

component logistics

Very few items requiring

sophisticated logistics

2,3

Gas

Wind

Offshore

366 turbines

1098 Blades

1464 Tower segments

27‘500‘000

PV

modules

Logistical complexity and

component size

Simple component logistics

(container shipment) decreases

need for local supply chain

The critical mass for building a partially local supply chain is far lower for wind

offshore than it is for other energy sources (especially conventionals)

© Siemens Wind Power 2014. All rights reserved.

Page 39

14-12-01

Siemens Wind Power August 20, 2014

5

5

Job creation by Wind Offshore

The level of GDP impact depends on the scope of

localisation (Scenario UK 2020)

Gross GDP Return

[% of LCOE]

73,0

Nuclear

36,0

Coal @ 0% local fuel

Coal @ 50% local fuel

Coal @ 100% local fuel

Gas @ 0% local fuel

Gas @ 50% local fuel

Gas @ 100% local fuel

Photovoltaics

Assumptions

63,0

90,0

18,0

61,0

103,0

CAPEX local content %

• Nuclear:

35

• Coal:

35

• Gas:

37

• PV:

40

• Wind Onshore:

25-39

• Wind Offshore:

27-40

53,0

Wind Onshore low localisation

Local tower manufacturing

Local rotor manufacturing & assembly

Local nacelle assembly

Wind Onshore with max localisation

67,5

2,6

11,7

4,8

86,6

Wind Offshore low localisation

Local foundation manufacturing

Local tower manufacturing

Local rotor manufacturing & assembly

Rotor Export (100% on top)

Local nacelle assembly

Wind Offshore max localisation

62,0

6,0

1,5

6,6

4,4

5,4

85,9

Share of domestic fuel %:

• Gas:

0-50-100

• Coal

0-50-100

• Nuclear

100

Sources:

Own analysis, mainly based on

Ernst&Young 2012: Analysis of the value creation potential

of wind energy policies (Link)

Assumptions:

CAPEX GDP impact is comparable for all conventional

technologies (nuclear, coal gas)

© Siemens Wind Power 2014. All rights reserved.

Page 40

14-12-01

Siemens Wind Power August 20, 2014

5

While coal relies to a great extent on exploitation of fossil

resources with low value add impact, wind value chain is

consisting of multiple layers of value add activities

Main value add components

LCOE

Split by %

Coal

Fossil resources

Fuel

Mining &

Processing

47%

Mining Equipment

Wind

OPEX

10%

Spare parts

Monitoring

Servicing

CAPEX

43%

Parts

mfg

Component assy

Construction & erection

OPEX

Fleet operations

Servicing

Spare parts

Monitoring

26%

Copper mfg

Generator assy

Steel mfg

CAPEX

Nacelle assy

Tower mfg

Installation

74 %

Tool mfg

Raw mat mfg

Blade mfg

© Siemens Wind Power 2014. All rights reserved.

Page 41

14-12-01

Siemens Wind Power August 20, 2014

5

Offshore wind has superior local effects on

employment – creating wealth for the economy

• It creates more local employment opportunities and has a more positive impact on GDP

than any other energy source.

• Especially in structurally weak areas in urgent need of jobs and investment.

21‘000

billion

job years

For every billion EUR invested in

wind power, 21‘000 people are

employed for one year in the EU.

Sources:

Already more than 35% of

contracts awarded for the

production & installation of

Offshore Wind farms go to UK

companies

86% of service contracts are

allocated locally.

Ernst&Young 2011: Analysis of the value creation potential of wind energy policies (Link)

BVG Associates 2011: UK content analysis of Robin Rigg offshore wind farm (Link)

BVG Associates 2012: UK content analysis of Robin Rigg Offshore Wind Farm O&M (Link)

© Siemens Wind Power 2014. All rights reserved.

Page 42

14-12-01

Siemens Wind Power August 20, 2014

5

Job creation by Wind Offshore

Wind Offshore helps regions and sectors with

structural problems to raise employment

Germany Offshore Industry:

• 90% of value add created in small and medium-sized enterprises1

• Already 18‘000 dedicated jobs, especially in Northern Germany2

• Creating employment in structurally lagging region and sectors

Wind offshore is especially catching up for job losses in rural areas and in the

marine sector, reducing structural unemployment

1 PwC, http://www.pwc.de/de/energiewende/offshore-windenergie-kommt-gewaltig-in-fahrt.jhtml

2 Handelsblatt: http://www.handelsblatt.com/unternehmen/industrie/hochsee-windkraft-tausende-jobs-in-offshore-branche-in-gefahr/8274098.html

© Siemens Wind Power 2014. All rights reserved.

Page 43

14-12-01

Siemens Wind Power August 20, 2014

Myth: Offshore only gives employment to Northern countries in

Germany

Fact: Offshore Wind creates value-add and employment all across

Germany

Share of Offshore Turbine Value-add [%]

18%

13%

12%

Source: PwC/wab 2012: Volle Kraft aus Hochseewind

http://www.wab.net/images/stories/PDF/studien/Volle_Kraft_aus_Hochseewind_PwC_WAB.pdf

Confidential © Siemens AG 2013 All rights reserved.

Page 44

June 27, 2013

Christoph Neemann / E W ST MC

5

Wind power costs are man-power intensive; moreover, a high proportion is sourced locally

United Kingdom fuel import rates and sources

Cost elements of LCOE

in % of total LCOE (excluding CO2 costs)

74

Fuel imports

26

82

18

Fuel imports

43

10

19 6

CAPEX OPEX

Sources:

47

75

Fuel

LCOE: Siemens-internal analysis

Gas & Coal imports and sources: https://www.gov.uk/government/publications

© Siemens Wind Power 2014. All rights reserved.

Page 45

14-12-01

Siemens Wind Power August 20, 2014

5

Job creation by Wind Offshore

Once built up, a local supply chain can also serve

export markets

Offshore Installation

Targets/Estimates

Northern European Countries

in GW by 2030 (*2020)

United Kingdom

Germany

France

Netherlands*

Sweden*

Denmark*

Belgium*

Total ex UK

38,0

15,0

15,0

6,0

3,0

2,8

2,0

41,8

Building expertise on crafting wind turbines can lead to a benefitial export

business case, fostering local growth and employment

© Siemens Wind Power 2014. All rights reserved.

Page 46

14-12-01

Siemens Wind Power August 20, 2014

6

The analysis will try to bring some substantiation

into a set of hypotheses

0

1

2

3

4

5

6

Mid-term, Wind Offshore can significantly reduce the gap to grid parity.

Wind Offshore – like other renewables – requires an early refurbishment of

transmission grids and intermittency leveling facilities like backups or storage.

Conventional technologies‘ costs that have not been fully addressed to their

cost base, giving them an ill-founded advantage.

A fair price of CO2 emissions would make wind energy‘s environmental

benefits far more obvious.

While Wind Onshore is already close to grid parity, its expansion is reaching

limits.

Wind power creates more local employment and positive GDP impacts than

other energy sources.

Wind power is a natural hedge against fuel price changes and allows geopolitical

independency

© Siemens Wind Power 2014. All rights reserved.

Page 47

14-12-01

Siemens Wind Power August 20, 2014

6

Geopolitical independency

Fossil fuel prices are volatile and subject to

geopolitical sensitivities.

Henry hub Natural gas spot price

USD/mmBTU

Hard coal prices

USD/to, Central Appalachian

14

350

12

300

10

250

8

200

6

150

4

100

2

50

0

01/'06 01/'07 01/'08 01/'09 01/'10 01/'11 01/'12 01/'13

0

Source: U.S. Energy Information Administration (http://www.eia.gov)

Fuel prices of conventional sources, especially natural gas are volatile; moreover

the limitations of their availability create a bottleneck risk.

Approach to valuation of geopolitical impact:

Import share of fuel x fuel costs x hedging premium (~17 % for gas) = geopolitical costs

Hedging premium derived from long-term (2 years) future hedges on fuel prices

© Siemens Wind Power 2014. All rights reserved.

Page 48

14-12-01

Siemens Wind Power August 20, 2014

Can society afford

(offshore) wind power?

!

?

How can society afford

not to do (offshore) wind power?

© Siemens Wind Power 2014. All rights reserved.

Page 49

14-12-01

Siemens Wind Power August 20, 2014

Summary: Why SCOE changes the way you look

at the electricity mix

Onshore und Offshore Wind will be the most cost competitive

electricity sources on macro-economic level by 2025

The continued build-out of wind power will take place less out of

political reasons, but out of economical reasons

Flexible gas power plants are the most cost-efficient backup

technology

© Siemens Wind Power 2014. All rights reserved.

Page 50

14-12-01

Siemens Wind Power August 20, 2014

Annex

Restricted © Siemens Wind Power 20XX All rights reserved.

Page 51

14-12-01

Author / Department

Summary of Key assumptions

Projection for United Kingdom in 2025 –

Average Scenario

Summary of Key assumptions

Projection for United Kingdom in 2025 - custom Scenario

Technology-specific assumptions

Topic

LCOE

Item

Units

General Nuclear

Fuel costs

EUR/MWh_therm

4

Capacity factors

%

92

Environment CO2 emission rate

g/MWh

0

CO2 price

EUR/t

81

CO2 costs per MWh

EUR/MWh

0

Baseload level

% of rated power

94

Intermittency

Fixed costs of gas backup

EUR/MWh

15,2

Transmission grid investment

kEUR/MW

Transmission

Distribution grid investment

kEUR/MW

Avg house price decline

%

5,0

Impact radius house prices

km

3,0

Average population density vs country average

%

20

Social

Average House price value total country

EUR/sqm

1.953

Average living space per person

sqm/person

44

House price level vs average

%

50

Local content CAPEX

%

35

Economy

Local content OPEX

%

80

Domestic fuel share

%

95

Geopolitical Hedging costs

% of fuel price

8,3

Coal

Gas

Photovoltaics

Wind

Onshore

Wind

Offshore

10

86

330

26

63

200

11

0

37

0

54

0

58

97

26

100

0

0

0

6

0

12

5,0

3,0

5,0

3,0

61

0,0

0,0

61

5,5

3,0

0,0

0,0

35

80

34

11,6

35

80

22

16,5

35

80

0

0,0

35

80

0

0,0

38

80

0

0,0

92

General assumptions

Topic

Economy

Item

GVA Multiplier CAPEX

GVA Multiplier OPEX

GVA Multiplier Fuel

Units

Value

1,67

1,33

1,14

E W ST MC / CWN / 2014-08-25 / Projection for United Kingdom in 2025 - custom Scenario

© Siemens Wind Power 2014. All rights reserved.

Page 52

14-12-01

Siemens Wind Power August 20, 2014

Summary of Key assumptions

Projection for Germany in 2025 –

Average Scenario

Summary of Key assumptions

Projection for Germany in 2025 - custom Scenario

Technology-specific assumptions

Topic

LCOE

Item

Units

Fuel costs

EUR/MWh_therm

Capacity factors

%

Environment CO2 emission rate

g/MWh

CO2 price

EUR/t

CO2 costs per MWh

EUR/MWh

Baseload level

% of rated power

Intermittency

Fixed costs of gas backup

EUR/MWh

Transmission grid investment

kEUR/MW p.a

Transmission

Distribution grid investment

kEUR/MW

Avg house price decline

%

Impact radius house prices

km

Average population density vs country average

%

Social

Average House price value total country

EUR/sqm

Average living space per person

sqm/person

House price level vs average

%

Local content CAPEX

%

Economy

Local content OPEX

%

Domestic fuel share

%

Geopolitical Hedging costs

% of fuel price

General

Nuclear

Coal

Photovoltaics

Gas

Wind

Onshore

Wind

Offshore

4

92

0

10

86

330

26

63

200

11

0

37

0

54

0

0

94

23

97

10

100

0

0

0

6

0

12

100

5,5

3,0

0,0

0,0

35

80

0

0,0

35

80

0

0,0

32

15,2

13

5,0

3,0

5,0

3,0

5,0

3,0

100

0,0

0,0

35

80

0

8,3

35

80

0

11,6

35

80

14

16,5

35

80

0

0,0

20

1.800

45

50

General assumptions

Item

Topic

Economy

GVA Multiplier CAPEX

GVA Multiplier OPEX

GVA Multiplier Fuel

Units

Value

1,67

1,51

1,14

E W ST MC / CWN / 2014-08-25 / Projection for Germany in 2025 - custom Scenario

© Siemens Wind Power 2014. All rights reserved.

Page 53

14-12-01

Siemens Wind Power August 20, 2014

5

Evaluation principle GDP Impact

Key drivers are local value-add and multipliers for

indirect and induced labour.

Rationale of gross economic impact

Fuel

OPEX

0-100%

75-85%

x 1,14

Domestic

Fuel

x 1,39

Domestic

OPEX

CAPEX

LCOE

Split

10-50%

x 1,67

Domestic

CAPEX

Local

content

Fuel

impact

OPEX

Impact

CAPEX

Impact

Domestic

GDP

Gross

Value-add Multipliers Economic

benefit

• All money spent on electricity, i.e. LCOE,

can be traced back to fuel, CAPEX and

OPEX.

• An economy only benefits from these

spendings if they take place locally

• The domestic value add is defined as the

sum of localised profits and local labour.

These two elements will go into the GDP.

• The local value add triggers further

employment up the value chain. This

effect is reflected by multipliers that differ

by the type of work conducted.

• Example: A blade manufacturing facility

will most likely trigger a higher local

production of glas fibers or moulds at

suppliers. Close to the new

manufacturing site, a bakery, a

supermarket and a hotel will open,

creating further employment.

© Siemens Wind Power 2014. All rights reserved.

Page 56

14-12-01

Siemens Wind Power August 20, 2014

5

Economic impact

Compensation for high gross effect

Gross economic impact

„Economic

advantage“

Minimum

86,0

Nuclear

71,0

Coal

Gas

65,0

94,0

Photovoltaics

Minimum

Wind Onshore

Wind Offshore

56,0

100,0

“Economical advantage” is the delta to the energy source with the lowest gross

economic impact .

© Siemens Wind Power 2014. All rights reserved.

Page 57

14-12-01

Siemens Wind Power August 20, 2014