Liquidity and Solvency Ratios

advertisement

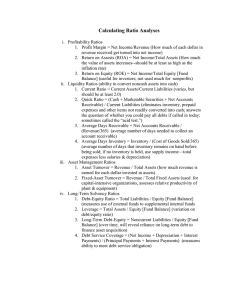

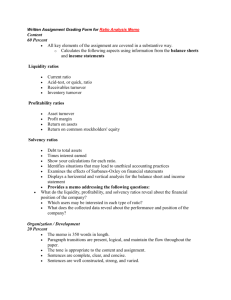

Liquidity and Solvency Ratios Given the continued slowdown of economic activity, we want to focus this month on the use of liquidity and solvency ratios in managing available cash in your business. We assume that your enterprise is utilizing financial statements on a regular basis that are accurate. (Please see the Financial Statement memo available online under Resources for more information.) Liquidity ratios provide indicators as to the company’s capacity to service debt in the short term while solvency ratios address the company’s ability to service long-term debt. Banks are especially interested in liquidity and solvency, showing the ability to pay rather than just the collateral securitizing the loan. The current economy has caused sales to slow dramatically and the timeframe to collect Accounts Receivables to lengthen. Liquidity becomes the point of focus for survival. Unlike sales, expenses seem to remain steady and while vendors are seeking cash more quickly, Accounts Payable payments tend to be deferred in order to conserve cash. Forecasts and budgets are key tools for successfully navigating this downturn. Best and worse case scenarios should be developed so that the company can prepare for either direction with confidence that enough cash is available for the continuance of operations. Weekly cash forecasts that tie to the budget aid in predicting potential cash crunches. Quarterly budget/forecast reviews allow for anticipation of cash needs and allow for strategies to be adjusted to reflect the changing environment. Liquidity Ratios Working Capital While there are many ratios that a company can consider in analyzing the financial statements, one of the most vital is current liquidity. Working Capital = Current Assets – Current Liabilities Positive working capital shows sufficient current assets to meet current liabilities. However, the speed that AR and Inventory becomes cash becomes the next focus in this economy (below). Negative working capital is a serious warning that the company has current liabilities in excess of current assets and can easily face a liquidity crisis. Future cash in-flows and payment scheduling is critical. Today extra working capital is a blessing to be guarded. Current Ratio Cathedral Consulting Group, LLC Page 1 Current ratio is another working capital assessment tool that shows the percentage of coverage current liabilities have. Current Ratio = Current Assets / Current Liabilities If the current ratio is 1.25, then each $1 of current liabilities has $1.25 of current assets to satisfy it. As noted above, current ratio does not say that cash in-flows will match payments (below). The next set of ratios is designed to monitor the speed at which current assets become cash. In an economic downturn this monitoring is critical for anticipating cash for debt payments. Accounts Receivable Turnover In order to understand how quickly your company converts Accounts Receivables into cash, calculate the turnover of AR. This ratio indicates how many times AR turns over completely within a year. The higher the turnover, the faster the company is converting AR to cash. Different businesses have differing rates so the trend is what needs to be monitored. AR Turnover = Sales on Account / Average AR Accounts Receivable Days Sales Outstanding This ratio tells us the average length of time a sale on AR takes to turn into cash. Note that this ratio is sales on AR, not all sales. Many companies accept credit cards, avoiding AR altogether. While there are credit card fees, the speed of cash flow, avoidance of bad debts, added convenience to customers, and ease of transactions make it worthwhile. AR days sales outstanding = AR / Sales on AR The final AR analysis is Aging AR. AR is broken down into those that are greater than 30 days, 60 days, 90 days, etc. The tracking of aging is most helpful in monitoring slowing payments and allows customers to be followed up to keep payments timely. Inventory Turnover This ratio indicates the number of times that inventory is turned over within a year. A higher turnover rate indicates that inventory is moving quickly, minimizing the risk of carrying items that could become obsolete or that incur high carrying costs. Speed in inventory turn is directly related to cash availability. Monitoring inventory turnover gives an early warning of potential slowing of cash flows. Inventory Turnover = Cost of Goods Sold / Average Inventory Solvency Ratios Debt Ratio The Debt Ratio indicates what percentage of the company’s assets is provided through its creditors. For example, if the debt ratio is 50% that indicates that creditors are providing $.50 on every dollar of assets at the company. Debt Ratio = Total Liabilities / Total Assets Cathedral Consulting Group, LLC Page 2 Equity Ratio Like the debt ratio, the equity ratio indicates what percentage of the assets is covered by funds provided by equity owners. Equity Ratio = Total Equity / Total Assets Debt to Equity Ratio This ratio allows us to determine the solvency of a company. If this ratio is above one it indicates that the company carries more liabilities than equity. Debt to Equity Ratio = Total Liabilities / Total Equity In the current economy financial strength is the key. Therefore less debt and better debt/equity ratios will be the trend for the future. This is called “deleveraging.” Tutorials & Articles for Further Reading “Beginners Guide to Financial Statements.” This article walks through the basics of financial statements and ratios. Unlike many sites, this article includes a good overview of the Cash Flow Statement. http://www.sec.gov/investor/pubs/begfinstmtguide.htm Mulit-millionaire Norm Brodsky provides the 10 top lessons he learned over his 30 years in business, including important lessons on understanding financial statements and liquidity. http://www.inc.com/magazine/20081001/street-smarts-secrets-of-a-110-millionman.html For additional financial ratios and to use American Express’ calculation tool, see http://www133.americanexpress.com/osbn/tool/ratios/financialratio.asp. Phil Clements is CEO of Cathedral Consulting Group, LLC and a Managing Director in the New York Office. Sharon Nolt is a former Senior Associate in the New York Office. For more information, please visit Cathedral Consulting Group LLC online at www.cathedralconsulting.com or contact us at info@cathedralconsulting.com. Cathedral Consulting Group, LLC Page 3