©2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

The Purpose of the

Statement of Cash Flows

* Provides

information about

cash inflows and

outflows during a

period.

* Provides

information about

cash changes

between two

balance sheet dates.

* Discloses items

that affect the

balance sheet but

don’t show up in the

income statement.

* Categorizes

changes as

operating, investing,

or financing

activities.

The Basic Structure of the

Statement

Additional Disclosures

In some cases, companies must also make

one or both of the following two disclosures.

Significant noncash investing or

financing

activities

Cash paid for

interest and taxes

Preparing the Statement of

Cash Flows

Information for the statement of cash flows is

collected from a variety of sources

Preparing the statement of cash flows requires an

examination of the changes in all non-cash accounts

Therefore, in order to explain a company’s change in

cash, you must explain the changes in the company’s

noncash accounts. And to do that, you need the

following three items:

• A comparative balance sheet

• An income statement

• Additional information on changes in account balances

The Cash Change Equation

Assets

= Liabilities + Equity

Balance

Sheet

Equation

Cash + Non-Cash Assets = Liabilities + Equity

Balance

Sheet

Equation

Cash = Liabilities + Equity + Non-Cash

Assets

Cash

Change

Equation

Change Change in Change in Change in

in Cash = Liabilities + Equity - Non-Cash

Assets

6

Three Classifications of Cash Flows

1. Operations –

cash flows related to selling goods and

services; that is, the principle business of the

firm.

2. Investing

–

cash flows related to the acquisition or sale

of noncurrent assets.

3. Financing

–

long term and short term cash flows related

to liabilities and owners’ equity; dividends

are a financing cash outflow.

Direct and Indirect Method

Direct method calculates cash flow from

operations by subtracting cash

disbursements to supplies,

employees, and others from

cash receipts from customers.

Indirect method calculates cash flow from

operations by adjusting net

income for noncash revenues

and expenses.

U.S. GAAP permits

either the direct or

the indirect

method;

a firm that presents

the direct

Mostmethod

firms

must

usea this

also show

reconciliation

method.

8

Reporting Cash Flows

from Operating Activities—

Direct Method

Operating activities include acquiring

and selling products in the normal

course of business. Different types of

businesses will have different

transactions that are included in cash

flows from operating activities.

Types of Operating Inflows of Cash

Operating Cash

Inflows Into Company

• Sales to customers,

• Collection of cash

from past sales that

were made on

credit, and

• Interest and

dividends received.

Company

Types of Operating Outflows of Cash

Operating Cash Outflows

from Company

Company

• Purchases of

merchandise for sale or

materials to

manufacture products,

• Payments for

operating expenses,

• Interest on debt, and

• Payments for services

and taxes.

Operating Activities - Direct Method

Calculating Cash Received from Customers

Operating Activities - Direct Method

Calculating Cash Paid for Inventory

Cash Paid for Operating Expenses

Cash

outflows for

operating

expenses

=

Operating

expenses

+ Increase in Payable

or

– Decrease in Payable

Other Revenues and Expenses in the

Operating Activities Section

Two items ignored in the Operating Activities

Section under the Direct Method

Depreciation

Gain/Loss on

Sale of

Equipment

Summary of Adjustments – Direct

Method

Reporting Cash Flows

from Operating Activities—

Indirect Method

+

+

Net Income

Non-cash expenses

Increases in current liabilities

+

-

Decreases in current assets

Increases in current assets

Decreases in current liabilities

Gains from investing & financing activities

+

Loss from investing and financing activities

=

Cash flow from operating activities

Types of Investing Inflows of Cash

Investing Cash Inflows

Into Company

• Sale of property,

plant, and

equipment,

• The sale of

securities (stocks

and bonds) of other

companies, and

• The receipt of loan

payments.

Company

Types of Investing Outflows of Cash

Investing Cash Outflows

from Company

Company

• Purchases of property,

plant, and equipment,

• Purchase of securities,

and

• Making loans as

investments.

Types of Financing Inflows of Cash

Financing Inflows Into

Company

• Selling Stock,

• Issuing Bonds,

• Contributions from

owners, and

• Borrowing from

banks on a longterm basis.

Company

Types of Financing Outflows of Cash

Financing Cash Outflows

from Company

Company

• Repayment of notes

and bonds,

• Cash payments to

repurchase stock

(treasury stock),

• Payment of dividends.

A Statement of Cash Flows (indirect method

shown) concludes by adding the Change in Cash to

the Beginning Cash balance to derive the Ending

Cash balance.

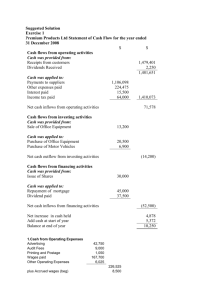

Hardin Supply Company

Statement of Cash Flows for the Year Ending 12/31/2012

$ 14

Net Income (amounts in thousands of dollars)

Depreciation and amortization expense

25

hhhhhhhhhhhhhhhhhhhh

Hhhhh

hhhhhhhhhhhhhhhhhhhh

hhhhh

Cash flow from operating activities

$ 35

hhhhhhhhhhhhhhhhhhhh

Hhhhh

hhhhhhhhhhhhhhhhhhhh

hhhhh

Cash flow from investing activities

(92)

hhhhhhhhhhhhhhhhhhhh

Hhhhh

hhhhhhhhhhhhhhhhhhhh

hhhhh

Cash flow from financing activities

30

Change in cash

$(27)

Cash, January 1, 2012

45

Cash, December 31, 2012

$ 18

The

Company

receives

$100 Cash

from a

customer

22

Free Cash Flow

The calculation starts with cash

flows from operating activities,

which is a measure of a company’s

ability to generate cash from its

current operations.

The cash that remains is

“free” to be used as the

company chooses.

It then subtracts

capital

expenditures,

which refers to the

cash that a

company spends on

fixed assets during

the year, and

dividends, which

are payments to

stockholders

during the year.

Cash Flow Adequacy Ratio

Cash flow adequacy ratio compares free cash flow to the

average amount of debt maturing in the next five years and

measures the ability to pay maturing debt.

The 6.3 ratio indicates that Under

Armour generated over $6.30 in free cash

flow for every $1 of debt maturing

in each of the next five years.

End of Chapter 11