Financial Accounting Basics by Dorota Kuchta

advertisement

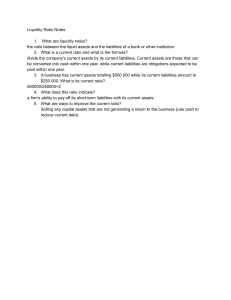

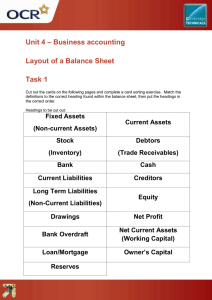

Financial accounting Dorota Kuchta Literature: P.D. Kimmel, J.J. Weygand, D.E. Kieso, Accounting for Business Decision Making M. Piper, Accounting made simple Financial accounting functions and basic elements: Recording and interpreting financial information Fair and true view of the organization (difficult) Double entry – accounts Financial statements: o Balance sheets o Loss and profit statement o Cash flow o Supplementary information Accounts: Debit (where to, what for the money goes), Credit (where from, who from the money comes) Four types: Assets: what we possess or have the right to (equipment, inventory, bank, debtors (accounts receivable, customers) etc.)) Liabilities: how the assets are financed (creditors (accounts payable, suppliers), bank, state etc.) Capital: investment + profit Income: the value of what we have sold in terms of the customer’s price (independent of the payment moment) Expenses: the value of what we have used to generate income (wages, cost of goods sold, materials used, electricity and other external services, advertisement etc.) (Profit=Net Income=Income-Expenses, our own money source – not given, not lent) (Capital = assets – liabilities – what somebody has “given” ( invested in our organization) plus profit) Financial statements: Balance sheet : assets = capital plus liabilities on a given day Loss and profit statement : Income, Expenses, profit in a period (between two consecutive balance sheet days) Cash flow statement: cash at the beginning of the period, cash inflows in the period, cash outflows in the period, cash at the end of the period.