Chapter 5 – Statement of Cash Flows

advertisement

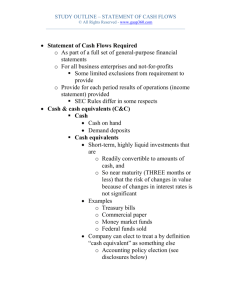

1. 2. 3. 4. What is a statement of cash flows? What are the three major sections of the statement Explain the importance of a statement of cash flows to users of financial information What are cash equivalents? Give examples. What are the two ways to calculate and report a company’s net cash flows from operating activities? Briefly describe each method 5. Give at least three examples of (a) cash inflow from investing activities and (b) cash outflows for investing activities 6. Give at least three examples of (a) cash inflow from financing activities and (b) cash outflows for financing activities 7. Give examples of non-cash investing and financing activities included in the supplementary disclosures of a statement of cash flows A statement of cash flows is an essential component within the set of basic financial statements. It provides information about the cash receipts and cash disbursements of an entity during a period. It answers the questions of where the money came and where it went. As an analytical tool, it is useful in determining the short-term viability of an entity particularly its ability to pay its obligations Users of accounting information are particularly interested in the enterprise’s cash flow because they need to assess the ability of the enterprise to remain solvent - to pay its expenses, repay debts and provide returns to investors and creditors Users of an enterprise’s financial statements are interested in how an enterprise generates and uses cash and cash equivalents. This is the cash needed in the conduct of its operations, for payment of its obligations, and in providing returns to its investors Cash equivalents are short-term, highly liquid investments that are both readily convertible to known amounts of cash, and are subject to an insignificant risk of changes in value Examples of items considered as cash equivalents are treasure bills, commercial papers, and money market instruments with original maturities of three months or less from the date of acquisition. Cash flows from operating activities shall be reported using either: a. the direct method, whereby major classes of gross cash receipts and gross cash payments are disclosed; or b. the indirect method, whereby the profit or loss is adjusted for the effects of transactions for a non-cash nature, any deferrals or accruals of past or future operating cash receipts or payments, and items of income or expense associated with investing or financing cash flows. c.