Accounting Unit 1

advertisement

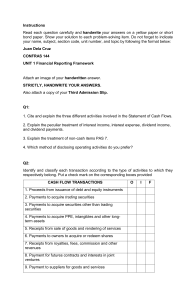

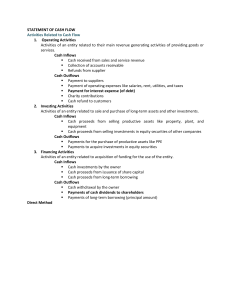

Accounting Unit 5b Chapter 19 STATEMENT OF CASH FLOWS Purpose of the Statement of Cash Flows To report the major items comprising cash receipts and cash payments during a period. Classifies cash flows into operating, investing, and financing activities. Answers important questions such as: 1. How does a company obtain its cash? 2. Where does a company spend its cash? 3. What is the change in the cash balance? Measuring Cash Flows Cash flows are defined to include both "cash and cash equivalents" in the statement of cash flows. A cash equivalent is an investment that must satisfy two criteria: It must be readily convertible to a known amount of cash. It must be sufficiently close to its maturity date so its market value is unaffected by interest rate changes. CLASSIFYING CASH FLOWS Operating Activities Generally include the cash effects of transactions and events that determine net income (with some exceptions such as unusual gains and losses). Specific examples: a. Cash inflows from cash sales, collections on credit sales, receipts of dividends and interest, sale of trading securities, settlements of lawsuits. b. Cash outflows for payments to suppliers for goods and services, to employees for wages, to lenders for interest, to government for taxes, to charities and to purchase trading securities. Investing Activities Cash inflows from selling long-term productive assets, equity investments (shares except those classified as trading securities), debt investments (bonds), collecting principal on loans and discounting loans. Cash outflows from purchase of long-term productive assets, equity investments (shares except those classified as trading securities), debt investments (bonds) and making loans. Financing Activities Cash inflows from issuing its own equity securities, bonds, notes and short-term and long-term liabilities. Cash outflows to pay dividends, purchase treasury shares, repay loans, and cover withdrawals by owners. PREPARING THE STATEMENT OF CASH FLOW Compute the net increase or decrease in cash (bottom line or target number) Compute and report net cash provided (used) by operating activities (using either the direct or indirect method). Compute and report net cash provided (used) by investing activities. Compute and report net cash provided (used) by financing activities. Report the beginning and ending cash balance and prove it is explained by operating, investing, and financing net cash flows. Page 1 of 2 Accounting Unit 5b Chapter 19 DIRECT METHOD Separately list each major item or class of operating cash receipts and cash payments. Classes of operating cash receipts include cash received from customers, interest and dividends. Classes of operating cash payments include cash paid for merchandise, wages and other operating expense, interest and income taxes. Subtract the cash payments from cash receipts to determine the net cash provided (used) by operating activities. The items to be listed are determined by adjusting individual accrual basis income statement items to cash basis items. This is done by determining impact from changes in their related balance sheet accounts. This is the method recommended (but not required) by the CICA. Page 2 of 2