Operating Leverage

advertisement

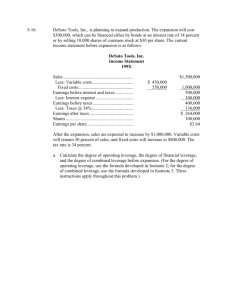

Leverage and Capital Structure Lecture Note Prof. Roy Sembel, PhD PROF. ROY SEMBEL EDUCATION 1982-86 IPB, Bogor. FMIPA. Major: Statistics, Minor: Economics; Ir., Best Graduate, Cum Laude 1988-90 Rotterdam School of Management, Erasmus University Rotterdam and The Wharton School, University of Pennsylvania Philadelphia MBA, Finance/Banking, Best Graduate, With Honours 1991-96 J.M.Katz Graduate School of Business, University of Pittsburgh; Major: Corporate Finance; Minor: Econometrics; PhD; Dissertation: “IPO Anomalies, Truncated Excess Supply, and Heterogeneous Information” WORK EXPERIENCE 1984-87 Teaching Assistant, FMIPA, IPB. 1990 Internship; ABN Bank, European Treasury Department, Amsterdam. 1990-91 Corporate Banking; ABN AMRO Bank Amsterdam 1994-96 Teaching Assistant, University of Pittsburgh. 1994-2000 Co-founder Indonesian Physics Olympic Team /TOFI Foundation & Indonesian Computer Olympic Foundation TOKI 1997-98 Economics & Finance Staff, Office of Dr (HC) Radius Prawiro, Jakarta. 2000 ACUCA Lecturer: Japan, South Korea, Taiwan, Hong Kong, The Philippines, Thailand 1987-Now Lecturer, Faculty of Economics, Christian University of Indonesia, Jakarta. 1997-2001 Visiting Lecturer at IPMI, Institut PPM, Magister Management Program University of Indonesia, University of Sam Ratulangi, Universitas Lampung, Magister Akuntansi & Post Graduate (S2 & S3) Program Faculty of Economics University of Indonesia, Pelita Harapan University. Subjects: Investment Analysis and Risk Management, Corporate Finance, International Finance, Derivative Securities, Managerial Economics, Banks & Capital Markets, eBusiness Management. 1998-2001 McKinsey & Co, Jakarta 2001-2006 Direktur Program Magister Manajemen Keuangan Universitas Bina Nusantara, Co-founder Indonesia Learning Institute (InLIne), Indonesia School of Life (InSchoOL) 2005-2007 Komisaris Independen & Ketua Komite Pemantau Risiko PT Bank Niaga Tbk 2005- Professor in Financial Economics; Charter member Lembaga Komisaris dan Direksi Indonesia 2006-2008 Academic Expert Advisor, Universitas Ciputra Surabaya, 2006- Owner/Komisaris (PT. Mobee Indonesia, PT MARS Indonesia) 2007- Supervisory Committee Asian Bond Fund Indonesia (TCW Bahana/BI), Ketua Komite Sertifikasi FPSB Indonesia 2007-2008 Pejabat Dekan FE Universitas Multimedia Nusantara (UMN) Ketua Umum Partai Barisan Nasional (BARNAS) 2008 Board of Advisor UMN 2008- Ketua Dewan Pembina Partai Barisan Nasional (BARNAS) Chief Research Officer CAPITAL PRICE 2009- Dean of Business School and Director of Graduate Program, UPH MISCELLANEOUS Speaker in many seminars in Indonesia, USA, and Europe. Writer of more than 1000 articles in KONTAN, GATRA, Sinar Harapan, SWA, Bisnis Indonesia, KOMPAS, Investor, Investor Daily, Warta Ekonomi, Manajemen & Usahawan Indonesia, InfoBank, Jurnal Pasar Modal, Media Akuntansi, DIA, Bahana, Jurnal Ekonomi UKI, JAKI, JBR, Scripta Economica UPH, Jurnal, Sinergi MMUII, published books, Internet. Learning Objectives Break-even level of sales. Operating and financial leverage and risk. Risks and returns of leveraged buy-outs. Affect of capital structure on value. Break-even Analysis Steps to Solution Construct a chart to find the sales break-even point = level of sales necessary to cover operating (not financial) costs. This requires that you calculate EBIT for different unit sales amounts. The point at which EBIT = 0 is the break-even level of sales. Break-even Analysis Assumptions Fixed costs remain constant as quantity changes. Variable costs vary as quantity of output changes: they are constant per unit of output. Costs $ Variable Costs Fixed Costs Quantity Sold Fixed vs. Variable Costs Fixed costs may include salaries, depreciation, rent. Variable costs may include commissions, materials, labor. Break-even Analysis Calculation of Break-even Quantity EBIT = Sales – Variable Costs - Fixed Costs Find Quantity which results in EBIT = $0 Break-even Analysis Calculation of Break-even Quantity FC Unit Salesbe = p – vc Where: Unit Salesbe = FC = p = vc = Break-even quantity Total fixed costs Sales price per unit Variable costs per unit Break-even Analysis Calculation of Break-even Quantity FC Unit Salesbe = p – vc Example: Fixed Costs = $1,000,000/year Price = $800/unit Variable Costs = $400/unit Break-even Analysis Calculation of Break-even Quantity FC Unit Salesbe = p – vc Example: Fixed Costs = $1,000,000/year Price = $800/unit = Variable Costs = $400/unit $1,000,000 $800 – $400 = 2,500 units Break-even Analysis Now calculate total revenue. TR = p x Q p = Sales price per unit Q = unit sales Break-even Analysis Calculate total revenue for different levels of sales. TR = p x Q Unit sales (Q) 0 500 1,000 2,000 2,500 x x x x x x Price (p) $800 $800 $800 $800 $800 = Total Revenue (TR) = $0 = $ 400,000 = $ 800,000 = $1,600,000 = $2,000,000 Break-even Analysis-Graph Sales & Graphical Costs Point $ Analysis of Break-even Variable Costs Fixed Costs $1,000,000 Quantity of Units Break-even Analysis-Graph Sales & Graphical Costs Point $ Analysis of Break-even Total Costs Variable Costs Fixed Costs $1,000,000 Quantity of Units Break-even Analysis-Graph Sales & Graphical Costs Point $ Analysis of Break-even Sales Total Costs Variable Costs Fixed Costs $1,000,000 Quantity of Units Break-even Analysis-Graph Sales & Graphical Costs Point $ $2,000,000 Analysis of Break-even Sales Total Costs Variable Costs Fixed Costs $1,000,000 Qbe = 2,500 Quantity of Units The Concept of Leverage You cannot easily move a large boulder. The Concept of Leverage However, with the aid of a lever you can move an object many times your size. The Concept of Leverage The longer the lever, the bigger the rock you can move. The Concept of Leverage In a financial context, the magnifying power of leverage can be used to help (or hurt) a firm’s financial performance. Operating leverage occurs due to fixed costs in the production process. With high fixed costs, a small change in sales may trigger a large change in operating income (EBIT). Operating Leverage Measurement of Operating Leverage Degree of Operating Leverage (DOL) DOL = % Change in EBIT % Change in Sales DOL > 1 means the firm has operating leverage. Operating Leverage Example: fixed costs = $1 and no variable costs EBIT for Sales of $3 = $3 - $1 = $2 EBIT for Sales of $4 = $4 - $1 = $3 DOL = % Change in EBIT % Change in Sales ($3 - $2)/$2 DOL = ($4 - $3)/$3 .50 = = 1.5 .33 Operating Leverage Measurement of DOL Calculation using per unit information: DOL = Sales - Total VC Sales-Total VC-FC Operating Leverage Measurement of DOL Calculation using per unit information: Sales - Total VC Sales-Total VC-FC DOL = Example: Q P VC FC = = = = 3,750 units $800 per unit $400 per unit $1,000,000 per year. Operating Leverage Measurement of DOL Calculation using per unit information: DOL = DOL3,750 units = Sales - Total VC Sales-Total VC-FC 3,750(800) – 3,750(400) 3,750(800) –3,750(400) – 1,000,000 Operating Leverage Measurement of DOL Calculation using per unit information: Sales - Total VC Sales-Total VC-FC DOL = DOL3,750 units = = 3,750(800) – 3,750(400) 3,750(800) –3,750(400) – 1,000,000 3 Interpretation: If sales change 1%, then EBIT will change 3% (same direction). Operating Leverage Degree of Operating Leverage falls as sales rise Quantity 2,500 (Qbe) 3,250 3,750 5,000 DOL Undefined 4.33 3 2 Operating Leverage Degree of Operating Leverage falls as sales rise Quantity 2,500 (Qbe) 3,250 3,750 5,000 DOL Undefined 4.33 3 2 The higher the sales level above break-even, the less EBIT changes as sales change If FC = $0, DOL = 1 Financial Leverage Degree of Financial Leverage Financial Leverage Degree of Financial Leverage Finance a portion of the firm’s assets with securities that have fixed financial costs Debt Preferred Stock Financial Leverage Degree of Financial Leverage Finance a portion of the firm’s assets with securities that have fixed financial costs Debt Preferred Stock Financial Leverage measures changes in earnings per share as EBIT changes. Financial Leverage Degree of Financial Leverage Finance a portion of the firm’s assets with securities that have fixed financial costs Debt Preferred Stock Financial Leverage measures changes in earnings per share as EBIT changes. % Change in NI DFLEBIT = % Change in EBIT Unique Level of EBIT Financial Leverage Measurement of DFL (Alternative formula) EBIT DFLEBIT = EBIT – I If DFL > 1, the firm has financial leverage. An increase in EBIT wil result in a larger increase in NI. Financial Leverage Example: EBIT = Interest Charges = $500,000 $200,000 Financial Leverage Example: EBIT = Interest Charges = $500,000 $200,000 500,000 DFLEBIT=500,000 = 500,000 – 200,000 = 1.67 times Financial Leverage Example: EBIT = Interest Charges = $500,000 $200,000 500,000 DFLEBIT=500,000 = 500,000 – 200,000 = 1.67 times Interpretation: When EBIT changes 1% (from an existing level of $500,000) Earnings Per Share will change 1.67% Combined Leverage Degree of Combined Leverage Measures changes in Net Income given changes in Sales Combined Leverage Degree of Combined Leverage Measures changes in Net Income given changes in Sales Combines both Operating and Financial Leverage Combined Leverage Degree of Combined Leverage Measures changes in Net Income given changes in Sales Combines both Operating and Financial Leverage Computed for a specific level of sales Combined Leverage Degree of Combined Leverage Measures changes in Net Income given changes in Sales Combines both Operating and Financial Leverage Computed for a specific level of sales % Change in EPS DCLS = % Change in Sales Unique Level of Sales Combined Leverage DCLS = DOLS x DFLEBIT Example: DFLEBIT = 1.67 DOLS = 3.0 Combined Leverage DCLS = DOLS x DFLEBIT Example: DFLEBIT = 1.67 DOLS = 3.0 DCL3,750 = 3.0 x 1.67 = 5.0 times Combined Leverage DCLS = DOLS x DFLEBIT Example: DFLEBIT = 1.67 DOLS = 3.0 DCL3,750 = 3.0 x 1.67 = 5.0 times Interpretation: When sales change 1%, Net Income will change 5.0% Effect of Leverage Leverage can help the firm or hurt it. If EBIT increases, leverage will cause net income to increase even more. If EBIT decreases, leverage will cause a larger decline in net income. Capital Structure Theory Capital Structure is the mixture of sources of funds a firm uses. Debt Preferred Stock Common Stock Capital Structure Theory A benefit of debt financing is that interest is tax deductible whereas payments to equity providers are not. Firms must trade off this benefit against the increased financial risk associated with higher debt levels. Capital Structure Theory -Modigliani and Miller (MM) MM wrote an important paper in 1958 in which they proved that with tax deductibility of interest payments, the optimal capital structure is 100% debt. Assumptions: No transaction costs, no taxes, everyone has same information and borrowing rates, debt is riskless, debt does not affect operations. Financial Leverage, EPS, and ROE Consider an all-equity firm that is considering going into debt. (Maybe some of the original shareholders want to cash out.) Current Assets $20,000 Debt $0 Equity $20,000 Debt/Equity ratio 0.00 Interest rate n/a Shares outstanding 400 Share price $50 Proposed $20,000 $8,000 $12,000 2/3 8% 240 $50 EPS and ROE Under Current Capital Structure RecessionExpectedExpansion EBIT $1,000 $2,000 $3,000 Interest 0 0 0 Net income $1,000 $2,000 $3,000 EPS $2.50 $5.00 $7.50 ROA 5% 10% 15% ROE 5% 10% 15% Current Shares Outstanding = 400 shares EPS and ROE Under Proposed Capital Structure RecessionExpectedExpansion EBIT $1,000 $2,000 $3,000 Interest 640 640 640 Net income $360 $1,360 $2,360 EPS $1.50 $5.67 $9.83 ROA 5% 10% 15% ROE 3% 11% 20% Proposed Shares Outstanding = 240 shares EPS and ROE Under Both Capital All-Equity Structures Recession Expected Expansion EBIT $1,000 Interest 0 Net income $1,000 EPS $2.50 ROA 5% ROE 5% Current Shares Outstanding = 400 shares EBIT Interest Net income EPS ROA ROE Levered Recession $1,000 640 $360 $1.50 5% 3% Proposed Shares Outstanding = 240 shares $2,000 0 $2,000 $5.00 10% 10% $3,000 0 $3,000 $7.50 15% 15% Expected $2,000 640 $1,360 $5.67 10% 11% Expansion $3,000 640 $2,360 $9.83 15% 20% Financial Leverage and EPS 12.00 Debt 10.00 EPS 8.00 6.00 4.00 No Debt Advantage to debt Break-even point 2.00 0.00 1,000 (2.00) Disadvantage to debt 2,000 3,000 EBIT EBI in dollars, no taxes Total Cash Flow to Investors Under Each Capital Structure with Corp. Taxes All-equity firm S G Levered firm S G B The levered firm pays less in taxes than does the allequity firm. Thus, the sum of the debt plus the equity of the levered firm is greater than the equity of the unlevered firm. Integration of Tax Effects and Financial Distress Costs Because costs of financial distress can be reduced but not eliminated, firms will not finance entirely with debt. Value of firm under MM with corporate taxes and debt Value of firm (V) Present value of tax shield on debt VL = VU + TCB Maximum firm value Present value of financial distress costs V = Actual value of firm VU = Value of firm with no debt Debt (B) 0 B* Optimal amount of debt Capital Structure in the Real World Firms attempt to balance the costs and benefits of debt to reach the optimal mix that maximizes the value of the firm. Affect on costs of capital: Capital Structure in the Real World Firms attempt to balance the costs and benefits of debt to reach the optimal mix that maximizes the value of the firm. Affect on costs of capital: Since debt is cheaper than equity, use of debt will initially lower the WACC. At high levels of debt, the WACC will increase as investors perceive the firm to be riskier.